A large portion of the US market continues to prefer using other alternatives to USD Libor than the secured overnight financing right (SOFR), responses to our IFLR survey have revealed.

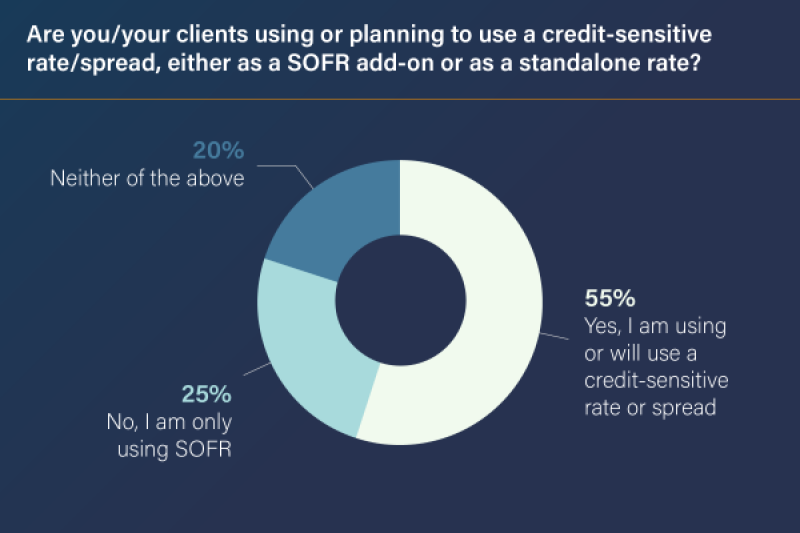

Over half of the respondents (55%) said they were using or planning to use a credit-sensitive rate (CSR) or spread as a substitute to Libor, while 25% said they would use SOFR only. The remaining 20% said they would not use either.

“SOFR has an important place: in the US, the efficient functioning of the repo market [on which SOFR is based], particularly in times of extraordinary deficit and debt levels, is very important for the Fed and the Treasury,” said Richard Sandor, chairman of the board and CEO at the American Financial Exchange (AFX), administrator of Ameribor. “Choice is now the preeminent word over here. It was our sense from the time that we set out on this journey that there was a need for that.”

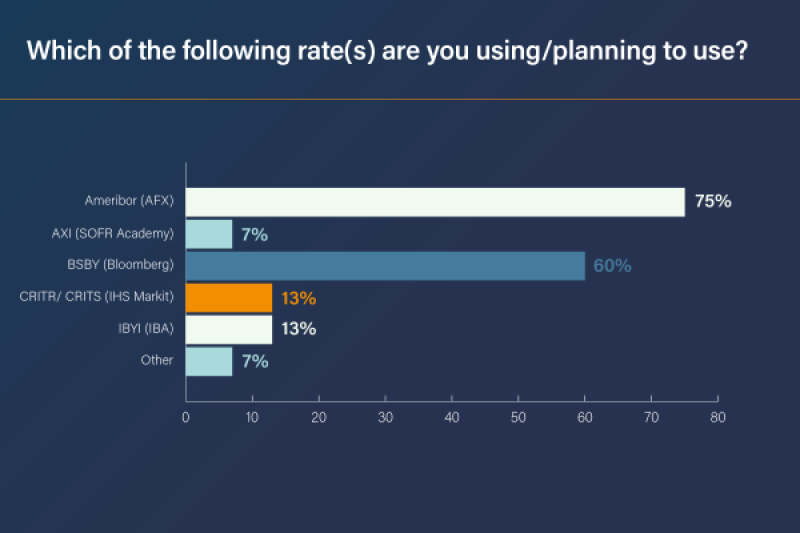

Over 70% of survey respondents said they would use Ameribor as their preferred CSR, shortly followed by BSBY – Bloomberg’s short-term bank yield index – which gathered 60% of interest.

“For many of our banks, having a CSR that reflects their cost of borrowing is a matter of survival as they don't have the knowledge of basis risk or the bandwidth to get into the repo market,” said Sandor. “We are the most credit-sensitive rate and have a particular niche, which is not the big banks, but the 5000 other banks in America. Those folks need a rate that reflects their credit risk, which is higher than big banks'.”

In times of stress, Ameribor will likely behave similarly to Libor, Sandor added – an element that is at once comforting and convenient to many users.

“There are two aspects to transaction costs associated with a benchmark: one is the liquidity of a market, and the second is the basis or spread risk,” said Sandor. “Our members need to have minimum basis risk because it will dominate the cost of hedging. To suit their market, they need a benchmark that reflects their particular costs and the credit risk of their borrowers – not the one associated with the repo market.”

Survey respondents also expressed an interest towards other alternatives, such as IHS Markit’s credit-inclusive term rate (CRITR) and credit-inclusive term spread (CRITS) (13%), ICE Benchmark Administration’s bank yield index (BYI) (13%) and SOFR Academy’s across-the-curve credit spread (AXI) – most of which cannot yet be used in contracts.

“This is in line with the idea that SOFR is not an all-in rate,” said Navin Rauniar, partner at consultancy firm TCS. “It makes sense for Ameribor to top the lot, as it is a supporter of Main Street. The US market will definitely end up in a multirate environment, but there will likely be dropouts from the race.”

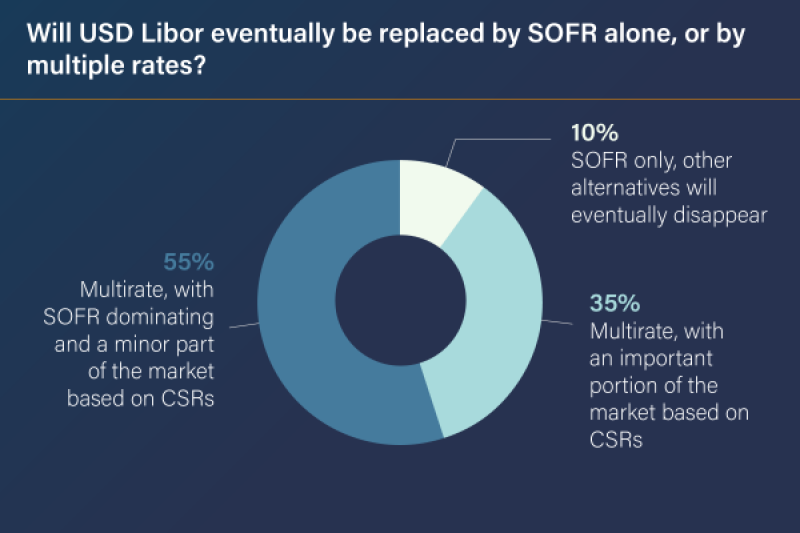

An overwhelming majority of survey respondents (90%) also agreed that a multirate world will prevail, with 55% saying it will be dominated by SOFR, and 35% saying that CSRs will concentrate an important part of the market.

“SOFR will clearly dominate the derivatives space and CSRs will mainly be used for the cash portion of the market – albeit with some derivative activity off the back of it,” said Robert Mackenzie Smith, senior research analyst at Bloomberg Intelligence. “As for Ameribor and BSBY, they will both find their niche and will be very useful to those parts of the market that want to use them.”

Ed Ivey, counsel at Moore & Van Allen, agreed that CSRs use would be limited principally to the loan market and its potential offshoots. “If you're a bank and your whole business is just lending, like small community banks, SOFR is not really a rate that is well suited to cover your actual costs,” he said. “Daily simple SOFR is not a rate that those types of lenders and borrowers were going to be willing to accept. They want to know how much they owe five days ahead as they try to do a monthly budget, which they can’t just complete with a ‘fill in later’.”

Misfit

Overall, many sources agreed that the Alternative Reference Rates Committee’s (ARRC) initial appreciation of SOFR use and demand was miscalculated, and that their approach had to be shifted along the way.

“The choice of SOFR as a benchmark replacement for USD Libor was very suboptimal,” said Michael Koegler, managing principal and co-founder at Market Alpha Advisors. “Moving from an unsecured term rate to an overnight secured rate that is somewhat influenced by technicals in the US Treasury Market does not fit a lot of use cases.”

This, Koegler added, is what is blatantly obvious in the survey results. “The majority of respondents said that they may use SOFR but will be looking at other benchmarks too – which is a completely different story to what the ARRC has been trying to get people to do,” he said. “There is a good reason for it: SOFR doesn’t work unless you are a highly rated institution that funds very close to treasuries. It introduces real problems and inefficiencies, which will eventually be passed on to the borrower in the form of wider spreads, increasing borrowing costs.”

With SOFR-based deals set to come at a higher all-in cost than with Libor, the only way for banks to protect themselves is to charge higher spreads, Koegler argued.

See also: Read part one of the report, about the US markets overall readiness for no new Libor

“While SOFR is robust in terms of being able to point to an index that has easily observable market prices behind it (overnight repo), it doesn't solve many of the problems that Libor used to,” he added. “An overnight rate can’t be used in a bank loan, for instance, which was one of the reasons why the Fed endorsed term SOFR. The issue is there's no transaction volume underlying three-month term SOFR: there is very little repo trading on a three-month term basis.”

Other sources agreed that the ARRC’s recommendation of SOFR as the replacement rate of choice for USD Libor may not have taken all the necessary elements into account.

“The rate has been chosen on the basis of its construction, as opposed to its use,” said Adam Schneider, partner at Oliver Wyman. “It is well-designed for derivatives trading, and for lending the implication is clear: if you don't like how [SOFR] performs, change the products that use it as needed, but keep the base rate as solid as can be. It's been the theory of the case all along.”

The authorities’ open criticism and consistent bashing of CSRs over many months has also been deemed unhelpful to market participants. “The messaging from the authorities on CSRs has only been partially successful,” said Rauniar. “The results are conflicting because the ARRC and the Fed have said numerous times that SOFR is the preferred rate, but that they are open to any other rate that is Iosco-compliant.”

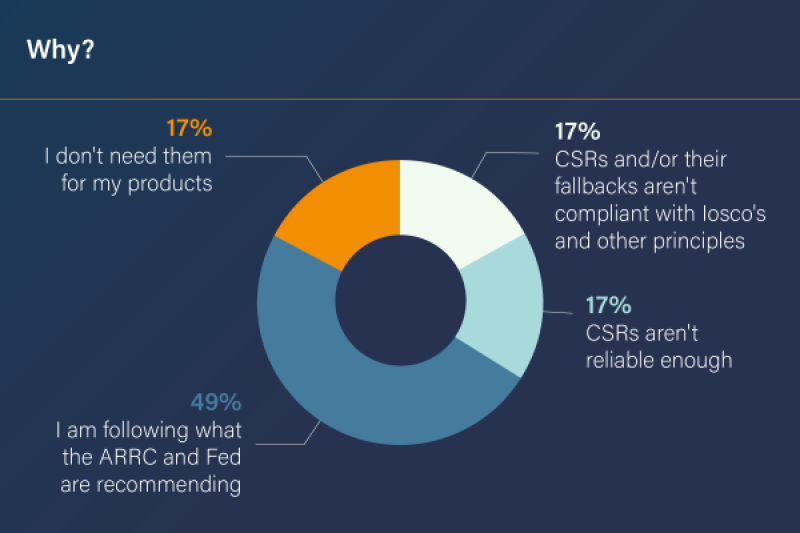

Half of the survey respondents who said they were not planning to use CSRs indicated they would not do so because they followed the ARRC’s and Fed’s guidelines. An equal split (17%) said they either didn’t need them for their products, or considered they weren’t reliable enough, or did not comply with Iosco’s Principles for Financial Benchmarks.

“The fact that there are applicability problems with SOFR shows that it was cobbled together because we had to get something,” said George Bollenbacher, expert consultant and former head of fixed income at Tabb Group. “There isn't a volume market in term repos, so term SOFR is determined the same way that Libor is. There is a term market for Treasury bills, but that choice was passed over.”

The ARRC, however, continues to stand by its recommendation and defends its track record. “We chose SOFR because it was far and away the best replacement for Libor: by nature of the transactions, the ability, the transparency, the size of the underlying markets – $800 billion to a trillion dollars a day in transactions – and the lack of reliance on quotes and expert judgment,” said ARRC chair Tom Wipf during a Libor telethon. “We always worked under the assumption that as market participants began to review other alternatives, and if they took the time to know what's in their reference rate, they would probably reach the same conclusion: that SOFR was obviously the best choice to avoid repeating the mistakes of the past.”

See also: Read part two of the report, on the federal legacy law

Wipf however conceded that the ARRC’s initial approach may have been incomplete and had to be tweaked. “We initially focused mainly on derivatives because they made up the notionals of the market, but we very quickly learned in our work that the cash products and their variety and distribution were much more complex,” he said. “It seemed to be a much bigger and deeper set of issues than one would have thought when we looked at this back in 2014. Tremendous work has been done to de-risk the derivatives market, but we ought to add to the cash markets – not just within each jurisdiction, but with comparisons across all the different [Libor] currencies.”

Exponential growth

As the ARRC pursues its SOFR and term SOFR crusade, pundits predict that CSR use will keep expanding as the market stops issuing new Libor contracts as of January next year.

“Once the first round of regulatory push against CSRs concludes, we are likely to see these rates slowly gain share,” said Schneider. “We will see major institutions leaning into CSRs, and therefore others will go along. Most banks are going to end up with both [SOFR and CSRs] and the market will naturally progress towards a new ‘normal’.”

This, Schneider added, may be influenced by the interest rate cycle. “Right now, all rates are tightly compressed, but it looks like rate increases in 2022 are likely and there may be significant differences between overnight and term rates,” he said.

AFX’s Sandor, meanwhile, foresees widespread adoption of non-Libor rates by 2025. “It should all be sorted by then,” he said.

“So far, there hasn’t been an adequate interest rate to cater for the whole market – by which I mean Wall Street and Main Street,” said Rauniar. “The main market has been screaming out for alternative options, and it seems they’re getting their day. What is interesting, is that Wall Street has joined the party and is now also encouraging liquidity in CSRs.”

See also: Read part four of the report on how the ARRC and the Fed have handled the transition

If the big banks are doing it, Rauniar added, then others are likely to follow along.

“With five of the seven USD Libor tenors published until mid-2023, there could be a kind of halfway house situation in the US,” Mackenzie Smith however warned. “But given the [June 2023] deadline, the conversation around CSRs and their use cases will get a bit more forensic as of next year, and we will probably see an evolution of their usage.”