Law firms globally can expect in-house counsel to send them a wave of Covid-driven litigation work in the next three months despite many external lawyers being asked to reduce their rates, according to a survey conducted by Euromoney’s Legal Media Group (LMG).

In May, LMG – which includes IFLR, ITR, MIP and Euromoney Thought Leadership Consulting – surveyed 435 senior legal and company officials about the impact of Covid-19 on their legal work and teams. General counsel, heads of legal and other figures including chief executives, all from a range of countries and industries and companies of various sizes, took part.

Deals on hold

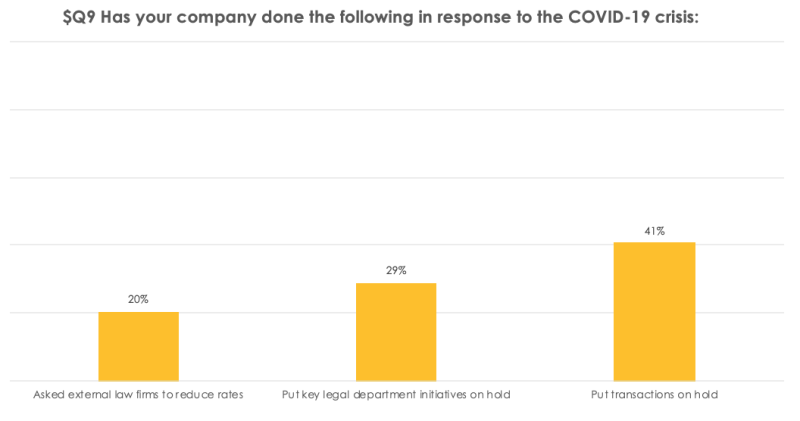

The survey also revealed that nearly half of in-house teams have put transactions on hold since the beginning of the crisis.

Given the well-documented impact of national lockdowns and travel bans on AGMs, site visits and other elements of due diligence, it might be reasonable to expect that number to be even higher. The consensus is that deals already in the later stages – importantly, post-due diligence – could generally continue to completion, whereas earlier-stage transactions have been rendered significantly more difficult. Whether these deals do progress once lockdowns are eased is unclear. Some may be abandoned altogether.

There’s also the broader environment to consider: M&A has long been a buyers’ market, with an abundance of dry powder sitting on private equity firms’ balance sheets. According to the global head of escrow at a major US bank, most prospective buyers their eye on a number of assets at any one time. In theory, those transactions could go ahead – and the pandemic may have even created new impetus to proceed. “We have been quite surprised by how much business is still getting done,” he said.

That of course raises a pipeline question, and hints at a potential dip in volumes later: “The concern then is that obviously once the pipeline runs dry it will take time to get things flowing again, because due diligence during lockdown is so difficult,” added the escrow head.

Dealmakers already looking to 2021 as M&A market disappears

Covid-19 workload

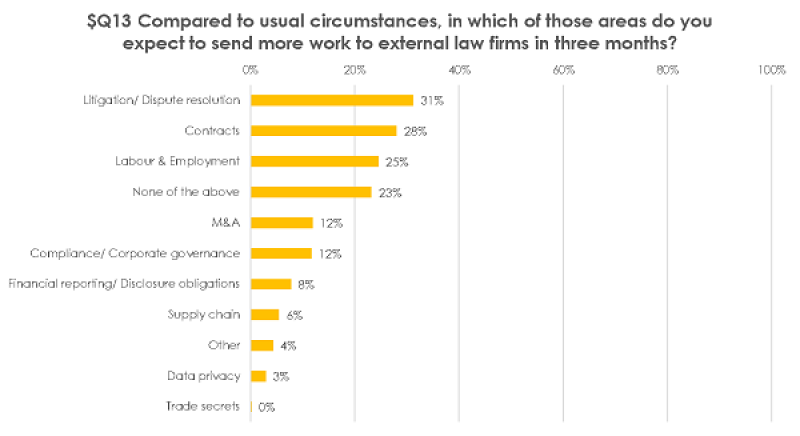

In asking what type of work counsel will send to external law firms in the next three months, we found that nearly a third (31%) of respondents will be keeping advisers busy with litigation/dispute resolution. This represented a significant jump from the 15% figure when we asked the same question but applied it to the situation today.

To understand the pandemic’s impact on legal teams, the survey asked respondents how much of their current workload is directed to Covid-19 – and nearly everyone (90%) said they have been affected to one degree or another.

More than a third (38%) answered one to 10%, in what was comfortably the most popular response, and even a tenth said that none of their work is focused on coronavirus. Given the ructions caused by the pandemic, it may seem surprising that the legal effects have not gone deeper.

However, beyond the most common answer of one to 10%, the remaining bands of 11 to 25%; 26 to 50%; 51 to 75%; and even more than 75% took some share of the vote.

Changing landscape

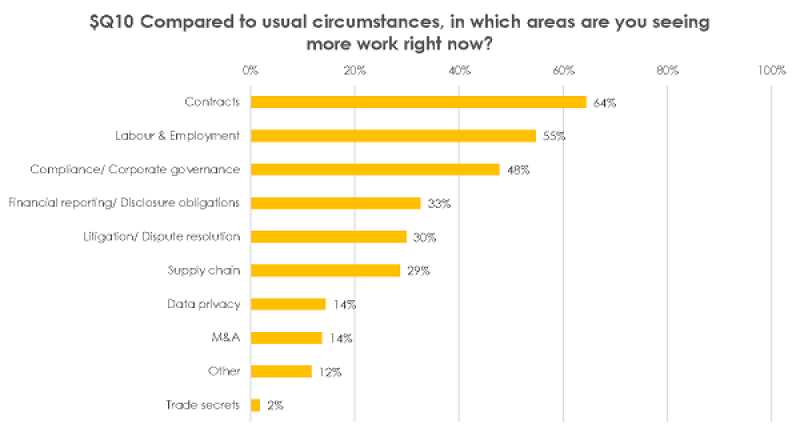

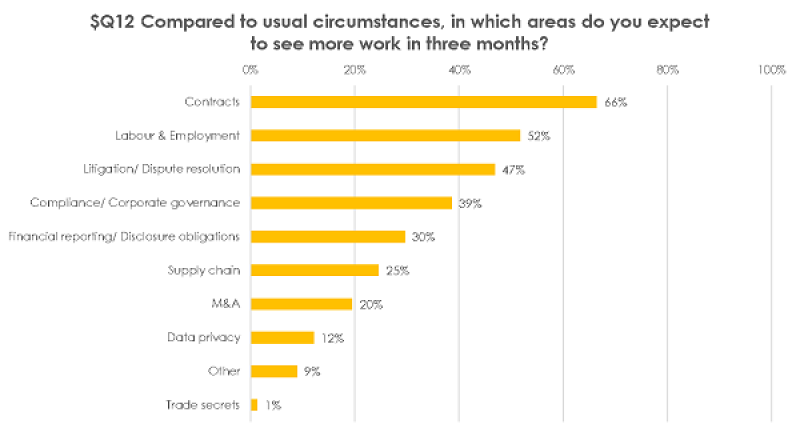

With Covid-19 reshaping business and society, the type of work that in-house counsel are doing is changing. According to a majority of respondents (64%), the extra work created since the pandemic is on contracts. Next was labour and employment (55%), and the third most popular answer was compliance/corporate governance, at just under half (48%).

There was then a fairly even spread among the other options, including financial reporting/disclosure obligations, litigation/dispute resolution, and supply chain. Interestingly, just two percent of respondents picked trade secrets. While these issues may appear insignificant for now, the nature of home-working and the potential for employees to become demoralised could raise the risk of trade secrets and confidential information being breached during lockdowns and their aftermath.

Financial impact

Budgets

Digging further, the survey asked about the impact on legal budgets. Two thirds of respondents (66%) said that their budget has been unaffected by Covid-19, with nearly a fifth (18%) revealing theirs has been ‘somewhat reduced’ and seven percent answering ‘significantly reduced’. Just eight percent have seen an increase.

However, while budgets may not have been slashed just yet, companies have not seen anywhere near the full economic impact of Covid-19, making it feasible that in six months to a year’s time, these figures would look very different.

Legal staff

On the (related) question about how legal teams have been affected, the findings are even more emphatic: 88% of respondents said there has been no change. Again, however, the full economic impact is largely unknown, and many companies may have benefitted from government furlough schemes where the state pays a share of employees’ salaries – so the true effects may not be seen for some time.

External fees

Regarding the amount of work sent to external law firms, the interesting figure is that 20% of respondents said they have ‘somewhat increased’ it. When you consider that very few respondents (seven percent) previously said that their legal budget has increased, it raises the question of whether some firms are taking on extra work at reduced rates, or even for free.

Companies’ responses

The answer to this can be inferred from the next set of findings, which followed a question about companies’ responses to the Covid-19 crisis. One-third (33%) said they have asked external law firms to reduce their rates; in light of the above-mentioned discrepancy between budgets and workload, it would seem that some have obliged. In addition, two-thirds (67%) said they have put transactions on hold, while nearly half (47%) have stalled key legal department initiatives.

Keeping advisers busy

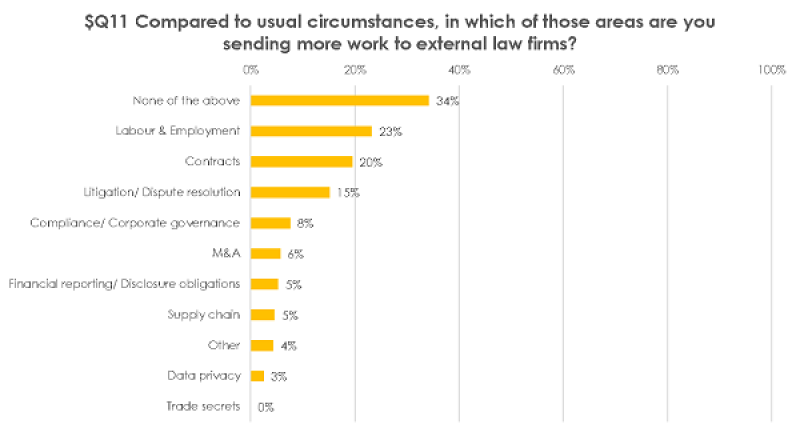

Illustrating how the extra work largely tallies with new matters sent to external lawyers, the survey found that labour and employment (23%), and contracts (20%) both account for the biggest new workloads that counsel are shipping out. Having said that, there is a large discrepancy between current extra work on contracts (64%) and that being sent to law firms (20%), possibly suggesting that contractual work gets stuck in-house before needing expert advice.

Compliance/corporate governance accounted for just eight percent of the new work for external firms, despite being the third most popular new work stream overall (48%).

Interestingly, while 30% of respondents said they are currently doing more litigation/dispute resolution work, just 15% said they are sending this work to external firms. Presumably this means that in some cases, in-house teams are not sending litigation work to outside counsel just yet, perhaps because these disputes are in the early stages where negotiations are ongoing.

Three months’ time

When asked about expected increases in work in the next three months, litigation/dispute resolution came third with 47%, which is 13% higher than for the current situation.

It sparks the key question of why companies expect more disputes in three months. One possible answer is that litigation is on the rise because of tensions in a number of industries – after all, we had respondents from a range of sectors, from banking and capital markets to consumer products and retail, with everything in between.

Another is that in-house counsel may be expecting to send the existing litigation work (which is perhaps in the early stages) to external firms soon – a finding seemingly backed up by the figure that 31% will be handing disputes over to external firms within three months.

The other notable change is the six percentile rise in expected M&A work – from 14% today to 20% in three months. And this looks likely to be transferred to external advisers, as M&A work sent to law firms will spike (from six percent to 12% of the vote), according to our findings. In three months’ time, law firms can also expect to get more contractual work (28% of the vote, up eight percentage points from today) and labour and employment matters (25%, a rise of two percentage points).

As law firms prepare for more work in certain areas, it would seem that keeping clients abreast of the latest Covid-19 developments won’t do anything to harm them – according to our survey, respondents were indifferent when asked whether there is too much Covid content from firms, and most said that it is appropriate.

For more IFLR insights on Covid-19, see IFLR's coronavirus resource hub here.