The Financial Action Task Force (FATF), headquartered at the OECD in Paris, is regarded as one of the leading international bodies for combating money laundering and terrorist financing. It regularly reviews its members' national regulations as to the status of the implementation of its 40 recommendations, so too in Switzerland. As a result of FATF's findings in its first evaluation in 2012, Switzerland introduced the Federal Act for Implementing Revised FATF Recommendations of 2012 (FATF Act) on July 1 2015. The main objective of the FATF Act was to improve the national transparency provisions governing bearer shares. In particular, a purchaser of bearer shares in a Swiss joint stock corporation has since been obliged to report the acquisition to the respective company within one month.

The number of acquired shares is irrelevant; the acquisition of a single bearer share is sufficient to trigger the reporting requirement. Further, any person who alone or in joint agreement with third parties acquires shares in a Swiss company (Ltd or LLC) and thereby reaches or exceeds the threshold of 25% of the share capital or voting rights, has since been obliged to notify the company of the first and last name and address of the beneficial owner. Additionally, companies now have to keep a register of the holders of bearer shares as well as of the beneficial owners reported to the company. The register must be maintained in such manner that it can be accessed in Switzerland at any time.

Further, the documents on which the notice was based must be retained for 10 years following a person's deletion from the register. Shareholders and governing bodies of companies that fail to comply with these measures can face substantial private and criminal law sanctions if their actions contribute to money laundering and insufficient diligence in financial transactions.

Problems and concerns

Within the OECD, the Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum) ensures that international standards regarding transparency and the exchange of information for tax purposes are complied with and implemented in a uniform manner internationally. Like the FATF, the Global Forum also reviews the national regulations of its member states as to the levels of their transparency. For this purpose, the Global Forum started peer reviews in the area of administrative assistance in tax matters on request and came to the conclusion that Switzerland's regulations were largely compliant with the international standards in July 2016.

However, in a second round of peer reviews which commenced in 2016 and put an emphasis on inter alia the identification of beneficial owners, the Global Forum concluded that the Swiss measures on the transparency of bearer shares were not sufficiently effective. The main criticism was that the measures introduced by the FATF Act in 2015 did not ensure the flawless identification of beneficial owners of bearer shares. This led to the Swiss government starting a rushed legislation process to implement the recommendations of the Global Forum in order to obtain a good assessment at the end of the second peer review round in 2020. As a result, the Federal Act on the Implementation of Recommendations of the Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum Act) entered into force in Switzerland on November 1 2019.

Swiss approach to improve transparency of beneficial ownership

Partial abolishment of bearer shares

The principal measure imposed by the Global Forum Act is the partial abolition of bearer shares for joint stock companies. There are two exceptions: bearer shares issued in the form of intermediated securities held by a Swiss custodian designated by the company and bearer shares of publicly listed companies which may still be issued. The intermediated securities must be held on custody accounts with a financial institution (e.g. bank or securities dealer). To prove that they fulfil any of the two exceptional provisions, the companies must file a notice with the commercial register.

Transitional regime for pending bearer shares

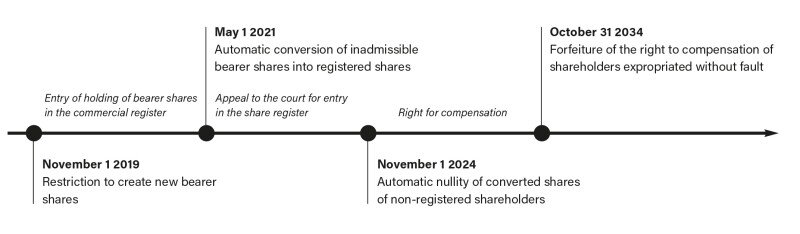

In order to grant affected companies sufficient time to implement the new measures of the Global Forum Act, the legislator has provided a transitional regime. From November 1 2019, when the Global Forum Act came into force, joint stock companies have a period of 18 months to amend their articles of association and convert the existing bearer shares into registered shares (unless they fulfil one of two exceptions mentioned above). Hence, the affected companies have until April 30 2021 to convert their bearer shares into registered shares. The same deadline applies for the notification (to the commercial register) of joint stock companies fulfilling any of the two aforementioned exceptions.

Automatic conversion

Bearer shares that are still issued at the end of the transitional period on May 1 2021 will automatically be converted into registered shares by operation of law. The competent commercial register office will record this change in the commercial register including a note showing that the commercial register documents differ from the entry records. This note remains until the company's articles of association have been amended to comply with the new legal situation. Until the articles of association have been amended, the commercial register is bound to reject any requests to register other changes to the articles of association in the commercial register.

Despite the conversion of the bearer shares into registered shares, such shares will retain their existing nominal value, voting and financial rights. The conversion of the bearer shares will also be effective towards third parties who plan to purchase such shares. In order to transfer the converted shares, they will have to be endorsed and the new purchaser will have to request the company to register his details (name, address) in the share register.

Consequences for holders of bearer shares

Since the FATF Act entered into force, purchasers of bearer shares have the obligation to notify to the company their first and last name and their address within one month since the purchase of the shares. All holders of bearer shares who have complied with these disclosure duties will be registered by the respective company in its share register after the conversion of the bearer shares. Shareholders who fail to fulfil their reporting obligations will not be registered after the conversion of the bearer shares into registered shares and will lose their voting and property rights. Furthermore, the fact that the shareholder failed to report the required information will be recorded in the share register. Within five years of entry into force of the Global Forum Act (i.e. at the latest by October 31 2024) and with the company's prior approval, defaulting shareholders have the possibility to request from the court that they be registered in the share register. If the request is successful, the shareholder will be registered and again be fully entitled to the shares. So far it is not clear under which conditions the company shall give its approval and under which conditions the court will decide in favour of the requesting shareholder. Presently, it appears that the court will merely verify that the shareholder is in fact the entitled owner of the shares and the shareholder then has to request the company to be registered in the share register.

Cancellation of bearer shares

Where defaulting shareholders fail to ensure their reinstatement within the five-year period, their shares will become null and void by law and the shareholders will lose all their shareholder's rights. The shareholders will thus be expropriated by the law. This measure is irreversible for the affected shareholders. The only option still available to the shareholders will be to apply to the court and demonstrate that they were not at fault for failing to disclose their shareholding and thus have a right to compensation in the amount of the fair value of their former shares. The right to compensation will lapse within a 10 year period since the entry into force of the Global Forum Act on October 31 2034. However, the chances for expropriated shareholders to be compensated will in reality be slim, as they themselves are in most cases to blame for the failed reporting and therefore have no valid claim for compensation. Accordingly, this measure will be of limited use. Finally, it must be noted that a compensation can in any event only be paid out if the company has sufficient freely disposable equity.

The transitional regime of the abolition of bearer shares can be summarised as follows:

Clarifications of reporting obligations

Apart from the partial abolition of bearer shares, the Global Forum Act also amended the obligation to disclose the beneficial owners of shareholders who, by themselves or by agreement with third parties, acquire shares in an unlisted company and thus reach or exceed the threshold of 25% of the share capital or voting rights.

As a consequence, the Global Forum Act aligned the term beneficial ownership with the Swiss accounting principle of corporate control. Accordingly, if the purchaser of at least 25% of the shares of a company is a legal entity, each natural person who controls the purchaser must be reported as the beneficial owner if any of the following requirements are fulfilled:

the natural person directly or indirectly holds a majority of votes in the highest management body;

the natural person directly or indirectly has the right to appoint or remove a majority of the members of the supreme management or administrative body; or

the natural person is able to exercise a controlling influence based on the articles of association, the foundation deed, a contract or comparable instruments.

If a natural person cannot be identified, the purchasing shareholder must give notice of this fact to the company whose shares were acquired. This negative disclosure ensures that the acquirer of the shares fulfils the notification obligations.

The legislator further clarified the disclosure obligations for listed companies and their affiliates. If the acquiring shareholder is controlled by such a company or controls a listed company, it must only give notice of this fact to the company and provide details of the company's name and registered office. A natural person as beneficial owner does not have to be identified in this case.

A new provision is that shareholders must give notice to the company within three months of any change to the first name or surname or of the address of the beneficial owner. This deadline ensures that shareholders report such changes in due time and avoid sanctions aimed at shareholders who fail to update the formalities of their declaration.

Sanctions for non-compliance

Civil law

As explained above, shareholders may have an obligation to report a beneficial owner to the company when they acquire shares. Swiss law provides for sanctions for shareholders who fail to give such notice. For as long as shareholders fail to comply with their obligations to give notice, the voting rights and property rights conferred by the shares are suspended.

Companies may also be sanctioned if they do not comply with their obligations to register its shareholders and beneficial owners. Companies are obliged to keep the share register and the register of its reported beneficial owners in accordance with the new regulations. This means that when a transfer of shares is reported to the company, it has the obligation to examine it from both a formal and a substantive point of view. Further, the company has a duty to update the share register within a reasonable period. In general, the same duties apply in relation to the company's register of its reported beneficial owners, though it is doubtful whether the company has the duty to actively identify the beneficial owners of its shares. If the company does not fulfil its legal obligations, any shareholder, creditor or the commercial registrar may request the court to take the required measures to remedy this organisational defect. In practice, an organisational defect will exist if a shareholder has made a notification to the company but the company fails to update the share register or register of its reported beneficial owners or does so incorrectly. The court may allocate the company a grace period, under threat of its dissolution, within which to re-establish the lawful situation.

As previously explained, under the new regulations joint stock corporations may only continue to issue bearer shares if (i) they have equity securities listed on a stock exchange or (ii) the shares are issued as intermediated securities held by a Swiss custodian designated by the company. As of May 1 2021, a new provision will be put in place which stipulates that an organisational defect exists if a joint stock corporation has issued bearer shares but does not fulfil either of the two exceptional provisions to do so. As a consequence, any shareholder or creditor or the commercial registrar may request the court to take the required measures. The court may then order the conversion of bearer shares into registered shares.

Criminal law

Until the recommendations of the Global Forum implemented in Switzerland in 2019, a violation of reporting obligations under company law had consequences only under civil law. The Swiss legislator decided that in order to create effective and clear consequences in connection with the new transparency provisions, the criminal law also needed to be amended. The Swiss Criminal Code now provides for sanctions for shareholders and governing bodies of companies that violate the beneficial ownership transparency provisions. The Swiss legislator thus introduced a regime that exceeds the recommendations of the Global Forum.

In particular, any shareholder who willfully fails to give notice of the beneficial owner of shares is liable to a fine up to CHF 10,000 ($10,277). The scope of this criminal provision also includes an obligation for the shareholder to report changes in the first name, surname or address of the beneficial owner. An erroneous, incomplete or late declaration can also be sanctioned. This may lead to problems and uncertainties because there are still situations in which it is unclear who actually needs to be reported as the beneficial owner (e.g. in case of shareholders agreements).

On the company level, a governing body is liable to a fine up to CHF 10,000 if he or she willfully fails to keep the share register or the register of the beneficial owners of the shares in accordance with the regulations. This can also mean a failure to correctly keep the register of shareholders and the register of beneficial owners or a failure to adequately store the registration documents. It is to be noted that only those who are legally obliged to keep the register are liable (e.g. the members of the board of directors or the persons to whom the obligations were validly delegated). The company itself cannot be liable.

Advice to companies and holders of Swiss (bearer) shares

Companies and shareholders in Swiss companies holding (bearer) shares should do the following, irrespective of whether they are domestic or foreign holders:

Joint stock corporations which have issued bearer shares need to assess whether they fulfil any of two the exceptional provisions that allows them to continue to issue bearer shares. If they do, they need to register this fact in the commercial register until May 1 2021.

On the other hand, joint stock corporations which may no longer issue bearer shares, should pro-actively convert bearer shares into registered shares. If the bearer shares are converted by law on May 1 2021, joint stock corporations must ensure that the conversion is properly reflected in the articles of association and the commercial register.

All companies need to analyse whether their corporate housekeeping instruments (share register, register of reported beneficial owners) are compliant in view of the new criminal sanctions.

Shareholders of non-listed joint stock corporations who hold bearer shares or more than 25% of the share capital in any company, need to carefully review their existing filings and cure any deficiencies immediately. If holders of non-listed bearer shares fail to comply with the transparency requirements by May 1 2021, they must apply to the court for registration in the commercial register. If the additional five-year deadline is missed, they may be expropriated and lose their rights without compensation.

Outlook

The implementation of the measures of the Global Forum Act by the Swiss legislator will without doubt improve transparency regarding shareholders and beneficial owners of Swiss companies. Bearer shares will be partially abolished and converted into registered shares. Only few joint stock corporations still qualify to issue bearer shares. In each case the shareholders will have to be made transparent and the beneficial owners will have to be reported. Companies and shareholders urgently need to undertake the necessary steps to comply with the legal requirements.

All of these new obligations entail the risk that not all of those affected will be aware of the new duties and may suffer negative consequences. Ignorance could even lead to unnecessary criminalisation of shareholders and board members. The legal and business communities therefore need to work together to analyse the required actions and find practicable and pragmatic solutions to this new framework.

Manuel Vogler |

||

|

|

Associate, Prager Dreifuss Zurich, Switzerland Tel: +41 44 254 55 55 Manuel.Vogler@prager-dreifuss.com Manuel Vogler is an associate at Prager Dreifuss and specialises in tax and commercial law. He advises domestic and foreign corporates and private clients on all aspects of tax law as well as entrepreneurs in commercial & corporate matters. |

Mark Meili |

||

|

|

Associate, Prager Dreifuss Zurich, Switzerland Tel: +41 44 254 55 55 Mark.Meili@prager-dreifuss.com Mark Meili is an associate in Prager Dreifuss' corporate & M&A and dispute resolution teams. He mainly advises companies with regard to commercial and corporate law matters. His main areas of practice include mergers & acquisitions, corporate finance as well as contract, corporate and commercial law matters. Mark further advises clients in matters of insolvency and restructuring law. |