The US M&A market is recovering from a roller-coaster year due to the COVID-19 pandemic. The onset of the pandemic in early 2020 caused a slowdown in deal activity, but the recovery in the second half of 2020 set the stage for a continued increase in deal activity into 2021.

Representation and warranty insurance (RWI), increasingly common in private M&A transactions, has adapted to the changing M&A landscape by accounting for pandemic-specific risks. RWI brokers are also emphasising the availability of particular policies, such as contingent liability policies, that may apply outside the M&A context.

The scope of cross-border transactions subject to governmental review has increased. In February 2020, the Committee on Foreign Investment in the United States (CFIUS) implemented a set of rules that expanded CFIUS's jurisdiction and mandated filings in the case of investments in certain specified critical technologies.

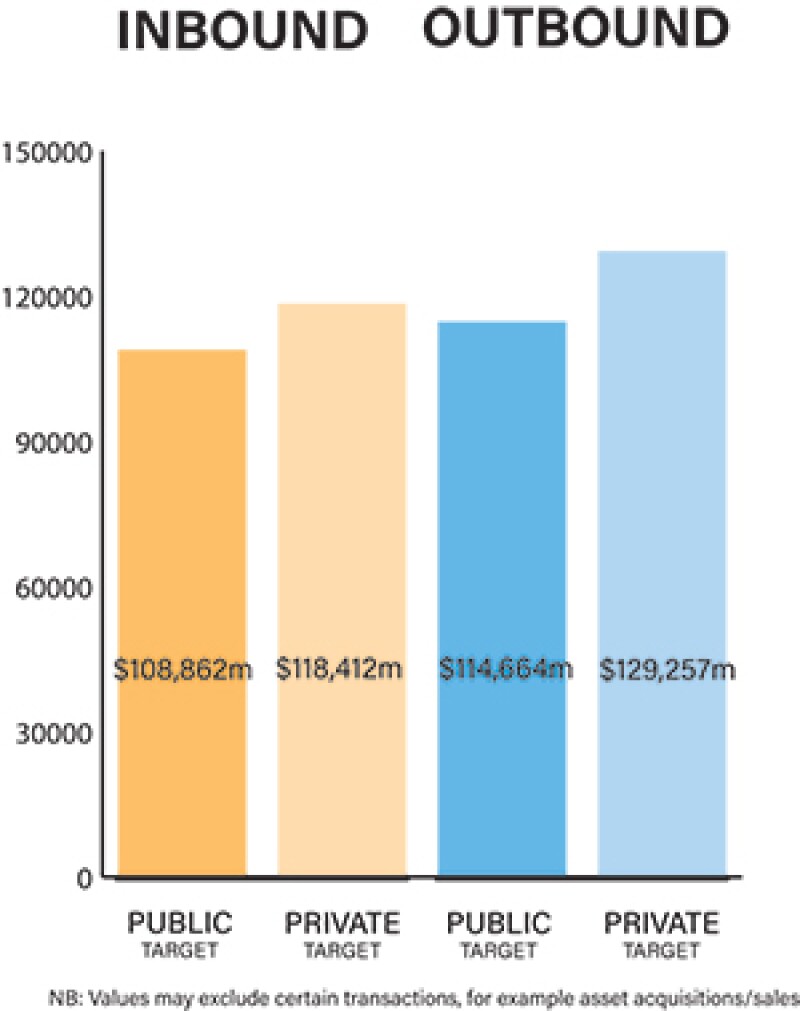

The market continues to be driven by both private and public M&A transactions, although private M&A is more prevalent because there are many more private companies than public companies. Ready availability of financing is a driving factor, particularly for private company and private equity (PE) deal-making, for which acquirer stock is not available as transaction consideration.

Several recent transactions highlight the importance of considering how certain measures taken in response to COVID-19 could be interpreted (or provide a basis for termination) under transaction agreements, including in transactions in which a target does not suffer a material adverse effect (MAE). For example, in May 2020, L Brands and PE firm Sycamore Partners agreed to terminate their agreement under which Sycamore Partners would have acquired L Brands' majority stake in Victoria's Secret. Prior to the termination, Sycamore alleged that by taking certain actions in response to COVID-19 (e.g. furloughing a large number of employees), L Brands breached its obligation to operate the business 'in the ordinary course consistent with past practice'.

In November 2020, the Delaware Court of Chancery held in AB Stable VIII LLC v. Maps Hotels and Resorts One LLC et al. that the seller breached its covenant to operate the target business 'in the ordinary course of business consistent with past practice' by taking various actions in response to COVID-19. The court determined that COVID-related economic effects did not constitute an MAE of the target, particularly as those effects fell within a 'calamities' exception to the MAE definition.

COVID-19 and recovery plans

COVID-19 caused a sharp decline in deal volume and deal value in the first half of 2020. Even with a strong rebound in the second half of 2020, M&A activity still ended down 21% by value compared to 2019, according to Mergermarket. Despite the challenges faced by the M&A market in 2020, deal activity is expected to accelerate in 2021.

|

|

More deal parties adjust their transaction structures and use COVID-specific terms and conditions to allocate pandemic-related risks |

|

|

More deal parties adjust their transaction structures and use COVID-specific terms and conditions to allocate pandemic-related risks, including through the use of contingent pricing structures and carveouts in MAE definitions and interim operating covenants to permit targets to take actions in response to COVID-19.

The frequency of distressed asset sales increased (and is expected to remain at elevated levels) in industries that have been severely negatively impacted by COVID-19, such as the transportation, lodging, hospitality, and live entertainment industries.

In 2020, there was a dramatic surge in the volume and size of special purpose acquisition company (SPAC) deals, an alternative path to taking a private company public whereby a SPAC is formed to raise cash in an IPO, and the proceeds are subsequently used to complete a business combination with a private target, typically within two years of the SPAC's IPO.

Private equity firms remain a driving force of deal-making. Despite COVID-19, uncommitted capital at PE firms remains at record levels, which can be expected to continue to drive M&A activity in 2021 as firms look to deploy that capital.

Legislation and policy changes

US M&A transactions are subject to regulation by both the federal government and the target's state of incorporation.

The federal government primarily regulates the issuance and sales of securities through the Securities and Exchange Commission (SEC), antitrust matters through the Federal Trade Commission (FTC) and the Antitrust Division of the Department of Justice (DOJ), and foreign investment that may have national security implications through CFIUS. The laws, rules and regulations administered by the SEC are particularly relevant in the purchase or sale of a US public company. The laws of the target's state of incorporation govern that company's internal affairs and impose requirements for shareholder approval of mergers and the procedures for effecting mergers.

In June 2020, the FTC and DOJ issued the final Vertical Merger Guidelines (Guidelines). Unlike the draft version, which proposed a safe harbour if the parties to the vertical merger had less than a 20% share of the relevant market, the final Guidelines do not include a safe harbour based on either party's market share. It remains unclear whether behavioural remedies will be acceptable to resolve issues in future vertical mergers and whether the Guidelines will remain in effect under the Biden administration.

The Biden administration has indicated that it expects to adopt policies and pursue legislation that could significantly impact M&A in certain sectors of the economy (e.g. increasing federal infrastructure spending and adopting laws or regulations to address climate change). Several states have adopted legislation limiting the amount of energy that can be used or generated by fossil fuels, which should continue to encourage renewables investments.

Market norms

Unlike the 'locked-box' approach that is more common in many non-US jurisdictions, in most US private acquisitions, the purchase price agreed to at signing is usually subject to closing or post-closing adjustment based on the amounts of certain financial accounts of the target (e.g. cash, indebtedness and net working capital) on the closing date. Under this approach, the parties generally must spend more time negotiating the adjustment mechanisms and related accounting methodologies.

Under the laws of most states, public target boards must generally retain the right (commonly referred to as a 'fiduciary out') to terminate the transaction agreement after signing but before the target's shareholders approve the transaction to accept a higher offer. Shareholder litigation is common in such transactions, and the buyer is generally liable for related costs.

RWI and transaction structures that provide for no post-closing recourse by the buyer against the seller except for fraud are increasingly common in private company transactions.

As a result of the pandemic, dealmakers have had to adjust to a virtual environment in which almost every aspect of an M&A transaction relies on technology, necessitating a keener focus on cybersecurity issues in the deal execution process. Also, data privacy and cybersecurity have become critical elements of the business and operations of most companies and thus should be a key focus of due diligence in any M&A transaction.

Public M&A

In light of the fiduciary duties of public company directors that generally require them to maximise shareholder value in a sale, target boards often conduct some form of a pre-signing market check. However, in some deals the target board will forego a pre-signing market check in exchange for a 'go shop' right to solicit competing offers for a limited period of time (usually 30–60 days) after signing the transaction agreement.

While state law generally requires target boards to preserve a 'fiduciary out' to accept a higher offer under certain circumstances, buyers usually negotiate for a prohibition on the target's right to affirmatively solicit competing offers (except in the case of a 'go shop' right), and the right to receive a 'break-up' fee if the target's board terminates the transaction agreement to accept a higher offer.

Most states require shareholder approval (usually by a majority of outstanding shares) of most mergers. Certain regulatory approvals, including clearance under the Hart-Scott-Rodino antitrust statute, and for non- US acquirers, from CFIUS, must be obtained before an acquirer can take control of a US company. Acquiring a US company in regulated industries such as financial services and energy may be subject to additional regulatory scrutiny at the federal and/or state level.

The acquisition of a US public company can be structured either as a one-step merger between the acquirer (or more commonly a subsidiary of the acquirer) and the target (typically requiring majority shareholder approval), or a two-step transaction involving a tender or exchange offer by the acquirer for all of the target's outstanding shares followed by a back-end merger. Both types of transactions are typically subject to the following conditions (among others):

Accuracy of representations and warranties;

Material compliance with covenants;

No MAE on the target; and

Receipt of regulatory approvals.

Nearly all public target M&A deals in 2020 included an MAE exception for changes, effects or conditions arising out of the COVID-19 pandemic and governmental responses thereto, according to Deal Point Data. Many agreements also provide for greater flexibility under the interim operating covenants to permit the target to take action in response to COVID-19.

Public company merger agreements generally require the target to pay a termination fee if the target terminates the agreement to accept a superior offer, or if the buyer terminates because the target changes its recommendation in favour of the deal. These fees usually comprise 2% to 4% of the transaction's equity or enterprise value, but can vary based on deal size and other factors.

In some transactions, the buyer is required to pay the seller or the target a reverse termination fee under certain circumstances (for example, the failure to obtain required regulatory approvals, or the failure to close the transaction even if all the buyer's closing conditions are satisfied). These fees are highly variable but often range between 5% and 7% of the transaction's equity or enterprise value.

Private M&A

There was an increased use of earn-outs in 2020, under which the seller will receive one or more additional payments, contingent on the target's future performance, in part to account for increased earnings uncertainty due to COVID-19.

Completion accounts (known as working capital or balance sheet adjustments in the US) are common in US private company acquisitions. Locked-box transaction structures are much less prevalent in private company acquisitions in the US than in many other jurisdictions.

At the beginning of the pandemic, RWI carriers started including broad COVID-related exclusions in their policies. These exclusions have been narrowed to focus on the target's COVID-related risks.

|

|

In 2020, there was a dramatic surge in the volume and size of SPAC deals |

|

|

All the conditions listed above for a public M&A (see the bullet points above), except the minimum tender condition, generally also apply in private M&A transactions. However, in the absence of RWI, representations and warranties usually survive the closing in private M&A transactions and may give rise to post-closing indemnity claims.

Merger and share purchase agreements are typically governed by the law of the target company's state of incorporation. If a target company is incorporated in a state with sparsely developed corporate law, the parties sometimes provide that Delaware law will govern certain issues.

The exit environment in the US remains robust, and was substantially boosted in 2020 by so-called 'de-SPAC' transactions, i.e. mergers between SPACs and private companies. PE firms recorded 952 exits in 2020 (a 14% decrease compared to 2019), with a combined value of $378.3 billion (a 6% increase compared to 2019), according to Pitchbook. Public listings (consisting of traditional IPOs and de-SPAC transactions) comprised eight of the 10 largest exits.

Looking ahead

There is growing confidence in the market that M&A activity in the US will return to, or even surpass, pre-COVID-19 levels in 2021.

Among the factors likely to drive and sustain M&A activity in the near-term are pent-up demand from the M&A slowdown during the first half of 2020, greater political certainty following the presidential election, continuing low interest rates, and the general availability of credit. Moreover, the amount of capital to be invested by PE firms, the Biden administration's likely support for infrastructure and renewables investment, the gradual recovery of oil prices, and the continuing popularity of de-SPAC transactions will also help create a positive environment for increased deal flow.

Click here to read all chapters from the IFLR M&A Report 2021

Robert Katz

Partner

Latham & Watkins

T: +1 212 906 1609

Robert Katz is a partner in the New York office of Latham & Watkins. His practice includes cross-border transactions, governance matters, joint ventures, leveraged buyouts, public and private acquisitions and divestitures, spin-offs, takeover and activist defence strategies, and tender and exchange offers.

Robert regularly represents financial institutions, public companies, and private equity sponsors and their financial advisors in their highest-stakes M&A transactions.

Robert, a nationally recognised corporate lawyer, helps clients navigate both negotiated and unsolicited M&A transactions across geographies and industries, including industrials, healthcare, technology, and media and communications.

Allison B Eitman

Associate

Latham & Watkins

T: +1 212 906 4734

Allison Eitman is a corporate associate in the New York office of Latham & Watkins and a member of the M&A practice.

Allison advises public and private companies and PE firms across a range of industries in domestic and international transactions, including M&As, dispositions, carve-outs, auction processes, and general corporate matters.

Allison's experience also includes representing boards of directors and special committees in connection with corporate governance and shareholder activism matters.

Bharath Mohan

Associate

Latham & Watkins

T: +1 212 906 4574

Bharath Mohan is an associate in the New York office of Latham & Watkins. Prior to joining Latham full time, he was a summer associate at the firm. He works within the firm's M&A department.

Bharath earned his JD from Duke University School of Law, where he graduated magna cum laude and served as articles editor for the Duke Journal of Gender Law and Policy. Earlier, he earned his BA from Dartmouth College, where he graduated cum laude.

Karen Jinmeng Song

Associate

Latham & Watkins

T: +1 212 906 1687

Karen Song is a corporate associate in the New York office of Latham & Watkins and a member of the firm's M&A practice.

Karen advises public and private companies, including PE firms, strategic investors, and financial institutions, in connection with M&As, PE investments, and general corporate law matters. She has experience representing issuers and underwriters in capital markets transactions and advising public companies with respect to the review and preparation of SEC filings, corporate governance matters, and interactions with security holders and stock exchanges.

Karen holds a degree from the University of International Business and Economics in China, and a LLM from Harvard Law School.