The EU has been building a sustainable finance framework to support the flow of private finance towards sustainable economic activities, and make the transition to a carbon neutral economy by 2050 possible.

The financial sector can contribute to the realisation of the (international) sustainability goals by, for example, financing sustainable initiatives or providing insight to the sustainability goals of financial products. (Private) investors also find sustainable investments increasingly important.

The regulations for the financial sector in the transition to a more sustainable climate and environment follow primarily from the Sustainable Finance Action Plan, which was published in 2018 (2018 Sustainable Finance Action Plan).

This 2018 Sustainable Finance Action Plan seemed to account for a good wave of regulations to be implemented by the financial sector, and now that wave is growing and also extends to the non-financial sector.

The change that all of these regulations aim to bring about in order to achieve the climate goals, is a change in behaviour; not only within the financial sector, but more importantly within the real economy, so that more and more money flows through investments to economic activities that contribute to a better environment.

The article provides an overview of the main EU regulations that are currently being implemented or need to be implemented by financial institutions within the EU and that also contain rules for corporates in scope of these regulations, focusing on the EU Taxonomy, and very briefly on non-financial reporting related developments. The article concludes with the Dutch specific developments on these subjects.

Need to share knowledge, especially on the ‘E’ of ESG

There has been an increasing focus on sustainability and environmental, social and governance (ESG) This focus is not limited to the financial sector, but it is the financial sector that currently faces the most changes that bring about challenges for the implementation of entirely new rules.

However challenging, the rules certainly also provide for opportunities. Green financing becomes more attractive than before and the ability to provide data on ESG aspects of businesses is attractive to large investors. Reflecting on the developments in the financial sector also shows the effects for the non-financial sector. One of the most interesting developments is that where previously there was no correlation between developments within the environmental world and the developments within the financial world, this is now history as these worlds need to consider the developments in both worlds, as the financial sector needs to report on environmental aspects of their financial products for example.

This in practice is quite a change and requires staff with expert knowledge. Especially the need to share knowledge between experts that did not work together before is necessary to ensure that information is used in the right context and disclosures and communications around ESG topics are aligned. Financial institutions need to look at their staffing and corporates need to do the same to ensure that they are able to deliver the right data to those financial institutions to enable them to comply with new disclosure requirements.

The ‘E’, the ‘S’ and the ‘G’ within an action plan

Rules on the integration of ESG-factors and ESG-risks within a financial institution find their basis in the 2018 Sustainable Finance Action Plan.

2018 Sustainable Finance Action Plan

The European Commission published the 2018 Sustainable Finance Action Plan in view of achieving the climate goals of the Paris Agreement in 2015 and the UN 2030 Agenda for Sustainable development.

The plan consisted of a number of actions – all resulting in various pieces of legislation – to facilitate a shift in capital flows towards more sustainable economic activities for the benefit of our planet.

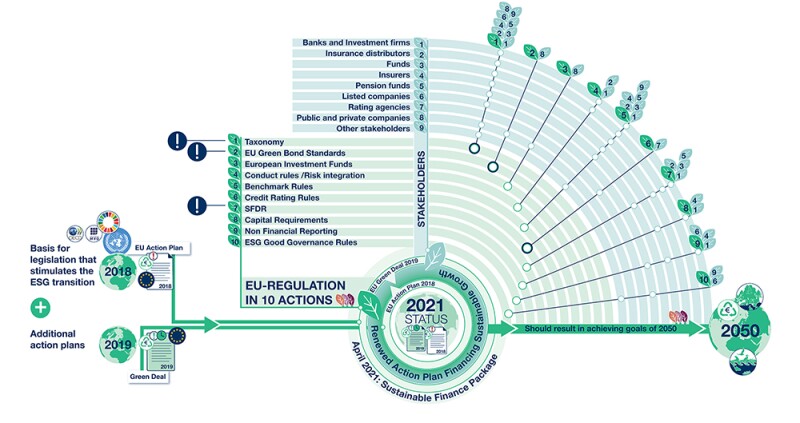

See Figure 1 for an overview of the 10 actions numbered by the green leaves in the middle, summarising the rules that are being developed as part of the action plan. The outer circle reflects the various stakeholders addressed by these rules.

As reflected in the middle circle of the visual, now in 2021 the action plan is further developed into a renewed sustainable finance strategy for financing sustainable growth (2021 Renewed Sustainable Finance Strategy).

Figure 1

EU Green Deal as accelerator

The 2021 Renewed Sustainable Finance Strategy builds on the 2018 Action Plan on sustainable growth, the transition finance report by the Platform on Sustainable Finance and a consultation held from April 8 2020 until July 15 2020.

The new strategy is also an integral part of the European Green Deal and the Commission’s efforts to ensure a sustainable and resilient economic recovery following the COVID-19 pandemic. The financial sector will be key in helping to meet the targets of the European Green Deal.

|

|

“The 2021 Renewed Sustainable Finance Strategy builds on the 2018 Action Plan on sustainable growth" |

|

|

With the publication of the EU Green Deal in 2019, the European Commission has made it clear that the transition to a more sustainable climate and environment is not going fast enough. Acceleration is necessary to achieve the goals. Above all, more private money is needed to finance the transition. To illustrate, in 2018, the estimate was that an additional €180 billion had to be invested each year to meet the climate and energy targets. This has risen since to an additional €250 billion per year. See also the communication from the European Commission: Stepping up Europe’s 2030 climate ambition (COM(2020) 562 final). The 2021 Renewed Sustainable Finance Strategy now estimated an amount of €350 billion per year of additional investments to be necessary.

The consequence of this political agreement is that the 2018 Action Plan will be in fact accelerated and further developed. The EU Green Deal adds new components. One of the components that affects the financial sector is the mentioned 2021 Renewed Sustainable Finance Strategy.

In addition, the new Capital Markets Union Action Plan is a source of additional rules that should contribute to the transition and are relevant to the sustainability transition within the financial sector.

2021 Renewed Sustainable Finance Strategy

With the 2021 Renewed Sustainable Finance Strategy that was published on July 6 2021, the European Commission adopted a number of measures to increase its level of ambition on sustainable finance, being:

A new EU Sustainable Finance Strategy;

A proposal for a Regulation on European Green Bonds; and

A Delegated Act on the information to be disclosed by financial and non-financial companies about how sustainable their activities are, based on Article 8 of the EU Taxonomy.

A roadmap

First, the new Sustainable Finance Strategy sets out a roadmap on sustainable finance for the years ahead. The roadmap includes six sets of actions and several initiatives to tackle climate change, and other environmental challenges, while increasing investment – and the inclusiveness of small and medium-sized enterprises (SMEs) and consumers – in the EU’s transition towards a sustainable economy.

Six sets of actions:

1. Extend the existing sustainable finance toolbox to facilitate access to transition finance;

2. Improve the inclusiveness of SMEs and consumers by giving them the right tools and incentives to access transition finance;

3. Enhance the resilience of the economic and financial system to sustainability risks;

4. Increase the contribution of the financial sector to sustainability;

5. Ensure the integrity of the EU financial system and monitor its orderly transition to sustainability; and

6. Develop international sustainable finance initiatives and standards, and support EU partner countries.

European green bonds

The Commission also adopted a proposal for a regulation on a voluntary European Green Bond Standard (EUGBS). The EUGBS is intended to be a new ‘gold standard’ for green bonds. Use of the standard would allow companies and public authorities to more easily raise large-scale financing for climate and environmentally-friendly investments, while protecting investors from greenwashing. The EUGBS will use the detailed definitions of green economic activities in the EU Taxonomy to define what is considered a green investment.

THE EU GBS is not further discussed in this contribution. Please contact the Stibbe sustainable finance team for further information.

EU Taxonomy and current developments

Finally, as part of the 2021 Renewed Sustainable Finance Strategy an important step in the development of the EU Taxonomy Regulation (Regulation (EU) 2020/852 of June 18 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088) was published.

As part of the 2021 Renewed Sustainable Finance Strategy, the European Commission adopted the Delegated Act supplementing Article 8 of the Taxonomy Regulation, which requires financial and non-financial companies to provide information to investors about the environmental – the ‘E’ – performance of their assets and economic activities.

On July 12 2021, further steps have been taken by the publication of two draft reports on the EU Taxonomy. Social and governance aspects are a feature, rather than the main focus, of the EU Taxonomy Regulation, currently dedicated to environmental considerations.

Given the EU Taxonomy´s current limited inclusion of social sustainability aspects, the European Commission gave the Platform for Sustainable Finance the mandate to also work on extending it to social objectives and established a subgroup dedicated to this task.

The first report is an important step in the development of the ‘S’ within the EU taxonomy as it relates to the social taxonomy. The second report covers an extended taxonomy to support economic transition.

EU Taxonomy – highlights

The EU Taxonomy Regulation is a regulation in the form of a tool. This tool is created to help investors and companies to make informed investment decisions on environmentally sustainable economic activities and to guide them in the transition towards sustainability. For certain companies, the tool contains mandatory disclosure requirements, but can also be used on a voluntary basis by those companies not subject to the mandatory disclosure requirements.

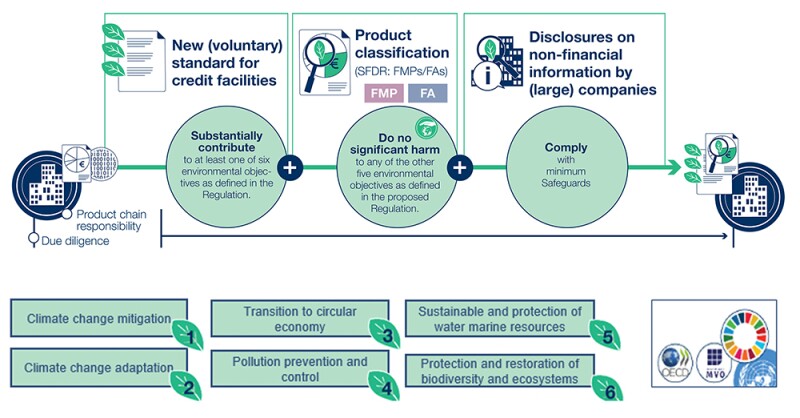

The tool uses science-based criteria that allow users of this tool to screen whether an economic activity can be recognised as green or ‘environmentally sustainable’ within the meaning of the EU Taxonomy Regulation. Screening should take place on economic activities categorised into six environmental objectives. These environmental objectives (Article 9 of the EU Taxonomy Regulation) are:

1. Climate change mitigation;

2. Climate change adaptation;

3. Sustainable use and protection of water and marine resources;

4. Transition to a circular economy, waste prevention and recycling;

5. Pollution and prevention control; and

6. Protection of healthy ecosystems.

These science-based screening criteria are for now included in the Draft Climate Delegated Act under the EU Taxonomy Regulation and consist of a long list of economic activities divided into Nomenclature of Economic Activities Codes (NACE-activity codes).

The Draft Climate Delegated Act contains the screening criteria for economic activities with significant contribution to two of the environmental objectives the EU Taxonomy Regulation covers: climate change mitigation and climate change adaptation. Another delegated act concerning the technical screening criteria for the remaining four environmental objectives covered by the EU Taxonomy Regulation the Environmental Delegated Act will be developed and adopted at a later stage.

The EU Taxonomy Regulation has direct effect and does not require further implementation into national legislation. Important to note is that the EU Taxonomy Regulation is not a mandatory list of economic activities for investors to invest in. It is also not a mandatory requirement to ensure that economic activities meet the criteria of the EU Taxonomy regulation. The purpose of the introduction of this tool is that it over time enables and encourages a transition towards more sustainable investments.

Draft Climate Delegated Act

The Draft Climate Delegated Act is a set of technical screening criteria that includes references to the common classification system for economic activities NACE to facilitate identification of those activities as that are codes applied throughout the EU.

The screening criteria further contain references to thresholds and performance levels that the economic activity should meet in order to qualify as contributing substantially to one of the climate objectives. The idea behind this is that by setting this type of screening criteria it can be assessed that the economic activity makes a positive impact on the climate objective (mitigation) or reduces negative impact on the climate objective (adaptation). The technical screening criteria also contain criteria on ‘do no significant harm’ indicating whether the economic activity has no significant negative environmental impact.

Markets and investors need clear and comparable sustainability information to prevent greenwashing. The Delegated Act specifies the content, methodology and presentation of information to be disclosed by large financial and non-financial companies on the share of their business, investments or lending activities that are aligned with the EU Taxonomy.

Non-financial companies will have to disclose the share of their turnover, capital and operational expenditure associated with environmentally sustainable economic activities as defined in the Taxonomy Regulation and the EU Taxonomy Climate Delegated act, formally adopted on June 4 2021, as well as any future delegated acts on other environmental objectives.

|

|

“In March 2021, an own-initiative bill on Responsible and Sustainable International Business Conduct was presented in Dutch parliament" |

|

|

Financial institutions, mainly large banks, asset managers, investment firms and insurance/reinsurance companies, will have to disclose the share of environmentally sustainable economic activities in the total assets they finance or invest in. This does not only follow from the EU Taxonomy Regulation but also follows from other ESG-related disclosure rules such as the Sustainable Finance Disclosure Regulation (SFDR).

The EU Taxonomy Regulation is intertwined with other initiatives following from the same EU Sustainable Finance Action Plan. The most relevant in addition to the SFDR is the Non-Financial Reporting Directive (NFRD) to be amended by the Corporate Sustainability Reporting Directive (CSRD).

The mandatory disclosures require large companies and FMPs to consider the following key criteria to determine whether an activity is green (i.e. an environmentally sustainable economic activity) in terms of the EU Taxonomy Regulation (Article 3 of the EU Taxonomy Regulation). An economic activity will qualify as such if it meets four conditions. A qualifying activity must:

Contribute substantially to one or more of the environmental objectives;

Do no significant harm to any of the other environmental objectives;

Comply with minimum social safeguards; and

Comply with technical screening criteria established and adopted by the EC (i.e. the Draft Climate Delegated Act).

In order to conclude that an activity qualified as an environmentally sustainable economic activity, all conditions must be met. In practice however the Draft Climate Delegated Act is designed in such a way to cover conditions 1–3.

Figure 2 shows the various uses of the EU Taxonomy Regulation and the conditions for qualifying as a ‘green activity’ for EU Taxonomy purposes.

Figure 2

What are the timelines?

The EU Taxonomy Regulation entered into force on July 12 2020. Mandatory reporting under the EU Taxonomy Regulation will apply as of:

January 2022 for climate change mitigation and adaptation objectives; and

January 2023 for the other four objectives: sustainable use and protection of water and marine resources, transition to a circular economy, waste prevention and recycling, pollution and prevention control, protection of healthy ecosystems.

More detail and more detailed timelines

Article 8 of the EU Taxonomy Regulation forms the basis for the Draft Article 8 of the Delegated Act that prescribes the use of certain key performance indicators (KPIs) and related methodology for the calculation to be made to come to the percentage of taxonomy alignment that must be disclosed. This means that the Article 8 of the Delegated Act will be the source for gathering the required information (for further information on the details of the EU Taxonomy regulation, please contact the Stibbe team). The draft Article 8 of the Delegated Act contains various timelines allowing for a phased entering into force.

ESG developments in the Netherlands

EU Taxonomy in the Netherlands

Without doubt it will be the EU Taxonomy Regulation that brings about the most significant changes to financial as well as non-financial institutions within the EU and therefore also in the Netherlands within the upcoming year.

As the EU Taxonomy is EU regulation that does not need to be transposed into Dutch legislation there is no specific Dutch legislation. It remains to be seen whether Dutch interpretation will be developed as the absence of guidance at European level and the complexity of the rules that are being developed at high speed requiring further guidance would be welcomed by the industry.

Nevertheless, the ESG developments following from the EU actions plans and strategies are key focus points for the Dutch supervisory authorities supervising Dutch financial institutions as both the Dutch Central Bank (DNB) and the Authority for the Financial Markets (AFM) are monitoring developments and request the industry to prepare themselves timely.

The industry is preparing itself for the entering into force of the first disclosure obligations under the EU Taxonomy, by rolling out implementation and disclosure strategies and setting policy on how to deal with data that is currently not yet available in the form that will allow for a smooth implementation.

In practice we also see applying the technical screening criteria of the Climate Delegated Act does not necessarily fit in with the Dutch implementation of EU legislation referred to in the EU Taxonomy Regulation and delegated acts. Resulting in difficulties around interpretation. For example, public housing is not organised centrally by municipalities which is a presumption under the technical screening criteria, requiring research on how to best apply the criteria in a Dutch context.

Corporate responsibility and sustainable business – mandatory due diligence

In March 2021, an own-initiative bill on Responsible and Sustainable International Business Conduct was presented in Dutch parliament. The bill proposes a duty of care for all companies in the Netherlands and an obligation to conduct due diligence in accordance with the OECD Guidelines for Multinational Enterprises for all enterprises with over 250 employees.

The legislative proposal imposes a duty of care on all companies in the Netherlands to address human rights violations and environmental damage in their value chains. Companies with more than 250 employees will be obliged to implement the six steps of due diligence, in line with the OECD Guidelines.

When the law comes into force, it will be enforced by a public regulator, which can issue financial sanctions. Repeated failure within five years to stop activities that cause or contribute to negative impacts or to provide remedy will be considered a criminal offence.

The bill also enables third parties to hold companies liable in civil court for harms suffered as a result of a violation of the law. If adopted, the law would replace the Child Labour Due Diligence Law, which was passed by the Senate in 2019.

The proposed entering into force is January 2023.

Further developments are expected in this field especially as a result of developments at EU level around EU sustainable corporate due diligence and corporate accountability as part of the action already announced under the 2018 Sustainable Finance Action Plan to create harmonised rules on sustainable corporate governance.

This contribution only provides insights into a number of legal developments in the field of ESG. For further information on these topics or other developments, please contact members of the dedicated Stibbe ESG team: Suzanne Kröner-Rosmalen (sustainable finance and key contact), Barbara Bier (corporate governance), Valérie van t Lam (environmental and administrative law), Marieke Driessen (banking, finance, ECM and sustainable finance), Steven Hijink (financial and non-financial reporting), Jeroen Tjaden (M&A), Jaap Waverijn (energy), Wouter den Hollander (litigation), Ingrid van der Klooster and Lisanne Baks (sustainable finance expert Knowledge department).

Click here to read all the chapters from IFLR's ESG Europe Report 2021

Suzanne Kröner-Rosmalen

Senior associate

Stibbe

T: +31 20 546 05 08

E: suzanne.kroner-rosmalen@stibbe.com

Suzanne Kröner-Rosmalen is a senior associate at Stibbe. She specialises in financial supervision and securities law and advises Dutch, and foreign institutions on a broad range of regulatory and compliance matters.

Suzanne is focused on investment management related topics such as ESG and financial sustainability, disclosure requirements, governance and remuneration restrictions. She has experience in the implementation of a variety of European financial regulations (CRD, AIFM/UCITS, MiFID, IDD) for several large financial institutions.

Suzanne has a master’s degree in law from the University of Leiden and graduated from the Grotius Academy in securities law.

Lisanne Baks

Junior professional support lawyer

Stibbe

T: +31 20 546 04 79

Lisanne Baks is a junior professional support lawyer at Stibbe. Lisanne specialises in European financial (regulatory) law and corporate law. Her experience and expertise spans a broad range of areas, from corporate governance and financial supervision to sustainable finance and ESG.

Lisanne has a master’s in law from VU University Amsterdam (2018) and a master’s in law from Utrecht University (2017).