After a busy finish to 2020, 2021 became one of the biggest ever years for M&A in Germany, with records across almost all categories. Most market participants had agreed that 2022 would also be a strong year for M&A, however, that was prior to accounting for the impact of Russia’s invasion of Ukraine.

One significant driver of M&A has been corporates disposing non-core units in order to refocus their business activities and to fuel their desire to access new markets and business lines. At the same time, financial investors continue to leverage favourable market conditions for sales to implement and often expedite exits. These sell-side factors are met by a largely appreciative buy-side, in which funding opportunities and cash resources (‘dry powder’) are combined with a relatively high investment pressure.

While it is widely expected that Covid-related restrictions will soon ebb away, the ongoing disruption of vital supply chains continues to have a significant impact on economic activity in Germany. At this point in time, any reliable prediction about economic development and the M&A market in 2022 might be premature, not least due to the war in Ukraine and associated uncertainties.

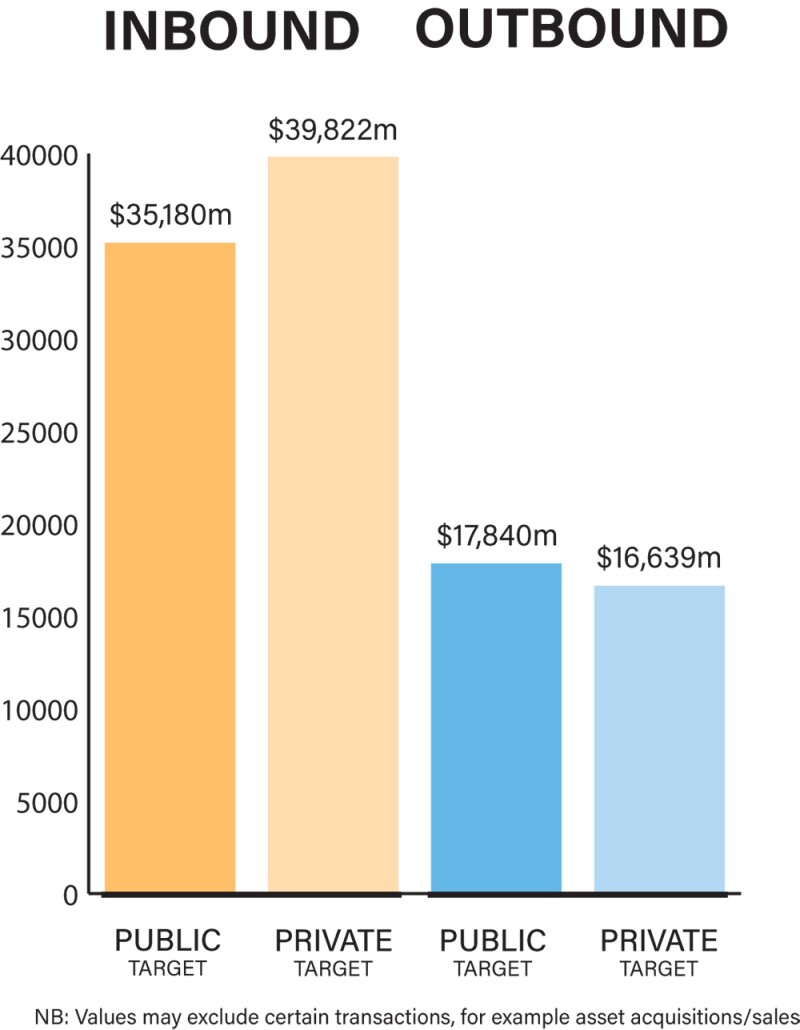

Public and private M&A both play an important role in Germany. While some recent IPOs and public takeover attempts garnered noticeable media attention, private deals are still dominating the league tables due to their sheer numbers. This focus is not new and can be attributed to a number of factors, including additional legal requirements that render quite complex the full integration of a listed company following a takeover. However, the situation may yet change, particularly given the remarkable number of planned IPOs and the recent drop in stock market prices that have the potential to offer attractive investment opportunities.

Economic recovery plans

Aside from an initial slowdown in market activity as well as certain Covid-related issues – such as the stability of supply chains and legal risks resulting from government support – that have now been included in standard due diligence assessments, the pandemic did not have a lasting impact on the M&A market in Germany.

In theory, the fundamentals look promising for a dynamic M&A market in 2022. Strategic players are expected to remain relevant and the shift to remote/digital working as well as the growing importance of digital business models have accelerated the need to address structural and business case-related weaknesses, which is expected to trigger comprehensive portfolio changes in many industries. While corporates are divesting their non-core (or ‘old economy’) assets leading to a high number of carve-out deals, they are buying into promising new ventures, often with a technology and digital focus. There is also an increased focus on suppliers and thus on vertical integration in order to secure supply chains. While attractive assets continue to hit the market, an ever-growing group of potential buyers with relatively easy access to financing are looking for investment opportunities. In particular, private equity funds have collected unprecedented amounts of funding, not least because of the low returns on alternative forms of investment.

Hamburg-based Körber Group e.g. plans to expand its software division for supply chain and warehouse management, which will be funded through a joint venture with US investor KKR, indicating that PE houses aim to further enhance technical solutions.

|

|

“The high liquidity and valuations led to an uptick in IPOs in 2021” |

|

|

The short, mid and long term impact of the war in Ukraine is hard to predict, and it is too early to say how economies and, consequently, M&A markets will react to changes to the global energy supplies market and the exclusion of Russian investors and banks from Western markets.

Public M&A is back on the radar in Germany. The high liquidity and valuations led to an uptick in IPOs in 2021, and, at the same time, Germany’s leading stock index DAX expanded and changed its rules to better reflect the quality of its member companies, with a corresponding knock-on effect on the further indices. Furthermore, not only have we seen an increase in taking companies public, but also in taking public companies private.

Successful transactions have shown that, despite rather formalistic rules under German law, such endeavours may very well work. Moreover, given the recent development of stock market prices, interested parties may now have access to an increasing number of attractive investment opportunities.

This can include trends related to:

Industry consolidation, M&A-driven growth, financing considerations or other factors;

Distressed M&A, reorganisations; and

The impact of Covid-19 on M&A-related disputes, use of indemnity provisions.

Financial investors continue to be relevant players in the M&A market as buyers and sellers. Their focus on enhancing performance and modernising structures bears fruit: not only do they impact the portfolio companies they hold, but they also establish best practices in certain industries and thereby influence corporates. Further, carve-outs continue to be strong, feeding off conglomerates trying to align their portfolios with their strategies.

Acquisitions of private companies are primarily structured as share deals and are not governed by any statutory process (other than regulatory clearances). They are a matter of negotiation between the respective bidder and seller as most relevant statutory provisions are not mandatory.

In contrast, public M&A transactions have to comply with the German Securities Acquisition and Takeover Act (WpÜG), the EU Market Abuse Regulation (Marktmissbrauchsverordnung) and the German Stock Corporation Act (AktG), and are subject to the supervision of the German Federal Financial Supervisory Authority (BaFin).

Private and public transactions may be subject to German merger control. Further, the Federal Ministry of Economic Affairs and Climate Action (BMWi) has the power to review direct or indirect acquisitions of German-based companies by foreign investors.

The BMWi may prohibit any acquisition of 25% or more of the voting rights by a non-EU/EFTA investor or may request commitments if it poses a threat to German public order or security or violates essential national security interests. In addition, acquisitions of 10% or more of the voting rights in a company active in certain areas of critical infrastructure or in the area of military and defence may be subject to a mandatory filing requirement.

Compliance with sustainability regulation, digital transformation and disruptive technology will continue to be a due diligence focus of German target companies.

ESG has become an investor focus and is now driven not only by consumer demand, but also by legislative developments across multiple jurisdictions. The M&A market is therefore showing a greater demand for ESG due diligence products, particularly in relation to value chains and corporate responsibility. Further, new reporting obligations due to regulatory developments and forthcoming changes will need to be observed.

Regulatory tightening and political uncertainty could prove an increased hurdle to in-bound and out-bound M&A transactions throughout 2022, as FDI control regimes continue to grow and merger review proceedings remain active. Furthermore, the recent sanctions imposed on Russia will effectively exclude investments by Russian investors in Germany and impose restrictions on investments in companies with affiliates in or ties to Russia.

Market norms

Foreign investors continue to wonder about notarisation requirements in Germany, particularly in connection with German limited liability companies (GmbH). A notary must read aloud to the parties all share purchase agreements, including annexes, which may prove to be a time-consuming exercise.

Depending on the deal structure, parties are advised to seek employment and tax advice early as German law contains some unique features in these areas.

The importance of technology has become increasingly clear during the past years. The M&A market would not have been nearly as successful during the pandemic were it not for the seamless transition to remote working, including virtual meetings, digital collaboration and transaction management platforms. Moreover, inevitably, tech companies have become extremely attractive M&A targets and have pushed valuation to previously unseen levels.

Public M&A

The scope of legal documentation required for the acquisition of shares in a public company depends on the type of business combination chosen as well as the type of shares being acquired and whether these shares are to be acquired over the stock exchange, via capital increase or from other shareholders.

Holding 30% of the voting rights in a listed company is considered to provide ‘control’ under German takeover law. Whoever is about to achieve or exceed this threshold directly or indirectly will need to consider a public takeover offer, which requires an offer document. Unsolicited takeover attempts are still rare in Germany, however, the general attitude towards hostile transactions is less negative than in the past.

After the decision to launch an offer has been published, the management board is prohibited from taking any action that could prevent the success of the takeover offer. However, the management board may search for a ‘white knight’; take any action within the scope of the management board’s powers if approved by the supervisory board and if no further legal requirements exist; and take actions that would have reasonably been taken if no offer had been launched. Furthermore, the shareholders may, under certain restrictions, authorise the management board to take action within the scope of the powers of the shareholders’ meeting before and independent from any takeover offer.

BaFin takes a rather restrictive position regarding the possibility to impose offer conditions. Voluntary public takeover offers, i.e. offers made by buyers that do not own shares in the target company or whose shareholding is below 30%, are usually only subject to regulatory approvals, fairly standardised market and company MACs and no defensive measures (such as capital increases during the offer period).

There is often a minimum acceptance threshold for offers as the acquisition of only a portion of shares may not be attractive. Mandatory offers, i.e. offers that are triggered once a shareholding of 30% is reached by one shareholder, can only be made subject to regulatory conditions.

Break fees in public M&A deals (when the target pays the prospective buyer) have traditionally been unpopular in Germany and few target companies or bidders are willing to accept them.

Private M&A

Deal processes for attractive assets are competitive, allowing sellers to choose locked box structures. Strategic acquirers, which traditionally favour completion accounts, are increasingly accustomed to locked boxes, particularly because pushing for completion accounts can weaken their position in a competitive process.

An increasingly common feature in competitive situations is that certain bidders try to pre-empt entire sales processes. This can be attractive for sellers as it enables them to maximise their leverage, but it can also carry reputational risks for the parties involved.

Recent deals saw an increase in earn-outs, most commonly in emerging technology and life sciences deals in which the knowledge of key individuals is important for long-term success and a fair valuation of target companies based on current KPIs is difficult. On the other hand, escrows remain uncommon, but they do occasionally provide recourse for buyers in the event of a downward price adjustment or as security for liabilities or warranties.

W&I insurance has remained prevalent in transactions involving PE sellers, and more frequently in cases of strategic investors’ involvement.

Deal certainty is one of the most crucial factors for sellers besides the purchase price and limitation of liability. Hence, transactions are typically only subject to merger control clearance by the relevant authorities and foreign investment control clearances. Any further deal conditions would depend on the transaction specifics.

Share purchase agreements relating to German targets are usually governed by German law under the jurisdiction of German courts or arbitral tribunals. Depending on specific preferences of the parties, agreements may also be made subject to non-German laws.

2021 has seen a striking number of private equity exits, relating to valuations rising after a dip at the beginning of the Covid-19 pandemic and the amount of dry powder available in the market. Due to low interest rates on external financing and the tight cash management during the pandemic, corporate buyers also have high liquidity reserves.

Many financial investors and strategic buyers have taken advantage of continuously favourable financing opportunities and numerous sellers have shown good timing in the sale of their investments to PE funds or strategic buyers or the floating of their participation on the stock exchange.

Looking ahead

Notwithstanding the significant impact the war in Ukraine will have on the M&A market, the following can be observed:

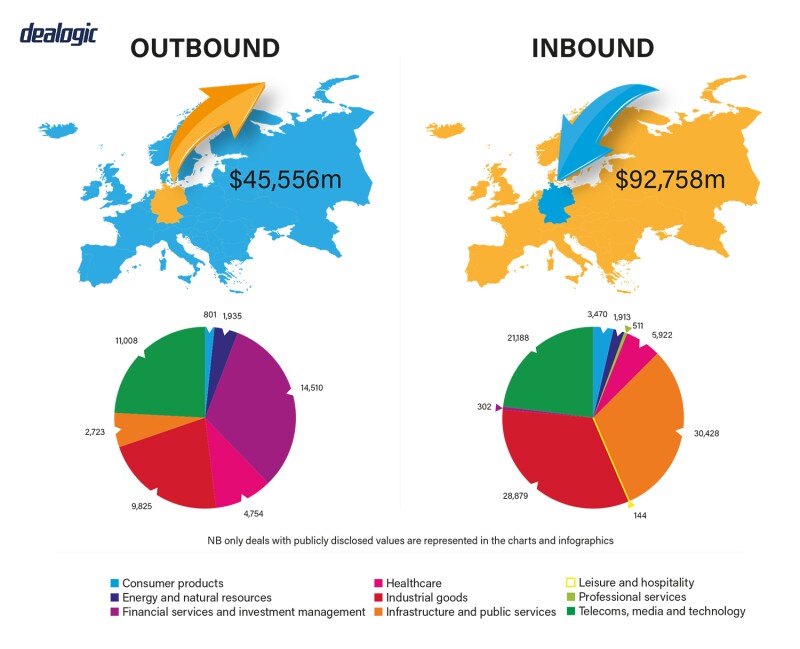

Cross-border deal flow is set to continue rising in 2022. Moreover, the pandemic recovery differential between the US and Europe and US corporates’ high cash pile is likely to further feed transatlantic deal flow.

Technology investments will continue to play a key role in M&A transactions. Consequently, corporates’ tech spend and the funding at the tech back-end will have implications for future deal flows. In addition, carve-out transactions will continue to fuel deal activities.

On the regulatory side, merger control issues and protectionist policies should be closely monitored as they will continue to influence deal transactions in Germany and globally. Finally, business models that are ESG-compliant will continue to shape the M&A market.

Further momentum will be created around take-privates, acquisition of minority stakes in listed companies (including by way of PIPEs), and – given the impact of the pandemic and associated lockdowns on a number of business models as well as liquidity squeezes due to Ukraine war related supply chain issues – distressed M&A.

However, the full impact on the M&A market of the fallout from the war in Ukraine will not be fully understood for many months.

Click here to read all the chapters from the IFLR M&A Report 2022

Heiko Gotsche

Partner

Latham & Watkins

T: +49 211 8828 4640

Heiko Gotsche is a M&A partner at Latham & Watkins with considerable experience representing clients in domestic and cross-border M&A transactions as well as on corporate law matters.

Heiko’s clients include German and international clients, including listed as well as family-owned companies, private equity investors, financial institutions, and high-net-worth individuals.

Christina Mann

Counsel

Latham & Watkins

T: +49 69 6062 6591

Christina Mann is a counsel at Latham & Watkins and a member of the corporate department.

Christina has significant professional experience in corporate law, M&A, and private equity. Prior to joining Latham, she worked for a global automotive and industrial supplier and an international law firm in Germany and New York.

Nicole Kubalek

Knowledge management counsel

Latham & Watkins

E: +49 40 4140 3372

Nicole Kubalek is a knowledge management counsel at Latham & Watkins and a member of the corporate department.

Nicole has broad experience in corporate law issues with particular emphasis on M&A. She has regularly advised public and private companies in all types of domestic and cross-border transactions.