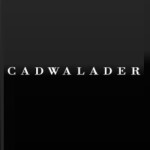

Green bond issuance is growing dramatically, and so are the challenges resulting from a lack of standardisation among green bond offerings. Global green bond issuance topped $290 billion in 2020. Despite slowing in the first half due to COVID-19, issuance saw a 9% increase over 2019. Projected green bond issuance for 2021 could reach $400 billion – $450 billion.

Green bond issuance

Source: Climate Bonds Initiative

Although green bond issuance has grown rapidly, sustained long-term growth of the green bond market will require solutions that foster standardisation. The following standardisation issues must be addressed:

There is a notable lack of common disclosure frameworks for each asset class of green bonds, compounded by the technical nature of ‘green’ disclosure data points. However, private-sector driven solutions are helping trade associations and industry groups address this challenge head on.

Many jurisdictions lack a clear legal definition of what qualifies as a ‘green bond’. The EU moved first toward adopting a standard classification system for what constitutes a green bond, and the United States Securities and Exchange Commission (the SEC) or other financial regulators may adopt a standard classification system for what constitutes a green bond and may require non-financial disclosures about green bonds.

Issuers should, as standard practice, include robust risk factor disclosures in green bond offerings to mitigate securities law liability concerns relating to lack of uniformity regarding green bond classification, as well as suitability for investor purposes.

Lack of common disclosure framework

Issuers and investors suffer from a lack of consensus about what green data should be provided to investors in connection with green bond offerings. This lack of a common disclosure framework will require a customised solution for each asset class of green bonds, which will likely require answering a number of questions:

What type of information is needed, and will this vary based on the asset class and the type of investor? Not all investors want the same information. Investors in non-financial corporate green bonds, for example, may focus on supply-chain environmental impacts, while investors in green asset backed securities (ABS) may look closely at the carbon footprint of the underlying income-producing assets.

What data points do investors in a given asset class want, specifically? Some investors are primarily interested in data points regarding climate resilience and/or climate risk scenario analysis, while other investors focus on data points that speak to the achievement of climate change prevention goals such as reducing carbon footprint or water usage. On which data should issuers focus their primary attention?

Is the data that investors want reasonably obtainable? Answering this question may require answers to other questions: Will a consultant need to be hired to obtain the data? Will contractual provisions need to be added to contracts in order to obtain data (e.g. leases with tenants, loan agreements with borrowers, or contracts with suppliers)? Is the data solid enough for an issuer to stand behind the disclosure statements made in the offering materials? Is the data able to be comforted by accountants or third party verifiers? Ideally, an issuer will identify a list of discrete, objective and codable data points that lend themselves to collection, verification, communication via the offering materials, and ultimately manipulation and analysis by investors.

To what extent will investors desire asset-level data regarding electricity usage? Will they care about whether the electricity is generated at a renewable source or from fossil fuels? In the case of green ABS backed by income producing real estate, is the data needed only for landlord controlled areas in a building? Or is it needed for tenant controlled areas too, even if they are separately metered? Is it just historical data they need, or is ongoing reporting required too? What about water usage data?

To what extent will the issuer be required to make information available on an ongoing (post-closing) basis? Is it feasible to do so? Issuers cannot provide certain data points without cooperation from third parties. In the commercial mortgage-backed securities context, for example, an issuer must obtain cooperation from borrowers and tenants in order to obtain periodic utility usage data.

At what level of granularity should the data be presented (e.g. company-wide, pool-wide, or on each individual asset)?

Is it permissible to make assumptions about an issuer’s assets when preparing disclosures about whether an asset pool is green (e.g. sampling or estimations)?

Unfortunately, the technical nature of certain ‘green’ data points can lead to further uncertainty. For example, the bewildering array of green building certifications leads to confusion. LEED, perhaps the most recognisable green building certification, consists of a score, but is also represented by a designation of certified, silver, gold or platinum. Typically, disclosure documents have only included the designation, but will investors benefit from being provided the score? Which version of LEED is the certification being based upon? Must the version be disclosed? LEED is far from the only green building designation. Do investors value the other certifications, such as BREEAM, as much as LEED? Do investors in different asset classes desire different green building certifications? For green bond issuers not involved in real estate, which certifications are most applicable to their assets or enterprises?

In addition, standardisation issues arise in the comparability of the energy rating of commercial buildings, a potential issue for any green bond ABS issuance backed by real estate, as well as for green bond issuances by any enterprise that owns or occupies a significant amount of commercial real estate. US building owners most commonly use the Energy Star® certification. Energy Star reports only a whole-building score, however, without differentiating between landlord and tenant energy contributions to the overall score. Although a whole-building assessment provides valuable insights into a building’s environmental friendliness, conducting whole-building assessments, as with Energy Star, is difficult because of the level of engagement required from tenants and utility companies. This difficulty may slow the adoption of Energy Star certifications.

|

|

“some 35 US jurisdictions, mostly municipalities, have enacted commercial building energy benchmarking and transparency policies” |

|

|

The Australian approach to building energy certifications presents its own technical advantages and disadvantages. Australian federal law requires the disclosure of the energy rating of commercial office buildings. The disclosure requirement is triggered by the sale or lease of more than 2000 square metres (approximately 21,700 square feet). The National Australian Built Environment Rating System (NABERS) system is required to be used to obtain a building energy efficiency certificate. Third party accredited assessors produce the certificates on behalf of building owners. The rating in the certificate covers the base building (common areas and central building systems, which are areas under the landlord’s control). If it is impossible, however, to separate base-building energy usage from tenant usage, then a whole-building rating is allowed.

NABERS also adjusts for green-sourced electricity used in the building (unlike Energy Star). The NABERS star rating system uses benchmarking comparisons to assign a star rating. The maximum possible score on the NABERS scale, unlike Energy Star, extends all the way to zero emissions. NABERS, and the legal requirement to use it, are useful tools for investors to compare the green performance of existing building stock, and base-building certifications are easier for building owners to obtain than wholebuilding certifications due to less tenant involvement being required. NABERS can be used to rate whole buildings, tenant-occupied spaces and the base building.

US federal environmental law does not require energy consumption benchmarking for commercial real estate. This contributes to a lack of standardised data and represents a challenge to green bond issuers and investors. Energy consumption benchmarking requirements, however, are being adopted at the state and local level in the US. According to data published by Institute for Market Transformation, some 35 US jurisdictions, mostly municipalities, have enacted commercial building energy benchmarking and/or transparency policies. Issuers and investors in green bonds should attempt to harness the availability of this data.

Clearly, as noted recently by US Treasury Secretary Janet Yellen, “the current financial reporting system is not producing the reliable, consistent, and comparable disclosures needed for investors to accurately compare climate-related risks and opportunities across companies.” To the extent that investor groups in a particular asset class can agree on wish lists of discrete, objective and codable data points that they reasonably desire, issuers will be better able to source and provide the data. Trade associations and industry groups are leading efforts to develop common disclosure frameworks for green bonds.

In the commercial real estate and commercial mortgage-backed securities asset class, for example, the Commercial Real Estate Finance Council® (CREFC), a prominent industry association, is spearheading efforts to identify standardised ‘green’ disclosure data points regarding commercial real estate loans and the real properties that secure them, and intends to incorporate the data points into its standard investor reporting package for commercial mortgage-backed securities offerings. CREFC’s effort to establish an industry-led disclosure framework for green bonds backed by commercial real estate is a model for other asset classes, and if successful, will lead most commercial mortgage-backed securities issuers in the US to disclose the same ‘green’ data points in a consistent manner and in a format that is comparable across issuers.

In Europe, CREFC’s affiliated trade association CREFC Europe has developed and published a highly-detailed due diligence guide for commercial real estate lenders. The purpose of the due diligence guide is “to help lenders to assess, in the early stages of discussions with a borrower, climate-related resilience and risk, as well as impact, and thus potential eligibility for a green/sustainable loan”. The guide is an excellent example of an industry-led effort to facilitate the identification and due diligence of green assets that can back green bonds.

In addition, the Structured Finance Association, a leading industry association for the US securitisation industry, has established asset-class task forces with the goal of developing green bond disclosure frameworks. The Structured Finance Association has noted a challenge that faces the standardisation of green bonds: On the one hand, there is a desire to avoid lax standards that may result in ‘greenwashing’, but on the other hand “overly ridged” disclosure frameworks “risk undermining the development” of green bonds.

Green bond classification systems

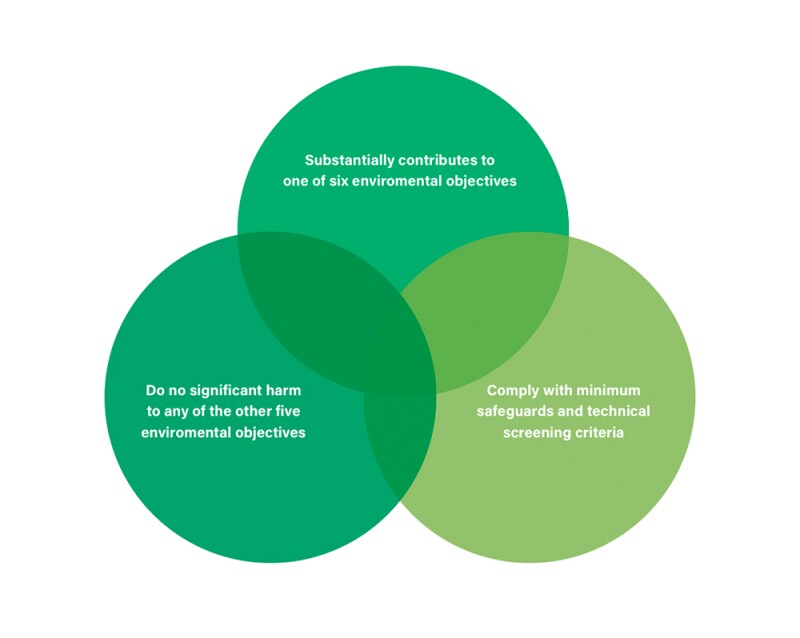

Europe has produced the most substantial legal developments to date toward the standardisation of green bonds through its adoption of the EU Taxonomy Regulation. The EU Taxonomy Regulation sets forth six broad environmental objectives: climate change mitigation; climate change adaptation; the sustainable use and protection of water and marine resources; the transition to a circular economy; pollution prevention and control; and the protection and restoration of biodiversity and ecosystems.

The regulation provides that, for purposes of establishing the degree to which an investment is environmentally sustainable, an economic activity will qualify as environmentally sustainable where that economic activity contributes substantially to one or more of the six objectives, does not significantly harm any of the objectives, and meets certain minimum safeguards and technical screening criteria.

EU Taxonomy Regulation requirements

EU member states are required to apply the criteria from the EU Taxonomy Regulation to determine whether an economic activity qualifies as environmentally sustainable for the purposes. EU member states will look to the criteria in the EU Taxonomy Regulation as they enact measures that set out requirements for financial market participants or issuers in respect of green financial products or green bonds that are marketed as environmentally sustainable. Additionally, certain large listed companies, banks and insurance companies with more than 500 employees will be required to make disclosures as part of their non-financial statements. Financial market participants (as defined in the EU regulations) will be required to supply related disclosures regarding their products’ alignment with the Taxonomy Regulation in precontractual disclosures and periodic reports.

|

|

“as green bond issuance continues to grow rapidly, issuers and investors must confront challenges regarding the development of common disclosure frameworks that work for each asset class” |

|

|

In addition, recent amendments to Regulation (EU) 2017/2402 (the Securitisation Regulation) added a new Article 45a (Development of a sustainable securitisation framework). The change requires that, by November 1 2021, the European Banking Authority, in cooperation with the European Securities and Markets Authority and the European Insurance and Occupational Pensions Authority, publish a report on developing a specific sustainable securitisation framework for the purpose of integrating sustainability-related transparency requirements into the Securitisation Regulation. In drafting the report, the European Banking Authority is required where relevant, to mirror or draw upon the transparency requirements in Articles 3, 4, 7, 8 and 9 of Regulation (EU) 2019/2088 (the Sustainable Finance Disclosure Regulation).

The US currently lacks a classification system for green bonds. The implementation of one in the US at the federal level could help to ensure that green bond issuances further national climate and environmental goals. The imposition of an overly prescriptive regulation, however, may stifle the private sector’s efforts to create industry-led common disclosure frameworks that are sufficiently adapted to suit the needs of investors in different asset classes of green bonds. Recently appointed head of the SEC, Gary Gensler, has already indicated that the SEC plans to introduce new climate-related rules.

Securities law liability considerations

What about issuers’ and underwriters’ securities law liability concerns? Are issuers and underwriters taking consistent approaches to green bond disclosures? Many issuers and underwriters have been protecting themselves through routine disclosure of risk factors regarding green bonds, but a search of prospectuses and other disclosure documents publicly filed in the US reveals that some issuers have not availed themselves of the protection afforded by risk factor disclosure. All issuers and underwriters of green bonds should consider incorporating risk factor disclosures. A sample green bond risk factor for a green commercial mortgage-backed securities issuance is included in Figure 1.

Figure 1: Sample green bond risk factor

The Certificates May Not be a Suitable Investment for all Investors Seeking Exposure to Green Assets |

The Certificates are intended to align with the Green Bond Principles 2021 (the “GBP”) issued by the International Capital Market Association. [–] has issued a second-party opinion to the effect that the financing provided by the Certificates is credible and impactful and aligns to the four core components of the GBP. See “Green Bonds” in this Offering Circular. However, the second-party opinion is not incorporated by reference into, and does not form part of, this Offering Circular. The Depositor, the Mortgage Loan Sellers and the Initial Purchasers do not make any representation as to the suitability of the second-party opinion or the Certificates’ satisfaction of the environmental and sustainability criteria described therein. The second-party opinion may not reflect all environmental or “green” considerations at the Mortgaged Property. The second-party opinion is not a recommendation to buy, sell or hold securities and is only current as of the date of its issuance. Furthermore, we cannot assure you that the second-party opinion will not be withdrawn in the future, which could adversely affect the value of the Certificates. In addition, we cannot assure you that the Mortgaged Property will always maintain a [green building certification] or that the Mortgaged Property will always be operated in a green manner. The Loan Agreement does not require the Borrower to maintain the [green building certification] in respect of the Mortgaged Property, and a failure to maintain the [green building certification] would not constitute an event of default under the Loan Agreement. In addition, the Mortgage Loan Sellers will not make any representations in the Mortgage Loan Purchase Agreement regarding the [green building certification]. Furthermore, the impact the Mortgaged Property will have on the environment will vary over time based upon the types of tenants that lease space in the building at any given time and the nature of those tenants’ operations. For example, some future tenants may use more electricity than the current tenants. After the Closing Date, a change in the characteristics or operation of the Mortgaged Property, a change in any relevant environmental or sustainability criteria or any withdrawal of the [green building certification] could have an adverse effect on the foreclosure value or the market value of the Mortgaged Property, which could lead to losses on the Certificates. Such an occurrence may also affect the value of the Certificates due to a change investors’ perceptions of the Certificates as “green bonds”, and may cause adverse consequences for certain investors with portfolio mandates to invest in green assets. |

As green bond issuance continues to grow rapidly, issuers and investors must confront challenges regarding the development of common disclosure frameworks that work for each asset class. Industry groups should continue to play a leading role in these efforts. Additional legislation and regulations in multiple jurisdictions requiring disclosure of more standardised ‘green’ data points can also be expected.

Finally, issuers should continue to exercise prudent disclosure practices to reduce risk by including robust risk factors relating to lack of uniformity as to green bond classifications, as well as suitability for investor purposes.

Click here to read all the chapters from IFLR's ESG Americas Report 2021

Michael Gambro

Partner

Cadwalader Wickersham & Taft

T: +1 212 504 6825

Michael Gambro is co-chair of Cadwalader’s capital markets group and a member of the firm’s management committee.

Michael concentrates his practice primarily on commercial mortgage-backed securities (CMBS), and generally in the financing, trading and securitisation of financial and other cash-flowing assets. He has long been at the forefront of regulatory developments affecting key segments of the industry, and is often involved in discussions with policymakers and regulators concerning issues that impact markets.

Michael is a graduate of Tufts University and completed his JD at Columbia Law School. He is admitted to the bar in New York.

Michael Ruder

Special counsel

Cadwalader Wickersham & Taft

T: +1 704 348 5303

Michael Ruder is a special counsel at Cadwalader, where he concentrates his capital markets practice on CMBS transactions and other securitisations.

Michael frequently represents issuers and underwriters in connection with agency and private label CMBS securitisations, including single-asset/single-borrower (SASB) transactions. He has securitised CMBS loans secured by a variety of asset types, including multi-family, office, retail, hospitality, industrial and assisted living facility properties. He also advises capital markets clients on matters involving green bonds, including one of the largest ever green bond CMBS issuances to date.

Michael is a graduate of Texas Tech University and completed his JD at Northwestern University, School of Law. He is admitted to the bar in New York and North Carolina.