The US occupies a unique position in the global economy as the largest investor and the largest recipient of foreign direct investment (FDI). This global investment position has benefited from and promoted the US historical approach to international investment. In general, this approach has aimed to establish an open and rules-based system that is consistent across countries and in line with US economic and national security interests. It also has maintained that FDI has positive net benefits for the US and for foreign investors, except in those instances in which national security concerns outweigh other considerations. For much of the post-war period, this approach has been supported by both Republican and Democratic presidents and congresses. Even in cases of national security concerns, the US approach has attempted to limit any market distorting effects.

Unlike multilateral rules that govern trade in goods and services, however, there are limited multilateral agreements that govern the treatment of foreign investment. Most restrictions or conditions that have been placed on in-bound investments have linked the approval of an investment project with various performance requirements. In general, rules on foreign investment, primarily through bilateral investment agreements (BITs) or free trade agreements (FTAs), focus on ensuring that inward investment is not discriminated against relative to domestic investment or other foreign investment, often referred to as national treatment and most favoured nation status, respectively.

The growing prominence of foreign investment, however, has raised concerns among some US policymakers about the historical US approach. For some policymakers, US direct investment abroad (USDIA) is contributing to slow growth in jobs, productivity and wages in the US economy. They argue that such investment shifts US jobs overseas through outsourcing and by diverting corporate investment from the US to overseas activities. Research and experience offer a more nuanced view: most analysts conclude that US investment abroad supports domestic exports, bolsters the global competitive position of US multinational firms, and sustains domestic economic growth. The Trump administration has not yet offered a formal statement on its foreign investment policy relative to the administration's America First policy.

Recent investments

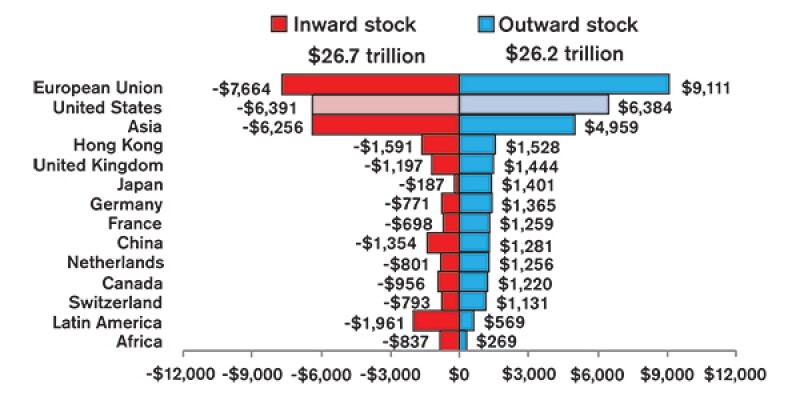

According to the UN, the total outstanding amount of global outward direct investment surpassed $26 trillion in 2016 (Figure 1). At $6 trillion, US multinational companies account for about a quarter of the global total. Hong Kong, the UK, Japan and Germany rank as the next largest overseas direct investors, with individual outward investment positions about a quarter or less than that of the US. Despite the steady increases in annual global and US overseas investment, neither US nor global FDI annual flows have regained the amounts recorded in 2007, prior to the 2008-2009 global financial crisis. US parent firms have more than 35,000 foreign affiliates employing nearly 17 million people.

Figure 1 - Inward and outward stock of foreign direct investment by major country or region (2016) |

|

Source: World Investment Report 2017, United Nations, 2017 |

US overseas investment by region and industrial sector

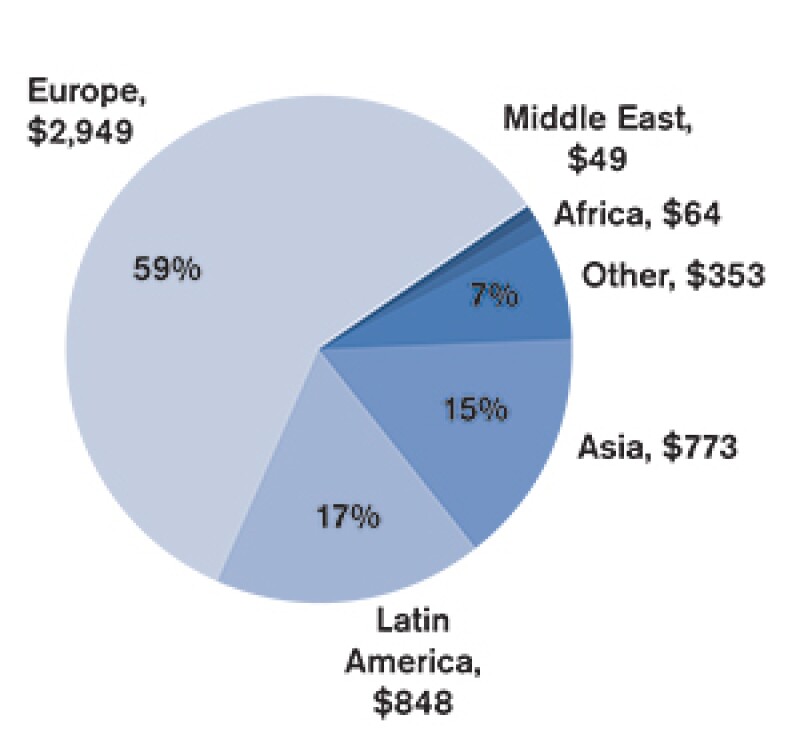

Some US policymakers argue that US investment abroad chases after low wages and lax environmental and labour standards in developing countries, thereby reducing investment in the US and placing downward pressure on US wages. On the whole, US firms appear to invest abroad to serve the foreign local market, rather than to produce goods to export back to the US, although some firms undoubtedly do establish overseas operations to replace US exports or production, or to gain access to raw materials, cheap labour, or other markets. About 74% of total USDIA is concentrated in high income developed economies where consumer tastes are similar to those in the US; investments in Europe alone account for 60% of all USDIA, or $2.9 trillion (Figure 2), based on historical cost data from the US Department of Commerce.

Figure 2 - US direct investment abroad by major area (2015) (billions of dollars; total = $5 trillion) |

|

Source: Department of Commerce Note: Data are value at historical cost |

Another 17% of total USDIA is located in Latin America; 15% is in Asia, including Australia, Japan, New Zealand, and South Korea; 1.3% in Africa; and about one percent in the Middle East. The Netherlands is the largest recipient of USDIA, reflecting a range of factors that make it a favourable place for US firms to operate.

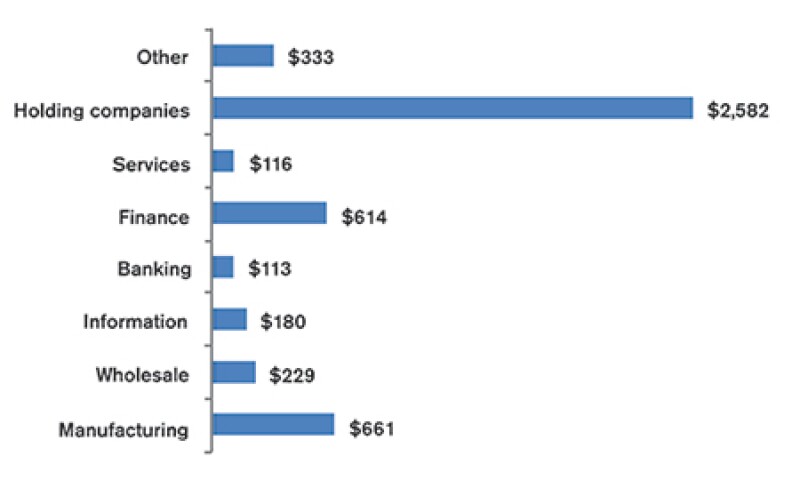

Similarly, USDIA by industry mirrors fundamental changes that have occurred in the US economy. As investment in the US economy shifted from extractive, processing and manufacturing industries toward high technology services and financial industries, USDIA followed suit. As a result, USDIA has focused less on the extractive, processing and basic manufacturing industries in developing countries and more on high technology, finance and services industries located in highly developed countries with advanced infrastructure and communications systems. Annual USDIA increased in most sectors in 2015 over the amount invested in 2014, except for investment in the banking, finance, and insurance sectors (Figure 3). Investments by holding companies reflect foreign investment through the foreign subsidiaries of US parent firms, rather than through the parent firms. Also, USDIA in service-oriented sectors, particularly computer systems design and technical consulting, increased through 2015.

Figure 3 - US direct investment abroad by major sector (2015) (billions of dollars) |

|

Source: Department of Commerce Note: Data are valued at historical cost |

Funding foreign investment

Although some observers argue that USDIA displaces domestic investment by shifting funds abroad, 2016 data indicate that USDIA was comprised 96% of reinvested earnings, 10% of equity capital, and a -5.8% of intercompany debt that reflects a net intercompany flow from the foreign affiliates back to US parent firms. In comparison, equity capital accounted for 53% of FDI in the US, with reinvested earnings and intercompany debt accounting for around 20% and 26.6%, respectively. Despite concerns that US direct investment abroad occurs at the expense of domestic investment, the reliance on reinvested earnings suggests that much of US direct investment abroad is financed by the foreign affiliates. This reliance on reinvested earnings may reflect the prominence of US direct investment in the highly developed economies of Europe, in which equity-financed investment is not used as widely as it is in the US.

Intra firm trade

Some observers also argue that USDIA shifts jobs overseas by reducing US exports. US data challenge this concept and provide indications that foreign investment apparently stimulates intra firm trade. This type of trade is characterised by the sum of (1) trade between US parent companies and their foreign affiliates, and (2) the US affiliates of foreign firms and their foreign parent companies. US total trade in 2014 was $1.6 trillion in exports and $2.3 trillion in imports. Of this amount, trade between US parent companies and their foreign affiliates accounted for $315 billion in both exports and imports, while the affiliates of foreign firms operating in the US accounted for $189 billion in exports and $521 billion in imports. In total, intrafirm trade accounted for 31% of US exports and 35% of US imports.

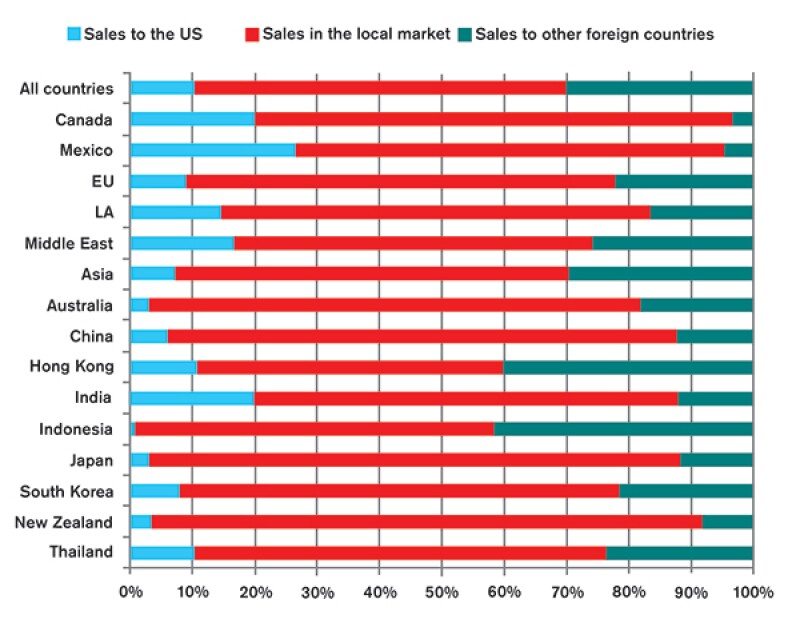

In 2014, the latest year for which detailed USDIA intra firm trade data are available, 10% of US foreign affiliate sales on the whole were to US parent companies (Figure 4). The similar share of US trade is higher for trade with Mexico and Canada (20% and 27%, respectively) in part due to formal trade agreements and the close physical proximity of the two trading partners. US firms operating in China had 82% of their sales in China and six percent of their sales back to the US.

USDIA is dominated by very large firms (more than 10,000 employees) that accounted for over three quarters of the overseas employment by US firms. Investments by holding companies reflect USDIA through a foreign affiliate, rather than through the parent company itself. This ownership by holding companies blurs somewhat the data on investment flows and investment positions by industry and country.

Figure 4. Sales by destination of the foreign affiliates of US parent firms (2014) (billions of dollars) |

|

Source: Department of Commerce |

Foreign investment current issues

The growing presence of foreign investment, as indicated by the data above, is sparking renewed interest by US policymakers and others in assessing the impact of the investment on the economy and any potential national security concerns. For instance, press reports indicate that some congressional leaders are mulling over various approaches to addressing concerns over some types of foreign investment, although many of these concepts have not yet been drafted into formal legislative language. In some cases, these policymakers may look to the Trump administration for clues on what approach the administration is likely to take. For now, a number of congressional leaders are raising concerns over two particular issues: the growing role of state-owned enterprises (SOEs); and the expanding number of countries that are adopting national security review mechanisms.

According to the OECD, an estimated 22% of the world's largest 100 firms are now effectively under state control. This ownership stake raises concerns that some governments give preferential treatment to SOEs in ways that may convey a competitive edge to their overseas activities and may have anticompetitive effects in the global marketplace. Such an association may offer firms greater market protection at home from which they arguably can develop a strong competitive position, or offer access to below-market financing terms through other government-controlled entities, providing firms with a competitive advantage over firms that are subject to market conditions. Arguably, these types of close associations between firms and governments may blur the distinction between firms that engage in economic activities purely for commercial reasons and those that operate at the behest of a foreign government to achieve a public policy goal.

Although the US has its own process for reviewing the national security implications of foreign investment through the Committee on Foreign Investment in the United States (Cfius), an increasing number of countries are adopting more extensive review processes that could chill US direct investment abroad. According to the UN, over the past decade national security-related concerns have become more prominent in the investment policies of numerous countries. Some countries have adopted new measures to restrict foreign investment or have amended existing laws concerning investment-related national security reviews. International organisations have long recognised the legitimate concerns of nations in restricting foreign investment in certain sectors of their economies, but the recent increase in such restrictions is raising concerns.

Various countries have different approaches for reviewing and restricting foreign investment on national security-related grounds. These approaches range from formal investment restrictions to complex review mechanisms with broad definitions and broad scope of application to provide host country authorities with wide discretion in the review process. As a result of these differences, foreign investors can face different entry conditions in different countries in similar economic activities.

While some governments may abuse the right to restrict foreign investment in certain sectors of their economies for commercial, as well as national security interests, there is no clearly defined methodology for determining which investment restrictions are serving which objectives, since economic activities can serve both commercial and national security purposes. The increasing number of national security restrictions likely argues for a robust international effort to coordinate activities and develop policy responses. The question, however, is which nation would lead such an effort?

The views expressed herein are those of the author and are not presented as those of the Congressional Research Service or the Library of Congress.

About the author |

James Jackson International trade and finance specialist, Congressional Research Service, James Jackson is a specialist in international trade and finance at the Congressional Research Service (CRS), US Library of Congress. The CRS is a non-partisan public policy research arm of the US Congress and a legislative branch agency of the Library of Congress. It serves as shared staff to congressional committees and members of Congress. CRS experts advise on every stage of the legislative process, from early considerations preceding bill drafting, to committee hearings and the oversight of enacted laws. |