Cross-border M&A in Indonesia has remained active in spite of the ongoing economic impact caused by the COVID-19 pandemic. Alongside transactions that have been carried out as part of restructurings and consolidation processes of state-owned enterprises, a number of much-discussed Indonesian acquisitions in 2020 emerged from the financial services industry.

In 2020, the Ministry of State-Owned Enterprises established the Indonesia Financial Group (IFG), a state-owned investment, insurance and guarantee holding company, in order to strengthen the group's influence in the financial services area. This emerged after the Bahana Pembinaan Usaha Indonesia (BPUI), the holding company owned by the ministry, acquired a number of institutions including Jasa Raharja, Jasa Asuransi Indonesia (Jasindo), Jaminan Kredit Indonesia (Jamkrindo), and Asuransi Kredit Indonesia (Askrindo). It is anticipated that further expansion planning will include certain inorganic growth by acquiring other similar companies or those with relevant businesses.

The other most discussed M&A transactions came from the banking industry. Bangkok Bank acquired Indonesia's Permata Bank, while Bank Central Asia (BCA) purchased the Indonesian branch of Netherlands-based Rabobank and Bank Royal Indonesia. Tjajo & Partners assisted on the latter deal that saw Bank Royal transform into a digital-based bank to complement BCA's established digital channels.

Outside financial services, a further notable transaction saw personal care company Kimberley-Clark acquire Softex Indonesia, one of the country's leading personal care companies, for $1.2 billion.

COVID-19 and recovery plans

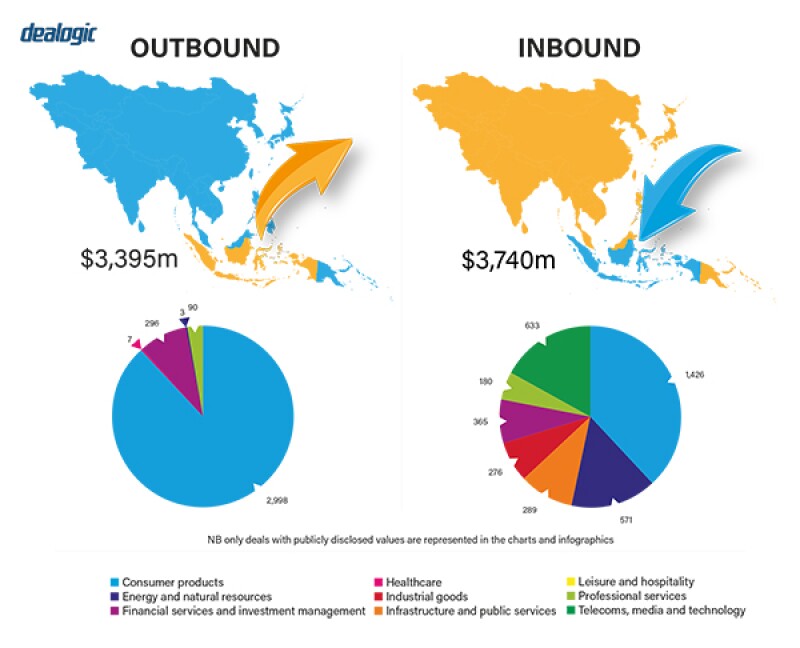

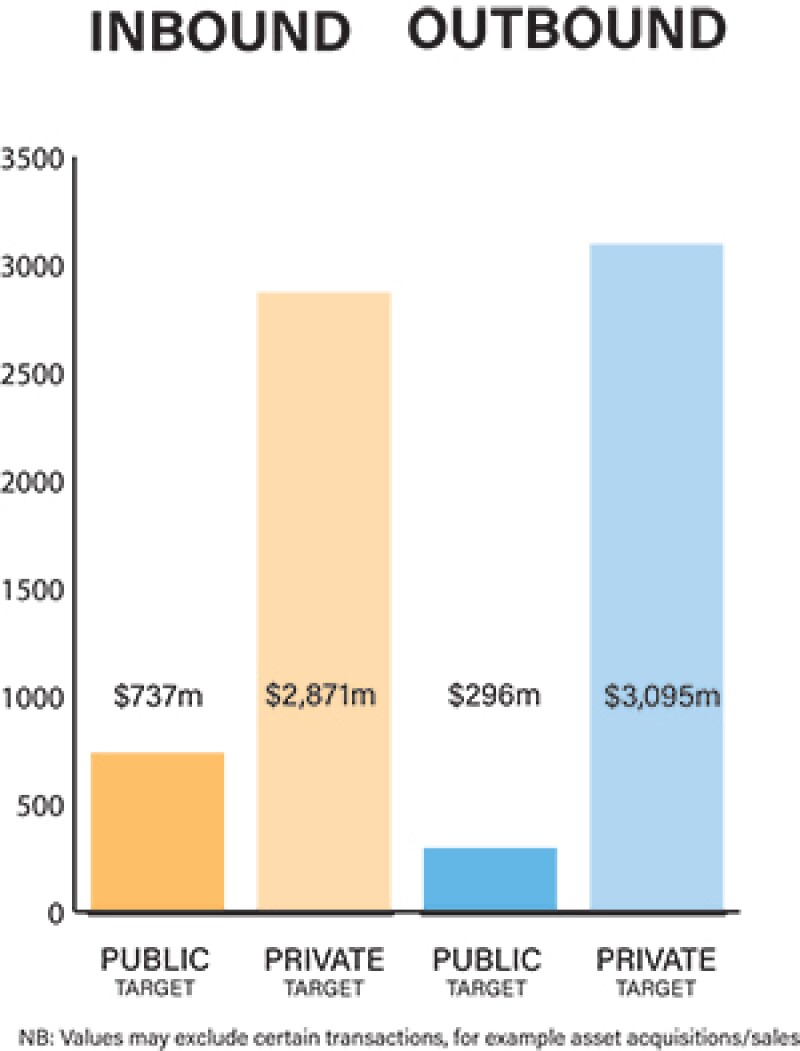

Indonesia had 40 cross border M&A transactions in 2020, comprising of 32 inbound M&A transactions and eight outbound transactions. In addition, there were 22 domestic M&A transactions. The 2020 statistics showcase less activity than 2019, where Indonesia recorded a total of 94 M&A transactions including 45 domestic deals. However, the total value of 2020 M&A transactions was $9.7 billion, higher than the 2019 total value of $7.2 billion.

|

|

The Omnibus Law, which introduces high-level changes to the investment framework in Indonesia, will also likely have an impact on deal flow |

|

|

Through M&A activity, Indonesian firms have sought to facilitate business growth and achieve further expansion of their services. Tjajo & Partners notably assisted Danareksa Persero on Bank Rakyat Indonesia's acquisition of Danareksa Sekuritas and Danareksa Investment Management to increase their stronghold in the area of financial services. Likewise, the firm also assisted the acquisition of Bank Royal by BCA that revamps the bank into a digital bank. Tjajo & Partners were also heavily involved in Semen Indonesia's acquisition over Holcim and their follow up actions in expanding their market coverage.

Sectoral consolidation has also been a key M&A driver in Indonesia. After sectors such as mining and pharmacy went through phases of consolidation during the end of 2019, the financial sector embraced such opportunities to unite in 2020. Key highlights include BPUI's multi-mergers and the ongoing consolidation of the state-owned Bank Syariah that is expected to be completed in 2021. The president has also released the Presidential Decree No. 40/2020 specifically governing the state-owned enterprises (SOE) restructuring acceleration team.

The influence of private equity (PE) funds also continues to grow in Indonesia. For example, East Ventures were briefly involved in the discussions for the Permata Bank deal, and this shows that PE firms remain interested in the market. Some PE firms are eyeing up the Indonesian digital and start-up sector as potentially lucrative businesses.

Legislation and policy changes

The general regulation governing M&A in Indonesia is Law No. 40 of 2007 on limited liability companies. There are other regulations applicable for certain companies or industries. For example, public companies will be subject to various rules in the capital markets, including the Financial Services Authority (OJK) regulations on acquisitions and material transactions. For the financial services sector, the OJK has set out specific regulations on M&A, banking, insurance, and multi-finance companies.

Other key regulations include Law No. 25 of 2007 on investment, Law No. 5 of 1999 on the prohibition of monopoly practices and unfair business competition, and Law No. 13 of 2003 on employment.

There is no particular regulatory body that governs and supervises M&A transactions, however there is the Business Competition Supervisory Commission (Komisi Pengawas Persaingan Usaha – KPPU) which, to some extent, has a supervisory role over certain M&A transactions under the realm of competition law. For certain industries such as financial services, the M&A transactions will need to get prior approval from the OJK.

Throughout 2020, there were a number of regulations released that may directly or indirectly impact future M&A deals in Indonesia.

The OJK issued the replacement of two important rules that govern capital markets and public companies concerning material transactions, affiliated party transactions and conflict of interest. The two new rules introduce provisions and thresholds, including new obligations, for certain transactions that may impact corporate action to be carried out by public companies, including for potential M&A transactions.

Another rule that directly impacts M&A transactions is the issuance of the Presidential Decree No. 40/2020 specifically governing the SOE restructuring acceleration team. It can be expected that the consolidation process will be more aggressive henceforth, meaning that some M&A deals cannot be avoided for certain state-owned companies.

COVID-19 has led to legislators issuing guidelines to tackle the impact of the pandemic on the Indonesian economy and business environment. The OJK have introduced specific regulation to anticipate turbulences that may take place in the banking industry, such as Regulation No. 18/POJK.03/2020 which authorises the OJK to mandate or instruct banks that fall under certain criteria to be subject to acquisition, merger, or consolidation.

The Omnibus Law, which introduces high-level changes to the investment framework in Indonesia, will also likely have an impact on deal flow. One of the most important changes is the potential alteration in the existing 'negative list'. The Omnibus Law regulates that all business sectors are either open or closed for investment (including foreign investment), or can only be conducted by the central government. Certain business sectors that can only be conducted by the central government are those that are services in nature and those activities intended for defence and security such as: (a) main weaponry equipment system; (b) government museums; (c) historical artefacts; and (d) provision of telecommunication navigation/shipping or vessel navigation support facilities.

Furthermore, the Omnibus Law introduces the concept of risk-based business licensing, which simplifies business licensing processes, sectoral business licensing processes, and investment requirements.

One of the most awaited implementing regulations of the Omnibus Law is regarding a 'positive list' concept to replace the 'negative list' concept as stipulated under the Presidential Regulation No. 44 of 2016 on the list of business fields which are closed, and business fields which are conditionally open for capital investment. These changes might have an impact on the foreign ownership restriction once a foreign entity or individual wishes to acquire a target company in Indonesia. However, the full picture of the impact of the Omnibus Law on M&A transactions will be clear once the new Presidential Regulation stipulating a 'positive list' is issued.

There is also a draft OJK rule that has been circulated concerning financial technology (fintech) lending. The rule has created wide discussion in the market, with most related parties believing that its implementation will increase the chances for consolidation among companies through M&A.

Market norms

A common market misconception in Indonesia concerns acquisitions and if they are deemed to have occurred whenever there is a transfer of shares above 50%. However, in truth, the key to determine whether there is an acquisition or not is whether there is a change of control in the company following such a transfer of shares.

A common overlooked aspect of M&A in Indonesia is the 'negative list' of investments, which some parties fail to consider. It should be noted that certain business activities are (a) closed to foreign investment; or (b) opened with restrictions of ownership. Post-completion reporting obligations are also sometimes overlooked, especially on matters related to anti-competition compliance.

In the midst of this pandemic, technology played an important role in M&A deals in Indonesia to facilitate negotiations, meetings, and closings. The use of the e-signature is used more frequently to avoid social contact, while the government have also started running an online system for licensing, i.e. the online single submission (OSS) system, whereby M&A transactions would also involve this system to update licensing information. Submissions through regulators is also conducted online.

Public M&A

The key factors involved in obtaining a public company in Indonesia are:

Acquiring a number of shares that makes the acquirer control the voting rights in the general meeting of shareholders (usually more than 50% of shares); or

• If less, the acquirer has arrangement with the other shareholders (excluding public shareholders) to have the power and ability to appoint and elect the management of the company (directors and/or commissioners).

Usually, the conditions precedent of a public takeover would consist of (a) regulatory clearance; and (b) corporate approval (particularly the general meeting of shareholders). However, findings during the due diligence exercise could also be added as conditions precedents. Meanwhile, sub-account opening, instruction for crossing of shares, and reporting obligation are following as the conditions subsequent.

Break fees are not that common in Indonesian public M&A, however they may come into play when the transaction is initiated from an open tender.

Private M&A

In Indonesia, private M&A usually operates with a basic mechanism where the seller and buyer agree the valuation for the business of the target company to be used as a basis to determine the consideration for the transaction.

The mechanism it would use depends on the nature or condition of the target company and its business. Earn-out mechanisms are often used when the valuation includes the target's future performance. The use of escrow is also not rare, especially when the target company has potential risks of tax and other financial liabilities.

|

|

The pandemic has increasingly shifted the habit and practice of consumers towards the technology sector |

|

|

Private takeover offers often have conditions related to licensing, i.e. prior approval from certain government authorities. This is related to the business license possessed by the target company. Some licenses may only require post-reporting obligations on the change of shareholders.

It is common practice that conditional share sale and purchase agreements are governed by foreign laws and jurisdictions, while the deed of share transfer is governed by Indonesian law. The private share transfer shall be performed in notarial deed and thus, it must be governed by Indonesian law.

Commonly in Indonesia, the exit is performed through sales through a third party. However, in recent times, exiting through a trade sales mechanism has been seen more frequently, especially for start-up companies when they are acquired by bigger players in the market or new investors.

Looking ahead

As the Indonesian economy proceeds to recover, M&A activity can still be expected to be relatively busy. Throughout 2021, companies whose sectors have been lightly impacted by the COVID-19 pandemic will look for options to get investors to maintain the going concerns of their operations. Meanwhile, companies with multiple lines of businesses and strong financial foundations will presumably look to consolidate their assets to boost revenue.

As the pandemic has increasingly shifted the habit and practice of consumers towards the technology sector, investment and expansion in this field would likely lead growth in Indonesia for 2021.

Changes and adaptations to the M&A guidelines for Indonesia remain probable. The Omnibus Law still leaves problems to be addressed with certain implementing regulations yet to be formally issued. Therefore, legal practice will have to prepare some changes throughout the year once those regulations are issued and react accordingly based on the impact of how the structure of future investment would be and how it may affect M&A transactions across Indonesia.

Click here to read all chapters from the IFLR M&A Report 2021

Melissa Butarbutar

Managing partner

Tjajo & Partners

T: +62 21 2251 3653

E: melissa.butarbutar@tjajolaw.id

Melissa Butarbutar is the managing partner at Tjajo & Partners. She specialises in the corporate and capital markets practices with experiences in the banking and finance field.

Melissa has been actively involved in M&A transactions. She is also experienced in advising and assisting clients, both private and state-owned enterprises, in various capital markets transactions including IPOs, rights issues, and bonds offerings. Her distinguished transactions includes representation on Semen Indonesia's acquisition of Holcim, and assisting Danareksa Persero in its divestment over Danareksa Sekuritas and Danareksa Investment. She was also in charge of assisting Indonesia Deposit Insurance Company (LPS) in the divestment process of Bank Mutiara, the landmark deal for the divestment of a failed bank under LPS scheme.

Melissa is a law graduate from the University of Indonesia. She continued her education at EDHEC Business School in France, where she attained a master's degree in legal and tax management.

Rambun Tjajo

Senior partner

Tjajo & Partners

T: +62 21 2251 3653

Rambun Tjajo is the founding partner of Tjajo & Partners, where he now serves as a senior partner. He is involved in all aspects of the capital markets, M&A and corporate related transactions.

Rambun leads the team in conducting the necessary thorough due diligence, drafting and reviewing the transactions documents, negotiating on behalf of issuers or lead underwriters, and reviewing prospectuses and other registration documents. His cross-border transactions representations have won several most notable deals awards in the capital markets fields by respected legal directories.

Rambun is a law graduate from Padjajaran University. He is one of the board members of Next Indonesian Unicorns (NextICorn) foundation, which promotes Indonesia's most investable start-ups to the most capable investors across the globe.

Kevin Yehezkiel

Senior associate

Tjajo & Partners

T: +62 21 2251 3653

E: kevin.yehezkiel@tjajolaw.id

Kevin Yehezkiel is a senior associate at Tjajo & Partners, who has more than seven years of experience focusing corporate and financial matters.

Kevin engages in a range of M&A mandates. He has dealt on due diligence processes, disclosure schedules and other ancillary documents. He is also responsible for drafting and negotiating key transactional documents and communicating with clients on day-to-day transactional matters.

Kevin graduated with a degree in law from Trisakti University.