Despite the headwinds created by Covid-19, Bahrain’s economy is on the path to recovery. M&A transactions are on the rise; however, deal value has not yet returned to the pre-pandemic level.

On the economic front, diversification and liberalisation have been on the agenda of the policymakers who aim to lead the Kingdom of Bahrain into a more competitive environment while striding confidently towards achieving its economic vision 2030.

The Prime Minister Resolution No. 40 of 2021 (Liberalisation Resolution) liberalised foreign ownership restrictions in Bahrain. Previously, various commercial activities required a minimum of 51% Gulf Cooperation Council (GCC) ownership. Now foreign ownership for a large array of commercial activities is allowed on the condition that the Bahraini company includes a Bahraini shareholder.

There are no official guidelines regarding the minimum shareholding percentage for the Bahraini partner; however, we believe that it could be as low as 1%. The Bahrain Ministry of Industry, Commerce and Tourism (MOICT) will have discretion in determining this percentage.

There is also a proposal to amend the 2015 Commercial Registrations Law (CR Law) that would see closed and public shareholding companies listed under the Bahrain Bourse. This would formalise a regulatory position that has not actively been enforced.

The squeeze-out provisions for the acquisition of public listed companies have been rationalised. The offeror was previously bound to offer compulsorily to buy the minority shareholders once it acquired 95% of the voting rights of the offeree company; however, last year the Central Bank of Bahrain (CBB) issued a consultation paper for amending certain provisions of the Takeovers, Mergers and Acquisitions Module of the CBB Rulebook 6 and in January 2022 the proposed amendments were made effective.

Now the offeror would have the option to go ahead with a compulsory acquisition after receiving 90% acceptance of the offer shares if it has earlier disclosed the same in the offer document (compulsory acquisition notice). The amendments also provide an exit mechanism for the dissenting shareholders, who have the option to request the offeror to buy their shares in the offeree company once it has received 90% acceptance of the offer shares (sell-out right).

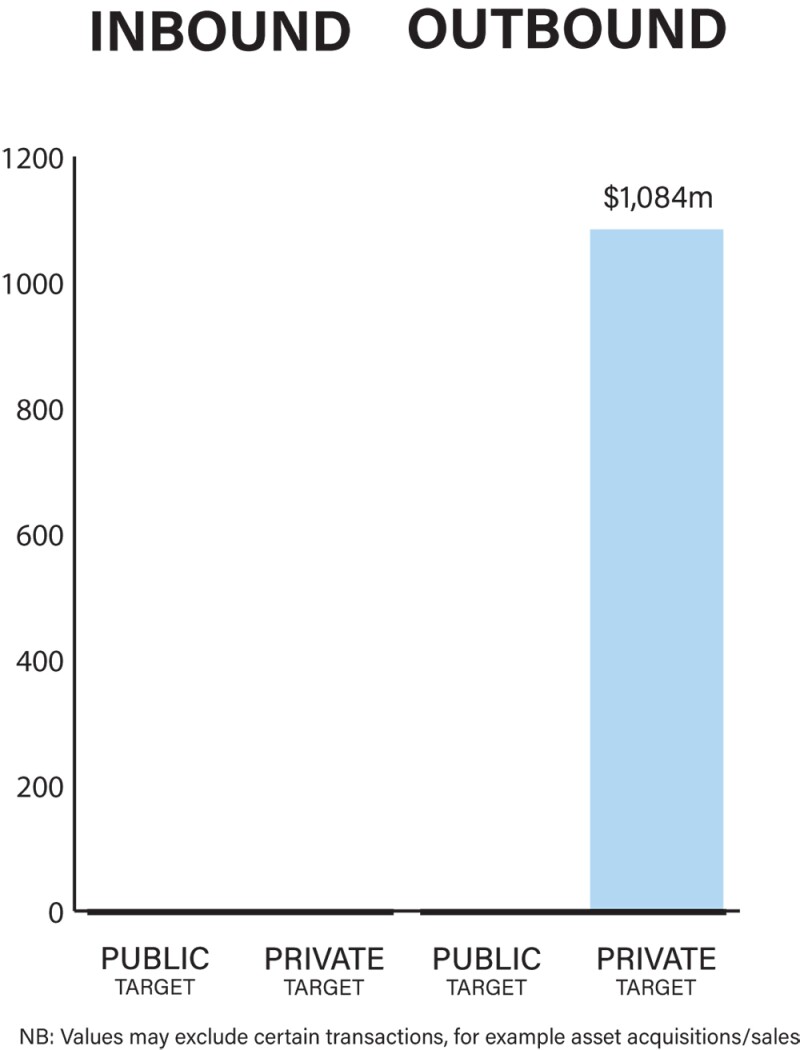

As in previous years, the market is driven primarily by private M&A transactions and public M&A activity is still relatively infrequent. This dynamic may be related to the high ownership concentration in most listed companies and scarce liquidity on the Bahrain Bourse. There appears to be some interest in taking some public entities private.

In a recent M&A transaction in 2021 concerning the acquisition of an entity engaged in manufacturing gases, the rules regarding thin capitalisation were debated. Prior to December 2018, a specific procedure was required in connection with a company whose losses exceed 50% of its capital within Article 286 of the Commercial Companies Law (CCL). Article 286 article was amended by Law No. 53 of 2018 to remove any reference to losses of 50% of capital.

Before, where the company’s losses exceed half of its registered capital, a special procedure was required in connection with the filing of annual audited financial statements. The MOICT’s interpretation of “losses exceeding half of capital” was varied. In some instances, an entity with substantial retained earnings and shareholder equity, but a de minimis registered capital, was identified as having excessive losses despite having shareholder equity which is multiples higher than its registered capital.

Regardless of amendments to Article 286 of the CCL, the MOICT is known to have demanded “commitments to rectify the financial position” for entities where there were “losses exceeding half of capital”. MOICT has taken this approach even though neither the CCL, its implementing regulations nor any other law falling within the purview of the MOICT clearly permits this imposed obligation.

For listed companies, the Capital Markets Supervision Directorate (CMSD) is introducing a resolution to regulate the process and procedures of M&A of listed companies. According to Article 93 bis of CBB Law Amendment No. (14) of 2020 (CBB Law Amendment), it is prohibited for any listed company to merge with any other entity without obtaining written approval from the CBB.

Economic recovery plans

Deal flow slowed significantly in 2021 in light of the Covid-19 pandemic. Industries such as airlines, hotels and food and beverages still top the chart for the hardest-hit sectors with extended restrictions on travel and dine-in services. However, at the end of 2021, we noticed a revived interest in the education sector and few expressions of interest for the acquisition of operational schools.

Also, under a recent amendment to the 2012 Child Law, nurseries and kindergartens will now fall under the jurisdiction of the Education Ministry, shifting the responsibility from the Ministry of Labour and Social Development Minister. The amendments aim to encourage investment in the field of primary education while also bolstering the education sector in Bahrain on a local, regional and international level.

The government of Bahrain has adopted a strategic plan to develop six key economic sectors, namely financial services, information and communication technology, industry, logistics, tourism, and oil. The change in market and risk dynamics lends itself to reconsiderations by existing shareholders and prospective acquirers of their investment positions. This enhances the probability of M&A activity seeking to arbitrage such risk appetite adjustments. Moreover, there has been a glut of credit in the Bahrain markets as capex-intensive financings are repaid and can be replaced with more efficient BASEL III-compliant financings to facilitate leveraged buyouts and similar acquisition structures.

|

|

“M&A transactions are on the rise, however, deal value has not yet returned to the pre-pandemic level” |

|

|

Subject to certain capitalisation requirements and/or having a Bahraini shareholder, foreign-owned companies now have access to a wide range of economic activities (a total of 178 different commercial activities have been amended to fall within this category). With the liberalisation of foreign ownership in about 33% of economic activities (previously restricted to 49% foreign ownership), it is not permitted for foreign investors to have a higher percentage of foreign ownership in these activities. Of the remaining economic activities, 3% restrict foreign ownership to 49%, while foreign access is prohibited in the other 3%.

The percentage of ownership by the Bahraini shareholder is left to the determination by the shareholders. In particular, the retail sector is now accessible to about 100% foreign ownership with the presence of a mandated Bahraini shareholder.

An exception to the mandatory Bahraini shareholder is also provided in the Liberalisation Resolution. A foreign investor may apply for a special exemption request to the Cabinet of Ministers through the MOICT, provided that investor meets the following criteria: (i) the company must be present in at least three international markets; (ii) the capital of the parent company shall not be less than BD20 million (approximately $53 million) or its equivalent in foreign currencies; and (iii) the company’s invested capital in Bahrain shall not be less than BD2 million within the first year.

The previous year also saw some traction in other sectors. In January 2021, Bahrain International Airport’s new passenger terminal began operating. This increased capacity for handling passengers and marked a new era for the aviation sector.

Increasing VAT from 5% to 10% had some negative impact on the M&A deal flow as it left many investors cautious especially in the retail segment, where there is an undertone of decreasing demand-side pursuant to this tax increase. Private equity (PE) investment into Bahrain has also continued its downward trend. The impact of the low price of oil and the limitations of the tourism industry are still evident and are expected to continue to dampen interest from investors. Moreover, closely held start-up companies lack a practically enforceable structure for PE funds, such that they would generally use an offshore vehicle in order to participate in a local entity.

The delay in the proposed takeover of Ahli United Bank (AUB) by Kuwait Finance House (KFH) is an example of the significant economic impact caused by Covid-19. In light of the circumstances arising due to the Covid-19 pandemic, the Board of AUB approved the suspension of the acquisition procedures in both the State of Kuwait and the Kingdom of Bahrain until December 2020 in consultation with KFH, after having obtained the CBB’s approval on the postponement of the acquisition procedures until December 2020. The CBB issued no objection to this extension. AUB has been repeating the suspension in its monthly progress announcement, most recently on December 31 2021.

Legislation and policy changes

The Take-over, Mergers and Acquisitions Module (TMA Regulation) of Volume 6 of the Rulebook (Rulebook 6) issued by the CBB is the primary governing regulation for public M&A in Bahrain and it works in conjunction with other regulations issued under Rulebook 6. It applies where there is an acquisition or consolidation of control of a Bahrain-domiciled publicly listed company; or an overseas company whose primary listing of equity securities is on a Bahrain exchange. Rulebook 6, including the TMA Regulation, is administered by the CMSD at the CBB. Private M&A, as such, is not a regulated activity beyond registration of share transfers and transfers of business premises, outlined primarily in the CCL.

On the legislative front, apart from the issuance of the Liberalisation Resolution and the amendments to the CR Law, there are no major changes to the regulations that would have an impact on M&A transactions or activity. From the regulatory standpoint, the CBB Law Amendment through the introduction of Article 93 bis vested authority with the CBB to regulate M&A of listed companies.

Covid-19 has had a noticeable impact across all sectors; however, the changes to the legal framework of Bahrain were mostly in alignment with the long-term Bahrain Economic Vision 2030 of the Bahrain government. The Privatisation Programme of Bahrain, which falls under the supervision of the Ministry of Finance, was in the limelight last year. In March 2021, Bahrain hosted a global event, the Bahrain Metro Market Consultation, to seek out private enterprises interested in establishing a public-private partnership for the development of its metro system.

The double impact of Covid-19 and climate change could be seen as a paradigm shift in societal behaviour and the adoption of green information and communication technology (ICT). Bahrain has an early mover advantage where it has poised itself to be a regional leader in promoting green ICT solutions.

In 2020, Bahrain Bourse launched its voluntary environmental, social and governance (ESG) reporting guideline for listed companies and other stakeholders. The MOICT has launched a number of energy efficiency initiatives in cooperation with the relevant entities to increase energy efficiency potential in Bahrain; however, we did not see these initiatives impacting the M&A deals or agreements that were concluded last year.

Nevertheless, it is important to note that various provisions of Bahrain’s Personal Data Protection Law (PDPL) require an implementation decision from the personal data protection authority (PDPA). Through Royal Decree 78 of 2019, the Minister of Justice, Islamic Affairs (MOJ) assumed the role of an interim PDPA. The MOJ has issued multiple draft resolutions for public comment and it is expected that that these resolutions, when implemented, could have a meaningful impact on the M&A agreements, especially for the sectors that process personal data and sensitive personal data.

The draft resolutions issued by the MOJ would impact the service industry as it is very common for service industry participants to engage in data processing activities.

Also, as indicated above, the CMSD is introducing a resolution to regulate the process and procedures of M&A of listed companies. This could impact M&A activities for listed entities.

Market norms

One common mistake in Bahrain is to structure and implement M&A deals following schemes and solutions developed in overseas jurisdictions without paying the necessary attention to the local legal and regulatory framework, both in cross-jurisdiction cases and in purely domestic transactions. This mistake can go unnoticed insofar as no conflict arises between vendor and buyer, though this may result in the completion process conflicting with local regulations.

If a conflict arises, the pitfalls of this approach become readily intelligible, including difficulty in obtaining legal redress in the local jurisdiction, uncertainties surrounding application of foreign law provisions in domestic court proceedings and impasse to meeting local requirements for completion.

Post-closing activities are frequently an overlooked area as action plans and timelines are often drawn up until the closing date leaving post-closing activities to proceed without a clear structure, sometimes even managed by a team that did not work on the deal. This neglect often subsists notwithstanding the number and importance of post-closing activities which are often implicated (such as changes to public registers which cannot be completed at closing). Transitional services arrangements involving continued seller involvement are common but may have dubious validity and enforceability.

Bahrain is making strides towards digitising its economy and improving its ecosystem through emerging technologies, where the government has identified the significance of technology to reinforce its economic growth, job creation and human development. With the implementation of the PDPL and the draft resolutions issued by the interim PDPA, considerations around data being transferred in connection with an asset sale are increasing; however, there is no evidence of technology relating to the deal making process.

The relative difficulty of travel combined with an enhanced acceptance by Bahrain authorities of electronic meetings and electronic signatures (the electronic transaction law introduced in Q1 2018 enhanced the use of electronic signatures) has enhanced the ability of technology to play a crucial role in the M&A negotiation and implementation process.

The Telecommunications Regulatory Authority issued the first licence to execute e-signature and trust services to BENEFIT Company at the beginning of August 2021. This will support the digital transformation strategy in Bahrain. Bahrain does not have a robust IP sector and, while Bahrain is positioning itself as an ICT centre in the GCC, this has not yet led to an increased focus on M&A.

Public M&A

Obtaining control of a public company often involves the launch of a tender offer (whether on a voluntary or a mandatory basis) unless de facto control is achieved by the acquisition of less than 30% of the target company voting share capital.

The threshold triggering an obligation to launch a mandatory offer is set at 30% of the voting share capital of the target company and further thresholds are contemplated for any incremental purchase between 30% and 50% of the voting share capital occurring within a specified timeframe. The launch of a tender offer is accompanied by the publication of an offer document subject to CBB approval.

In respect of competitive and hostile bids, there are regulatory provisions that prohibit certain frustrating actions.

Usually, conditions attaching to an offer include levels of acceptance, approval of shareholders for the issue of new shares, and listing/regulatory approvals. A voluntary offer must not be made subject to conditions whose fulfilment depends on subjective interpretation or judgement by the bidder or lies in the bidder’s hands.

Once a firm intention to make an offer is formally announced, the bidder is committed to proceed. The scope to withdraw by invoking the conditions to the offer is limited. To the extent that the bidder intends to attach conditions other than normal conditions, the CBB must be previously consulted. As a general rule with limited exceptions, financing for an offer must be fully committed when the announcement of the firm intention to make an offer is made.

Break-fees are not used in Bahrain and their validity is uncertain as a commitment to a break-up fee can be seen as unlawfully impinging upon each shareholder’s right to decide whether to sell or retain the shares. In the absence of more legal clarity as to the permissibility of break-up fees, this instrument is not expected to be adopted in the structuring of public M&A deals.

Private M&A

The use of completion accounts is still the prevailing consideration mechanism in the realm of private M&A, though the financial data tracked for the purposes of determining any price adjustment with respect to the headline purchase price vary from working capital only adjustments to full-fledged adjustments based on net worth variations.

Locked box mechanisms are still relatively uncommon though greater use of such mechanisms is expected, especially in the context of vendor-initiated private auctions. There has been an increase in the use of earn-outs in private M&A, and these are likely being used as a tool for bridging widening valuation gaps between seller sides and buyer sides. Escrows are very common and are mostly used in connection with management of claims against representations and warranties.

Regulatory approvals are invariably attached to private offers in respect of target companies operating in regulated industries. It would be reasonable to expect that the registration of share transfer (post-closing) with the Bahrain Bourse is included as a condition to the private acquisition for closed joint stock companies listed under Bahrain Bourse following the implementation of the proposed amendment to the CR law.

It is also not uncommon to find material adverse change clauses associated with specific quantitative metrics, though these are usually strongly negotiated. It is quite common to bring down all representations and warranties to closing so that any breach (or material breach) of them may give a deal exit to the buyer.

It is quite common to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements, although the use of foreign jurisdiction clauses in M&A transactions is not recommended in light of the enforceability issues that these may give rise to.

In the case of foreign governing law, foreign arbitration should be seen as a must due to the problems faced in proving the provisions of a foreign law in front of a Bahraini court and the difficulties in enforcement of foreign court decisions in Bahrain. Bahrain governing law with Bahrain court enforcement may be valuable to facilitate enforcement of local obligations associated with the transaction and may be favourable for a foreign party that received robust local law advice against a Bahraini counterparty.

The exit environment is very challenging. The main exit channel still consists in a private sale to an industrial or private equity purchaser. The initial public offering exit route is uncommon in light of the structural liquidity issues affecting local capital markets. Sales to financial sponsors are also often unviable because of the reluctance by financial sponsors to take on balance sheet equities also in light of the penalising capital treatment that this asset class receives under BASEL III capital adequacy regulations.

Looking ahead

It is expected that the Liberalisation Resolution will usher in new investment proposals for the liberated sectors, especially the retail sector. The unfolding of redundant nominee structures could be seen in sectors that have been opened up with the interest of foreign investors to acquire an existing business with promising growth prospects. However, the conditions stipulated in the Liberalisation Resolution could act as floodgates, checking the unrestricted flow of foreign capital in local businesses.

Consolidation in the financial industry is likely to continue, propelled by structural reasons going beyond the existing economic cycle. The increase of the VAT rate will likely have a shrinking impact on M&A transactions.

The implementation of draft resolutions by the interim PDPL would further align Bahrain’s data protection regime to the General Data Protection Regulation (GDPR) and will continue to increase the interest of foreign companies already bound by GDPR to extend their presence into Bahrain.

Click here to read all the chapters from the IFLR M&A Report 2022

Steven Brown

Partner

ASAR-Al Ruwayeh & Partners

T: +973 17 533 182

About the author

Steven Brown is the managing partner of the Bahrain office at ASAR – Al Ruwayeh & Partners and works primarily in the corporate and financial field.

Steven has broad knowledge and experience in corporate law, including governance and compliance of public and regulated entities. He also leads the Bahrain finance practice. He has been involved in numerous banking and finance transactions, local and cross-border acquisitions and transaction structuring in Bahrain. His M&A experience includes acting as lead and local counsel on various transactions representing buyers, sellers and targets in addition to assisting underwriters and financiers on public entity transactions.

Steven holds a bachelor’s degree from Marquette University and a JD from Washington University in St. Louis.

Rahul Sud

Senior associate

ASAR-Al Ruwayeh & Partners

T: +973 17 533 182

About the author

Rahul Sud is a senior associate with ASAR – Al Ruwayeh & Partners and has multi-jurisdictional experience of working in India, Singapore, Qatar and Bahrain.

Rahul is noted for his skills in advising innovative solutions to clients. He has extensive deal experience across domestic and cross-border M&A, foreign direct investments, joint ventures, restructuring and reorganisations. He also has experience on matter relating to banking, finance, intellectual property and technology laws.

Rahul holds a bachelor’s degree from Symbiosis Law College and a LLM from National University of Singapore.