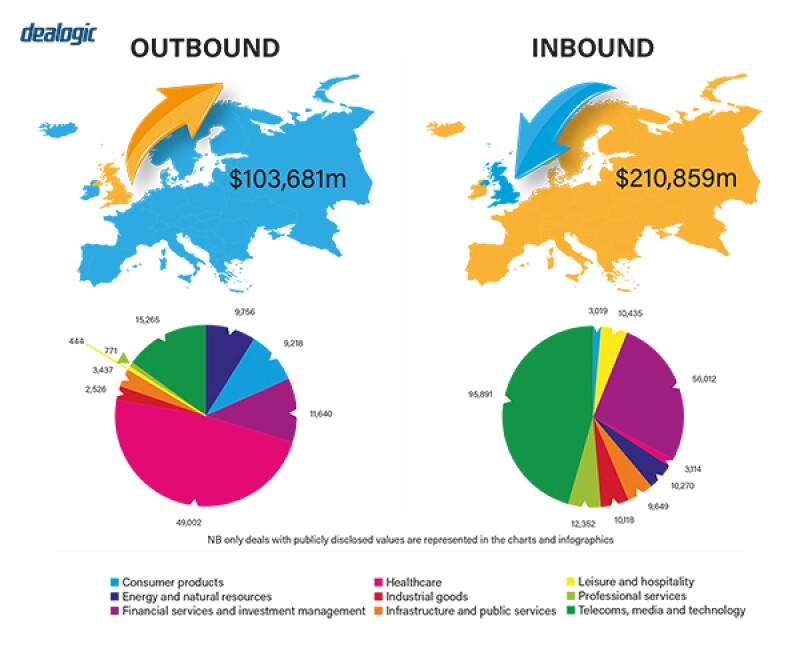

The UK M&A market in 2020 was significantly down in the first half of the year due to the effects of the COVID-19 pandemic. Deal activity picked up in the second half of the year, as companies navigated their way out of the immediate liquidity crisis.

The use by a private company of a merger with a listed special purpose acquisition company (SPAC) as an exit method and route to the public markets is a growing trend in cross-border deal-making.

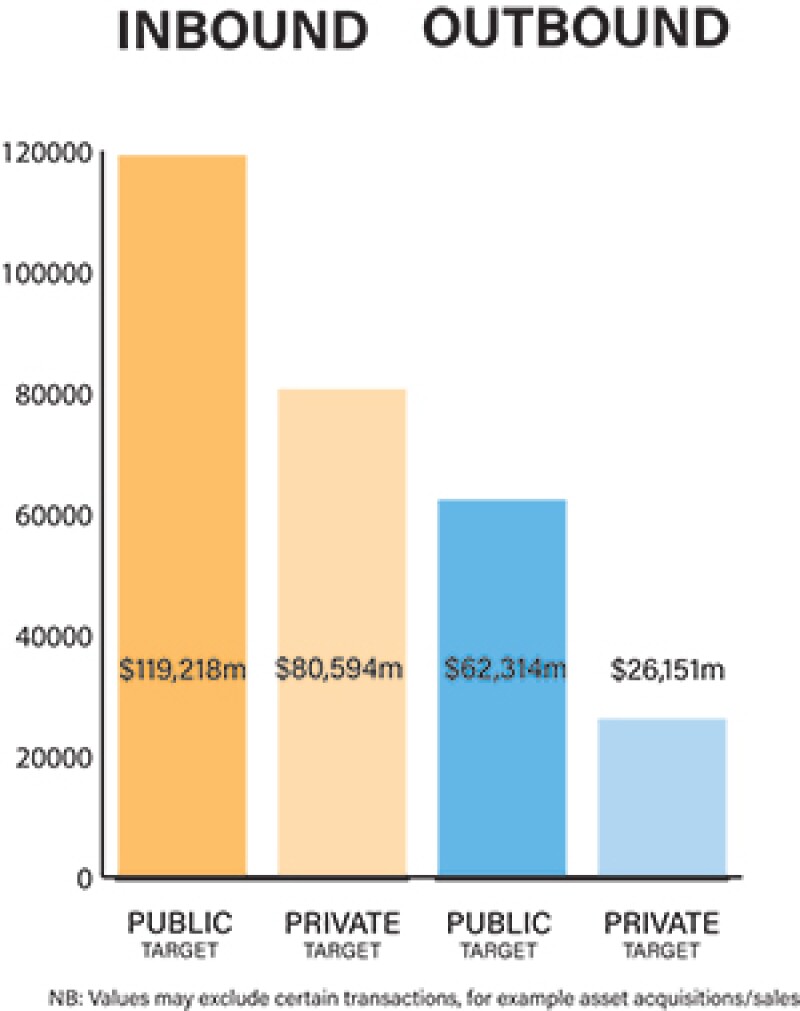

Both public and private M&A transactions play an important part in the UK market, with private M&A deals making up a far higher number of UK target M&A deals. Public takeovers have a prescribed process under the City Code on Takeovers and Mergers (the Takeover Code), as administered by the Panel on Takeovers and Mergers, whereas the structure and process of private acquisitions are a matter of negotiation between the buyer and seller.

Among other notable deals, Latham & Watkins advised on NVIDIA's acquisition of Arm for $40 billion, a deal that highlighted the UK's ongoing discussion of national interest and security. Transactions involving overseas entities acquiring UK companies in sensitive sectors will be subject to greater scrutiny following the announcement of the National Security and Investment Bill.

COVID-19 and recovery plans

UK M&A activity overall decreased in 2020 as a result of COVID-19, as companies responded to the challenges arising from the pandemic and focused on strengthening their balance sheets. Despite this backdrop, and the initial shock to businesses in the second quarter, domestic M&A and inbound M&A increased in the third quarter; however, outbound M&A has seen a significant drop each quarter. Real estate, financial services, retail and hospitality have all seen a decrease in M&A activity, while the technology, warehousing and healthcare sectors have been more robust.

Deal activity is expected to continue to increase in the first quarter of 2021, as vaccines are rolled out and companies look to acquisitions to better protect against future challenges or disposals to increase liquidity. However, with the continued uncertainty following Brexit, and the UK government lifelines introduced during COVID-19 coming to an end, the speed of recovery in the first part of 2021 may be dampened.

The most significant factors influencing deal structures are related to:

Industry consolidation, M&A-driven growth, financing considerations or other factors;

Distressed M&A work: takeover reorganisations, bidding, post-M&A closings; and

The impact of COVID-19 on M&A-related disputes, use of indemnity provisions.

The COVID-19 pandemic has caused companies multiple challenges, the effect of which has been to create a liquidity need for many companies and an increase in refinancings and restructurings (including debt-for-equity swaps). Latham & Watkins has advised on several balance sheet restructuring matters in 2020 in affected sectors including Swissport, New Look, PizzaExpress, and FatFace.

|

|

In 2020, there was an increase in exits by way of a merger with a SPAC |

|

|

Parties are also seeking to address the allocation of risk in transaction documents. Express references to COVID-19 are being included in conditions precedent (as opposed to attempting to rely on the doctrine of frustration), and earn-outs are becoming more common as buyers seek comfort on a target's financial performance during COVID-19 before paying full value. Warranty and indemnity (W&I) insurers have responded by including broad exclusions for breach of warranty claims resulting from COVID-19.

In 2020, there was an increase in exits by way of a merger with a SPAC (or blank cheque company), which is seen as a more efficient route to the public markets, while also enabling the financial sponsor to participate in any upside in the enlarged structure, as evidenced by Paysafe's merger with Foley Trasimene Acquisition Corp. II, which Latham & Watkins advised Paysafe on.

The market dislocation caused by COVID-19 is encouraging financial investors to revisit old targets and move to execution quickly where assets are now distressed. W&I insurance uptake by financial investors on both the buy-side and sell-side remains a common feature in M&A transactions as they look to bridge the gap, which has also resulted in corporates becoming more familiar with such products to remain competitive (on the buy-side) or to keep a larger portion of the proceeds as free cash (on the sell-side).

We expect UK M&A to continue to recover in 2021 as COVID-19 vaccines are rolled out and the first companies and financial investors emerge from the pandemic seeking to take advantage of M&A opportunities.

Legislation and policy changes

The Companies Act 2006 applies to public and private companies registered in the UK. While the Companies Act does not govern M&A activity as such, its requirements dictate the way that deals by UK companies are effected.

The acquisition of private companies is a matter of negotiation between the buyer and seller, and no regulated offer process is required. In non-regulated industries (i.e. other than financial services, telecoms, media, pharmaceuticals), deals are not typically subject to input from regulatory bodies, save for competition and foreign direct investment (FDI) matters.

Public acquisitions are governed by the Takeover Code.

The end of the Brexit transition period on December 31 2020 (the transition period) marked the end of the European Commission's status as the 'one-stop shop' for the review of mergers relating to the UK meeting certain monetary thresholds. This means that if a merger satisfies the jurisdictional thresholds of the EU Merger Regulation and the UK's Enterprise Act 2002, the Competition and Markets Authority (CMA) and the European Commission may now conduct parallel assessments of the same merger in their respective jurisdictions. In its 2020–2021 Annual Plan, the CMA estimated that this would result in a 50% increase in the number of merger cases it reviews.

The National Security and Investment Bill was published in November 2020 and is expected to become law this summer (the NSI Regime). The NSI Regime will give far-reaching powers to the UK's Secretary of State for Business, Energy and Industrial Strategy (BEIS) to intervene in relation to transactions that risk national security. The NSI Regime introduces (i) a statutory requirement for parties to notify relevant transactions in the most sensitive areas of the economy; and (ii) a 'call-in' power that enables BEIS to assess other transactions that may give rise to national security risks.

The Pensions Regulator will gain enhanced powers in 2021. Unlike the NSI Regime, the Pension Schemes Act will not have retrospective effect, however, it expands the circumstances in which the Pensions Regulator can exercise existing moral hazard powers. The Pension Schemes Act also creates new moral hazard powers that can be exercised against any 'person' and includes penalties that encompass criminal sanctions. Given increasing political and public pressure on the Pensions Regulator, dealmakers should anticipate increased scrutiny of deals that involve a defined benefit pension plan.

As of April 2021, a dedicated Digital Markets Unit (DMU) will be set up within the CMA that will introduce and enforce a new code to govern the behaviour of platforms that have considerable market power – known as 'strategic market status'.

Under the new code, platforms including those funded by digital advertising could be required to be more transparent about the services they provide and how they are using consumers' data. The platforms would also be required to give consumers a choice over whether to receive personalised advertising, and would be prevented from placing restrictions on their customers that make it hard for them to use rival platforms. Moreover, the DMU is expected to introduce greater scrutiny of M&A involving firms with strategic market status.

Market norms

UK companies can be acquired by way of a share purchase (i.e. purchasing all the shares of the target company) or an asset purchase (i.e. purchasing all the assets of the target company) but, as a matter of UK domestic law, M&A transactions between private UK companies cannot be consummated by way of a merger by absorption. The Companies Act does provide for mergers for UK public companies, but these provisions are generally not used and a scheme of arrangement is more commonly seen. This is in contrast to other jurisdictions where mergers are frequently encountered.

The UK merger control regime is voluntary, and there is no obligation for the notification of mergers in the UK, although, in practice, notifications are made to avoid any interim enforcement orders that might create deal uncertainty or delay.

An area that is often overlooked by parties involved in M&A transactions is that buyers do not usually attend to consolidation of group companies immediately after closing, resulting in continued administrative and financial burdens (e.g. filing annual accounts) to maintain dormant or inactive subsidiaries.

There is an increasing use of artificial intelligence (AI) technology to conduct more efficient due diligence in M&A transactions. Dealmakers have also made extensive use of virtual meeting technology and electronic signature platforms to negotiate and close transactions during the pandemic.

Public M&A

A bidder may choose to stake-build in order to obtain control of a public company, however, depending on the time of such acquisition and form of consideration, doing so may set a floor price and fix the form of consideration for any future offer. Furthermore, acquiring 30% of the voting rights in a public company will require a bidder to launch a mandatory cash offer for the remainder of the shares it does not own.

In addition, any dealing giving rise to speculation, rumour or an untoward movement in the public company's share price may mean an announcement is required (if the acquirer is considering making an offer for the whole company), while disclosures will also be necessary once certain thresholds of ownership are crossed.

A takeover offer will usually be subject to an extensive set of conditions, including: securing acceptances carrying more than 50% of the voting rights in the target (or, in the case of a court-sanctioned scheme of arrangement, the requisite 75% target shareholder approval), antitrust and regulatory approvals, bidder's shareholder approvals, listing of consideration shares (when applicable), and conditions dealing with the state of the target's business.

A bid cannot be subject to conditions that depend on the subjective judgment of the bidder. Additionally, seeking to rely on a material adverse effect (MAE) or similar bidder protective condition to not proceed with an offer requires the consent of the Takeover Panel, which applies a materiality test with a high bar (requiring the circumstances to be of considerable significance and aiming to strike at the heart of the purpose of the transaction) before it will permit an offer to be lapsed.

|

|

The market dislocation caused by COVID-19 is encouraging financial investors to revisit old targets and move to execution quickly… |

|

|

In 2020, the Takeover Panel effectively confirmed that it would not make COVID-related exceptions to its general approach to MAE conditions when it declined to permit the bidder for Moss Bros to rely on an MAE condition on the basis of the impact of COVID-19 on Moss Bros' business. It is possible that we will see a move by bidders towards more tailored conditions aimed at events like the pandemic, which the Takeover Panel has indicated are more likely to be exercisable (assuming the relevant situation arises) than would be the case if the bidder were seeking to rely on a general MAE condition.

Occasionally, a bidder will announce a firm intention to bid on a pre-conditional basis, when posting of the bid document is suspended pending satisfaction of stated pre-conditions, often material antitrust conditions if it is anticipated that these will involve protracted processes.

In public takeover offers, break fees (when the target pays the prospective buyer) are now largely prohibited, whereas reverse break fees (when the prospective buyer pays the target) are not prohibited. Only in limited circumstances can a break fee be offered, for example, a break fee may be offered to a 'white knight' making a bid in competition with a hostile offer that has already been announced (subject to such fee being de minimis and payable only upon the first offer becoming or declared wholly unconditional).

If the bidder is a UK public company and subject to the UK Listing Rules, and the total value of the reverse break fee exceeds 1% of the market capitalisation of the bidder, the bidder's directors will need to treat the reverse break fee as a material transaction (which, among other things, requires shareholder approval). If the bidder controls more than 10% of the target, a reverse break fee may also constitute a related party transaction for the purposes of the UK Listing Rules.

Private M&A

According to the Latham & Watkins 2020 Private M&A Market Study (the Study), which examined over 260 deals signed between July 2018 and June 2020, 47% of deals included a locked-box mechanism, 25% of deals included a completion accounts mechanism and 28% of deals did not provide for price adjustment. This trend is consistent with results from the previous four editions of the study and reflects the continuing seller-friendly nature of the UK M&A market. The number of deals that featured an earn-out remained limited at 18% (albeit an increase of 4% from the previous study).

The Study also revealed the continued limited use of escrows in private M&A deals (19% of deals surveyed, a third successive year of escrows featuring in 20% or less of deals), and a steady use of W&I insurance (34% of deals).

In private M&A, the conditions to closing that are included in a purchase agreement will vary based on the circumstances of each transaction. Historically, conditionality beyond regulatory and anti-trust clearances is uncommon, but the increasing role of regulation in deal making and the impact of COVID-19 could change this.

According to the Study, only 10% of deals included a material adverse change clause (which refers to events that have a negative impact on the market generally or, more specifically, on the target company's business). The use of breach of covenant/warranty conditions remains very limited (8%), but we are seeing an increase in the use of FDI conditions (11%).

Purchase agreements relating to UK companies and assets are typically governed by English law and are subject to the jurisdiction of the English courts. For global transactions, depending on the location of the parties and their advisers, purchase agreements are frequently governed by English law (since it is viewed as stable, impartial and commercial, with a developed litigation infrastructure) but may alternatively be subject to the laws and courts of another jurisdiction, such as New York.

The market for exits remains resilient, with sellers seeking an IPO (or merger with a SPAC) or sale to realise their investment; in some instances, sellers employ dual-track or triple-track exits to give greater certainty that an exit will occur.

Looking ahead

We expect UK M&A activity to continue to increase in 2021. However, remaining uncertain following the end of the Transition Period and the continuing impact of COVID-19 mean that the speed of recovery is likely to be slower in the first part of 2021.

We expect the market to continue to be 'seller friendly', with sellers seeking greater certainty as to a buyer's financial ability and covenant strength. We are also likely to see an increase in the use of earn-outs and escrows as buyers seek comfort on the financial performance of a target during COVID-19.

Click here to read all chapters from the IFLR M&A Report 2021

Nick Cline

Partner

Latham & Watkins

T: +44 20 7710 1087

Nick Cline is an M&A lawyer at Latham & Watkins, with more than 20 years of experience. He focuses on UK and international, cross-border M&A, corporate reorganisations, and joint ventures and is a member of the firm's executive committee.

Nick has extensive experience advising UK plc and international client boards and legal teams on their most complex M&A matters, as well as advising them on their day-to-day corporate advisory needs. He is ranked by legal publications and rated highly by clients.

Robbie McLaren

Partner

Latham & Watkins

T: +44 20 7710 1880

Robbie McLaren is a partner at Latham & Watkins, and serves as global vice chair of the firm's healthcare and life sciences industry group and co-chair of the London corporate department.

Robbie's practice focuses primarily on cross-border M&A, joint ventures and emerging companies. He represents clients who primarily operate in the life sciences, healthcare, and technology industries. He is highly regarded by clients and ranked by legal publications.

Douglas Abernethy

Partner

Latham & Watkins

T: +44 20 7710 4760

Douglas Abernethy represents clients in a range of complex corporate finance and M&A matters, with a particular focus on public takeovers and take-private transactions.

Douglas delivers pragmatic and commercially driven advice on M&A matters to multinational PE firms, financial institutions, and UK-listed companies. He represents clients in connection with significant acquisitions and divestitures involving assets in a diverse range of industries. He also advises financial institutions serving as lenders and advisors to parties on M&A transactions.

Terry C Charalambous

Associate

Latham & Watkins

T: +44 20 7710 3095

Terry Charalambous is an associate in the London office of Latham & Watkins and a member of the firm's corporate department.

Terry advises clients on M&A, PE, venture capital, and general corporate matters. He previously trained and qualified at another law firm, where he also spent time on secondment to Amazon assisting with general commercial matters in the UK and across Europe.