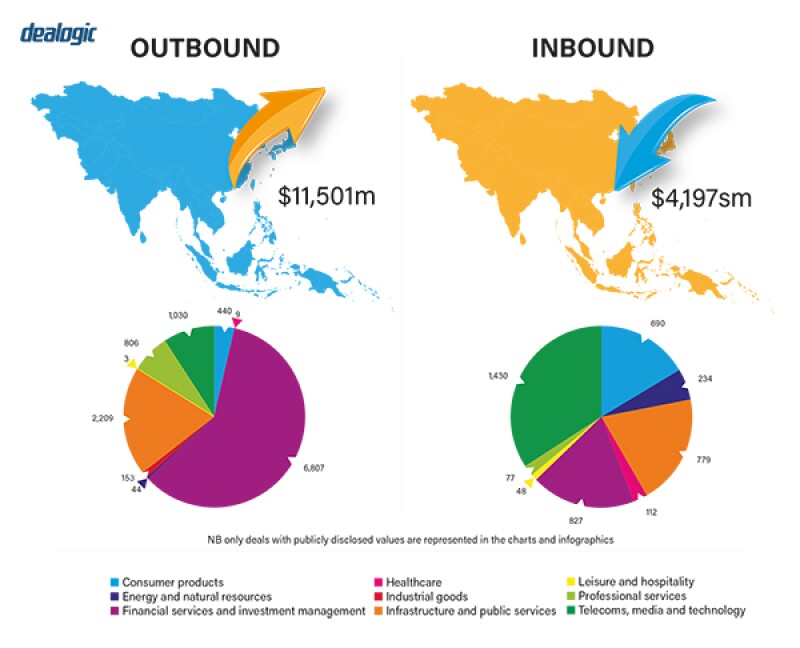

While Hong Kong SAR saw a modest decline in the number of M&A deals for 2020, the total deal value rose overall compared to 2019, thanks to a solid recovery in the second half of the year. There has been an increase in outbound activity, with a focus on Chinese target companies.

Heightened geopolitical tensions and logistical difficulties caused by COVID-19 have presented challenges to cross-border deal-making, resulting in lengthened deal timetables and market uncertainty as buyers conduct more-detailed due diligence exercises to assess the commercial and regulatory risks of their targets.

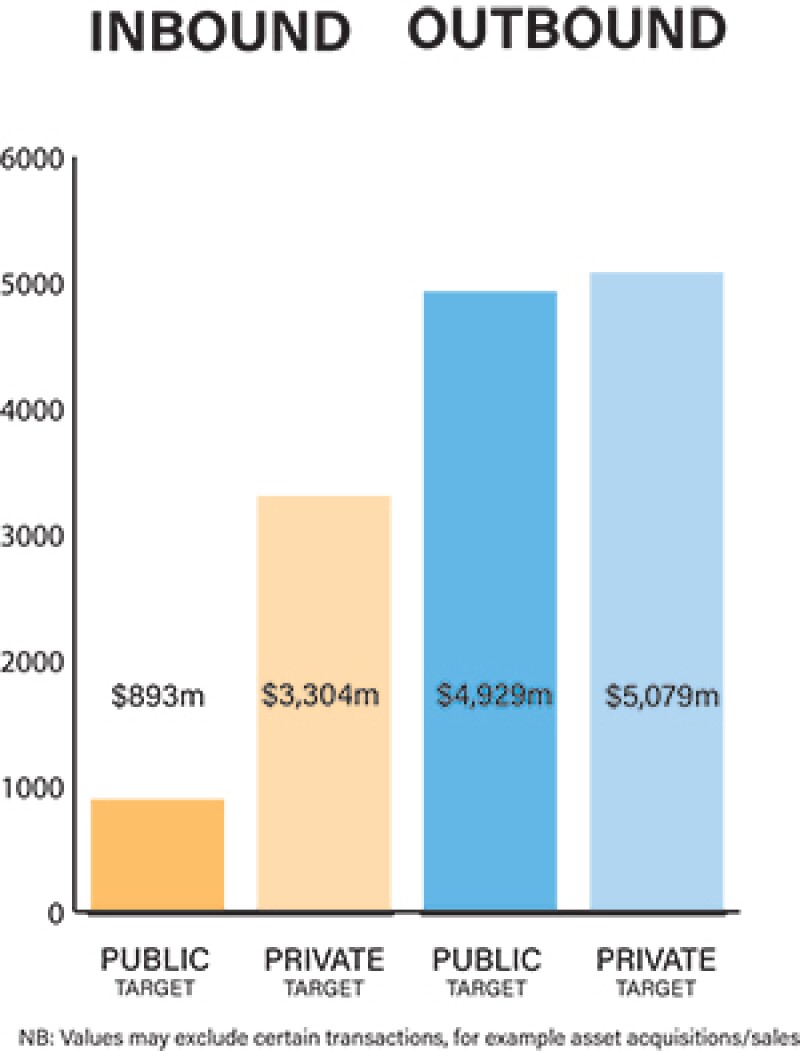

Hong Kong SAR continues to be a hub for large-scale private and public M&A transactions. However, due to depressed equity valuations in 2020 resulting from the pandemic, there has been an increased number of take-private and private investment in public equity (PIPE) deals. The state of the capital markets overall heavily influences deal pricing and valuations, particularly in the case of public transactions.

COVID-19 and recovery plans

Despite experiencing an initial slowdown in M&A deal volume, Hong Kong SAR experienced a strong rebound in the second half of 2020 as it started to recover from the effects of COVID-19.

The pandemic has spurred activity in the healthcare and life sciences industry globally, including in Hong Kong SAR, where there has been increased private equity (PE) interest in the acquisition of biotech and healthcare companies. Investment in this industry has had the benefit of the new listing regime, which was introduced last year and allows for pre-revenue biotech companies to apply to list on the Hong Kong Stock Exchange (HKEX).

|

|

New legislation enables private funds to be registered in the form of limited partnerships |

|

|

COVID-19 has had a significant influence on how deals are structured. Market uncertainty has made it difficult to value targets and forecast future performance. Buyers are considering their walk-away rights more carefully, leading to negotiation of more favourable material adverse change (MAC) clauses, although enforcement of MACs remains an issue.

Difficulty in agreeing company valuations has meant that completion accounts mechanisms are being favoured by buyers as a way to mitigate the risk of shifts in the value of businesses pre-completion. Buyers are also using earn-outs or deferred consideration structures to address the risk of unforeseeable disruptive events.

The last few years have seen active PE participation, fuelled by a stockpile of dry powder amassed from successful fund-raising by PE funds. Despite the uncertain market, PE is likely to remain a driving force in the market going forward.

The M&A market in Hong Kong SAR has proved itself robust in the last 12 months, and despite the continuing pandemic, the relatively strong rebound seen in the second half of 2020 combined with positive vaccine news has paved the way for a steady recovery in 2021.

The pandemic, along with the uncertain geopolitical landscape, including trade tensions between the US and China, means investors will continue to approach M&A cautiously, focusing on growing existing businesses and looking for niche or perceived quality opportunities for investment.

Legislation and policy changes

M&A transactions involving public companies or companies with a primary listing of their equity securities in Hong Kong SAR are subject to the regulations of the Code on Takeovers and Mergers (Code), which is administered by the Securities and Futures Commission (SFC), the Listing Rules, and the Securities and Futures Ordinance.

Against a backdrop of COVID-19, the increasing trend of protectionist policies by international governments, as well as trade tensions and geopolitical uncertainties, are likely to be challenges for cross-border transactions.

For Hong Kong SAR specifically, 2020 saw new legislation introduced (the Limited Partnership Fund Ordinance (Cap. 637)), which enables private funds to be registered in the form of limited partnerships in Hong Kong SAR. The regime is intended to attract PE and venture capital funds to set up in Hong Kong SAR to direct capital into corporates. 2020 also saw the implementation of the Inland Revenue Department's electronic service, which allows contracts and instruments of transfer to be e-stamped. The timing of this implementation was fortunate given COVID-19 and the shift to remote working arrangements.

Hong Kong SAR's merger control legislation currently only applies to M&A transactions that involve an undertaking that directly or indirectly holds a carrier licence within the meaning of the Telecommunications Ordinance. The Competition Commission is thought to be reviewing the existing framework of its broader anti-competition regime; however, whether the merger regime will expand to other sectors remains to be seen.

Market norms

It is commonly assumed that the Code only applies to companies listed in Hong Kong SAR when in fact it applies to public companies in Hong Kong SAR, which may include unlisted companies. Another common misconception is that there is no merger control regime in Hong Kong SAR. As mentioned above, there is a merger regime, but it currently only applies to the telecommunications and broadcasting sectors.

Hong Kong SAR maintains its own law for M&A transactions that is still closely based on English law (as opposed to the civil law regime that applies in China), which includes connections to the Code. Parties are increasingly using W&I insurance on M&A deals both on the sell-side to execute a clean break and on the buy-side to create a more competitive bid in an auction context. Typically, there are premiums in the range of 1%–2% of the sum insured.

During the COVID-19 period, technology has been key. Organisations have had to ensure that their IT is sufficiently robust to support remote working. Electronic signing platforms such as DocuSign have become more commonly used in transactions. More generally, transaction management platforms are gaining traction, simplifying and automating certain legal processes such as completion checklists, and there continues to be a trend towards using cognitive or artificial intelligence (AI) software for due diligence.

Public M&A

A takeover of a public company listed in Hong Kong SAR may be executed principally by way of a general offer (mandatory or voluntary) or a scheme of arrangement (SOA). If a takeover offer is made and acceptances are received in respect of 90% or more of the shares to which the offer relates, the offeror may compulsorily acquire the non-accepting shareholders' shares. An SOA requires approval by members representing at least 75% of the voting rights of members present and voting in person or by proxy at the meeting, with not more than 10% of the voting rights attached to all disinterested shares opposed to the scheme.

Most listed companies in Hong Kong SAR have a controlling shareholder that holds more than 30% (and often more than 50%) of the company's shares, making it vital to have the controlling shareholder's support in any attempt to obtain control. As a result, hostile bids, while allowed, virtually never occur.

COVID-19 has not affected public takeover rules in Hong Kong SAR. All conditions to a voluntary general offer or an SOA must be satisfied within the time periods prescribed by the Code. Consequently, many takeovers in Hong Kong SAR are affected by way of a pre-conditional offer in which there are mandatory regulatory conditions that cannot (or may not) be satisfied within the prescribed time periods.

Other than the acceptance condition, conditions that are usually attached to a takeover offer include regulatory approvals and various standard no occurrence of MAC or illegality conditions, although the consent of the executive is required to invoke such conditions. No financing conditions are accepted, as the announcement of an offer should include confirmation by the financial advisor that the offeror has sufficient financial resources to satisfy the full offer price.

Break fees in public M&A remain uncommon in Hong Kong SAR, as most deals are consensual and require the controlling shareholder to agree to the deal. The Code provides that an inducement fee or a break fee must be de minimis (usually no more than 1% of the offer value). The target's board and financial advisor must confirm to the executive that each of them believes that any agreed fee is in the best interests of the shareholders, and such arrangement must be fully disclosed to all shareholders in the offer announcement.

Private M&A

Consideration mechanisms involving post-completion net debt and/or working capital adjustments based on completion accounts are more prevalent than locked-box structures in M&A transactions in this region, especially in 2020 when buyers saw the need to mitigate market uncertainty caused by COVID-19. For seller-friendly transactions in which targets are being sold in competitive auctions, locked-box structures are still very common.

Earn-out structures do not commonly feature in transactions in this region, largely due to the uncertainties that such structures create for both buyers and sellers. However, earn-out structures are becoming more attractive as parties attempt to work around the difficulties in predicting future performance of the business in this climate. Escrow arrangements are still widely used, particularly when there are financial sponsor sellers who would not typically provide a parent guarantee.

W&I insurance continues to grow in popularity and is now a regular deal tool used to facilitate M&A transactions. While it was initially used by PE sponsors looking to achieve a clean exit, increasingly, parties consider its use as a tool to bridge gaps between liability caps offered by sellers and coverage required by buyers, particularly in PE deals. Insurance underwriters within the region generally view Hong Kong SAR as a relatively stable and low-risk jurisdiction, which has a positive effect on premium levels.

|

|

There has been an increase in outbound activity, with a focus on Chinese target companies |

|

|

In competitive auctions, sale conditions may be limited to receipt of requisite third-party consents, such as regulatory consents in respect of targets operating in regulated industries and consents required under contractual obligations binding on the vendors and/or target entities. In bilateral transactions, potential buyers generally have more leverage to negotiate additional, bespoke conditions precedent, including MAC clauses, repeated warranties and no-breach conditions.

In M&A transactions involving a Hong Kong SAR target, the transaction documentation is typically governed by Hong Kong SAR law, given that local laws dictate the share transfer and attendant control transfer procedures. For regional M&A transactions, foreign governing laws sometimes get adopted, for example Singapore law or the laws of England and Wales, and parties increasingly designate Hong Kong SAR or Singapore for arbitration.

In 2020, the HKEX ranked second globally in terms of IPO proceeds, behind the NASDAQ. HKEX's ranking was driven by several secondary listings of high-profile US-listed China-based companies on the HKEX in 2020 and take-privates. The uncertain market has made it more difficult to execute trade sales and sales to financial sponsors, both in Hong Kong SAR and globally, although the market recovered considerably towards the end of 2020.

Looking ahead

Despite the pandemic and continuing geopolitical uncertainty, it was encouraging to see the way the M&A market has rebounded in the second half of 2020 and it is hoped that this rebound will flow through to a stronger 2021, particularly as the vaccine rollout continues.

Hong Kong SAR remains an attractive hub for both inbound and outbound investment, particularly for Chinese companies seeking alternative options due to growing regulatory pressure in the US. PE houses still have significant stockpiles of capital that need to be deployed, which should drive deal flow in 2021.

Click here to read all chapters from the IFLR M&A Report 2021

Simon Cooke

Partner

Latham & Watkins

T: +852 2912 2709

Simon Cooke is deputy managing partner of Latham & Watkins Asia offices, advising clients on a broad range of corporate transactions.

Simon regularly serves Asian and global PE clients on domestic and cross-border buyouts, growth capital, pre-IPO, PIPE, privatisations, and other PE transactions. He also advises a range of clients on general private and public company cross-border M&A and corporate finance transactions.

Simon is consistently listed as a leading advisor on corporate, M&A and PE transactions in Asia by ranking guides.

Amy Beckingham

Partner

Latham & Watkins

T: +852 2912 2550

Amy Beckingham is a partner in the Hong Kong SAR office of Latham & Watkins and a member of the corporate department.

Amy specialises in public and private M&A and joint ventures, acting for PE and other financial investor clients on transactions throughout Asia, across a wide range of industry sectors. She has also advised PE clients on their IPO exits in a number of jurisdictions across Asia.

Maurice Conway

Counsel

Latham & Watkins

T: +852 2712 2731

Maurice Conway is a counsel in the Hong Kong SAR office of Latham & Watkins and a member of the corporate department.

Maurice's practice focuses on international M&A and PE transactions, as well as general corporate matters across a diverse range of industries, with particular focus on representing PE clients and corporates on investments across Southeast Asia.

Frank Sun

Partner

Latham & Watkins

T: +852 2912 2512

Frank Sun is a partner in the Hong Kong SAR office of Latham & Watkins and a member of the corporate department.

Frank specialises in PE investment and public and private M&A transactions.

Frank regularly advises PE funds and corporate clients in PE investments, cross-border acquisitions, PIPEs, privatisations and a wide range of other complex M&A transactions.

Terris Tang

Partner

Latham & Watkins

T: +852 2912 2719

Terris Tang is a partner in the Hong Kong SAR office of Latham & Watkins and a member of the corporate department.

Terris advises clients on various corporate finance transactions, including public and private M&A, capital markets, including IPOs, corporate restructurings, PE and general compliance matters. He has more than 10 years of experience advising Chinese and international corporations, PE firms, and financial institutions across Asia and globally.