Following the stalemate that persisted over almost all of 2020, the Greek M&A market bounced back in 2021 with a leap in respect of both deal volume and value and regained much of the lost impetus from the Covid-19 pandemic. Key players throughout the M&A lifecycle found themselves fully adapting to this new reality and setting their priorities in a more concise and well-planned fashion.

In this context, consolidation of activities and optimisation of core operations have become a recurring theme in the Greek (and for the most part, global) transactional landscape. Building on knowledge acquired during the pandemic, conglomerates have been pivoting their M&A activities towards opportunities that are in line with their strategic goals, thus allowing them to become more agile both operationally and financially, instead of opting for size and scale.

This trend, in turn, has led to an upsurge in restructurings and transformations, in the form of divestitures, carve-outs, demergers etc. This has increased the pool of opportunities for deal makers – particularly private equity (PE) investors – who are eager to deploy the significant amounts of dry powder compiled over the past couple of years.

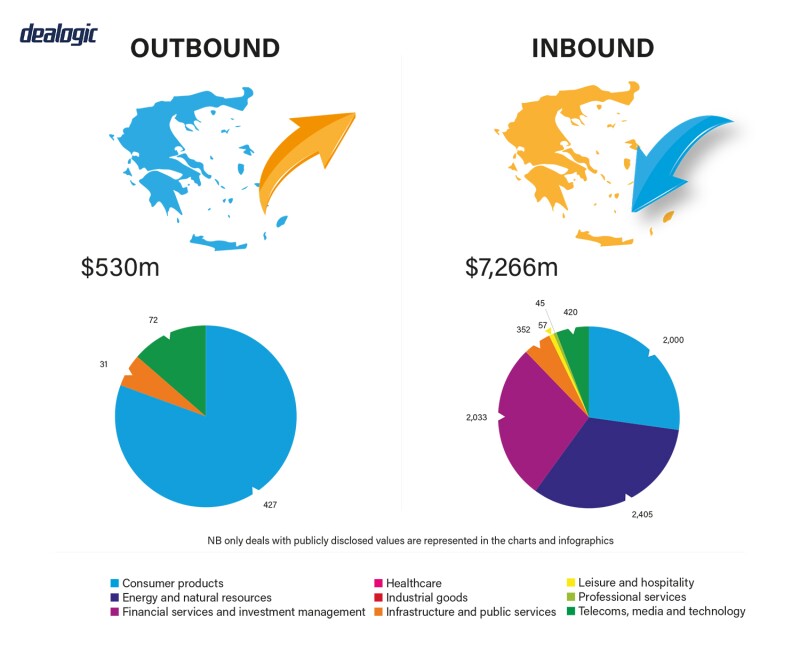

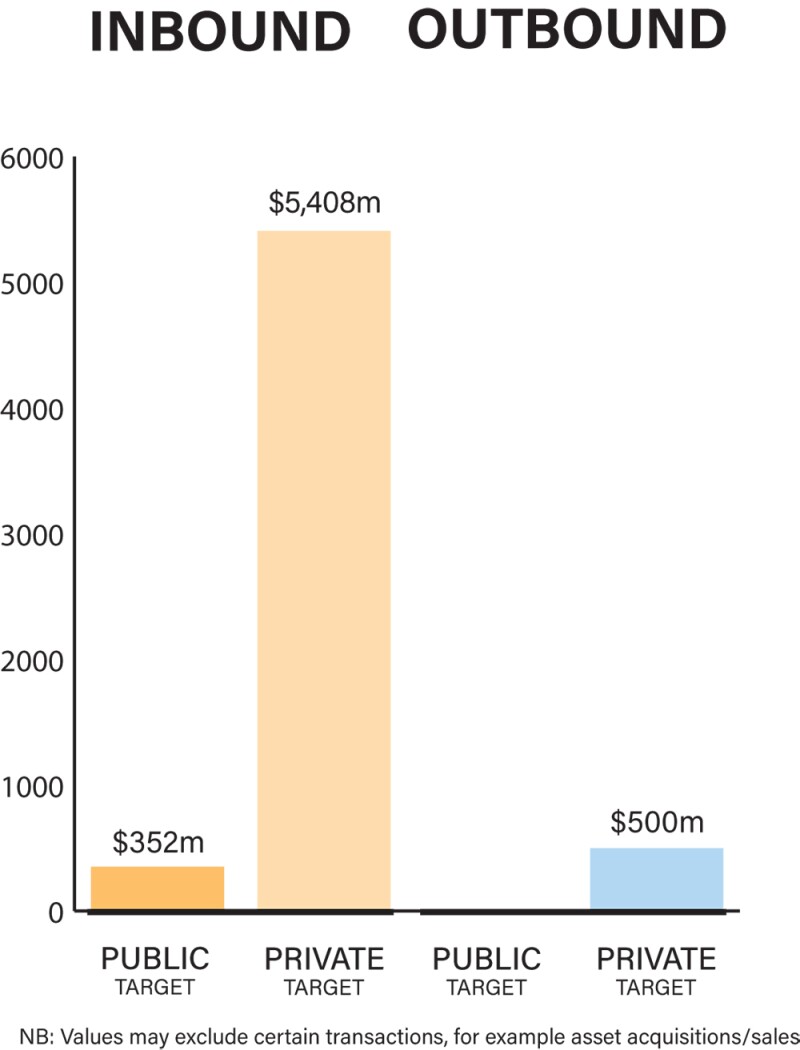

Although private and public M&A transactions are both important facets of the Greek market, private M&A deals occupy the lion’s share in Greek transactional practice and attract most interest from foreign investors. This fact is partly due to the additional protective covenants surrounding public M&A transactions, e.g. with respect to disclosure requirements and minority shareholders’ rights, which may render such transactions more complex.

There are also numerous privatisation projects that faced significant setbacks during the previous few years but are now restarting and moving towards completion. The Hellenic Republic Asset Development Fund has facilitated many of these processes, which are attracting great interest from both local and foreign investors and are enhancing the growth potential of the Greek economy.

An example of recent deal trends was the sale of Unilever’s Greek tomato business to Minerva, involving the transfer to the acquiring entity of well-known trademarks in the Greek market and the respective manufacturing site. The deal formed part of Unilever’s overall focus strategy, requiring the divestiture of non-core business sectors globally, and was implemented through a competitive private process.

Despite the lack of conditions regarding regulatory approvals (e.g. merger clearance), a relatively extended timeline was put in place to allow time for the performance of a series of pre-completion actions, including corporate restructurings required to facilitate the smooth transition of the business to the new owner.

Likewise in the food and beverages sector, a deal that hit the market was the acquisition by Mondelēz International of Chipita Global, a high-growth company of Greek origin which is a leader in the central and eastern European croissants and baked snacks category. It produces its products in 13 factories and distributes to more than 50 countries.

The acquisition of Chipita for approximately $2 billion builds on Mondelēz International’s continued expansion into fast-growing snacking segments. It was subject to merger control approval and pre-completion corporate reorganisation actions, increasing the level of complexity in line with the deal’s financial value. The deal was one of the landmark M&A projects during the past decade.

Economic recovery plans

Covid-19 hit the global and Greek economy hard and its repercussions are still being felt throughout the world. However, it also set in motion new trends, which led to new highs for M&A activity in 2021 compared to 2020 as well as previous years across a number of sectors. Examples include the energy, food and beverage, financial services and software/IT services sectors.

The M&A deal flow ranged from traditional full-scale acquisitions of businesses to strategic minority investments and the establishment of joint ventures, as a means of risk sharing. Corporates and PE firms have also been revisiting old targets, which were put on hold due to the pandemic.

All indications point to another busy year of deal-making as regards inbound M&A activity, with Greece’s perception as an investment destination continuing to improve among EU countries. The levels of economic optimism remain high; after taming the uncertainty of Covid-19, there is dry powder in abundance and multiple projects waiting to be realised in various economic sectors.

Some of the potential challenges that are now showing up on the horizon, such as inflation rates and supply chain complications, do not seem to take away from this positive sentiment or discourage eager potential investors.

The Greek government is regularly assessing and implementing additional measures and incentives to attract investor interest, to alleviate some of the concerns regarding the country’s political and economic uncertainty. In addition, elements such as the high quality of the local workforce and the low cost of living in Greece (compared to other EU capitals) further contribute to the country’s attractiveness. What remains to be seen is whether there will be any potential impact on deal flow from the latest geopolitical turbulences, especially in the energy sector.

Outbound M&A activities have not been at the forefront of the Greek transactional scene over the past few years during which the country’s economy suffered an unprecedented recession, but it will not be surprising if 2022 is the year when Greek corporates start looking more actively for targets outside Greece, given their continuing strategic interest in prospects mainly in the EU and the Balkans.

Not long ago, dealing with Covid-19 consequences and allocating related risks were the key drivers in structuring a deal, with material adverse change (MAC) and force majeure clauses dominating all discussions in fear of deals falling through right before the finishing line. Now, however, both sellers and buyers have familiarised themselves with navigating these challenges and are executing their M&A strategies with precision.

|

|

“An uptake in exits should be expected in 2022, particularly from institutional investors who have weathered the Covid-19 storm and are now aiming for higher valuations of their stakes” |

|

|

Consolidation of activities has become common in the Greek market lately, implemented not only by global conglomerates, but also by more traditional, family-owned local businesses opting for quality of operations over quantity.

The reduced deal flow of the previous period means there are significant amounts of investor capital that are now waiting to reach the market. However, use of this capital is not limited to mega deals (which are not that common in the Greek jurisdiction anyway). Investors and particularly PE funds are now frequently targeting small and medium-sized businesses with growth potential and remain on the lookout for potential synergies with their existing portfolios.

Even with the now limited impact of Covid-19 on transaction terms, deal certainty continues to be a focal negotiating point in terms of structuring, especially in transactions with an extended pre-completion timeline. Both sellers and buyers are keen to minimise the other’s walk-away rights, but break-up fees remain rarely used. Furthermore, while in 2020 (and to a lesser extent the first half of 2021) there was a shift of negotiating power to credit-worthy buyers, the tide appears to have turned lately with sellers claiming higher valuations for their companies and assets and buyers adopting a risk-based approach in the context of their (remote) due diligence on targets.

The focus is now on findings with a material impact on the targeted business, which are being addressed through specific indemnities in the transactional documentation. The unavoidable information asymmetry between the two sides also necessitates the use of various contractual tools, such as earn-outs and deferred payments or warranty and indemnity insurance to bridge the gap in expectations.

Finally, the parties are becoming more mindful of extended deal-completion timelines, whether that means proactively engaging in preparatory actions prior to signing any long form agreements or fulfilling a series of conditions in order to reach completion. Delays experienced with public authorities trying to keep up with the backlog created in periods of limited working frequently come into play, while timing may also be an issue in the case of restructurings and transformations used by corporates as a means of unlocking value.

To this end, deal makers and executives are devoting significant efforts to defining pre-completion covenants carefully, to provide comfort to buyers by adequately securing the value of the targets, while staying within the boundaries of applicable competition rules regarding jumping the gun.

Financial investors have resurfaced as key players in the Greek transactional landscape lately. A significant number of deals over the past year have been driven by PE, fuelled by previously unallocated capital and the pressure to generate returns. Shareholder activism may also have played its part in the strategic review of existing portfolios, leading to quite a few divestitures of non-core businesses and a shift to longer investment timelines.

It remains to be seen whether the global trend towards special purpose acquisition companies will ultimately reach the Greek market as well.

Legislation and policy changes

Greece does not have a separate dedicated M&A legal framework. Any private M&A activity is subject to the general corporate law provisions regulating the form of the relevant legal entity, as well as applicable civil, commercial and criminal law provisions and the respective tax rules. In this respect, the key pieces of legislation are:

Law 4548/2018 on sociétés anonymes, Law 4072/2012 on private companies and Law 3190/1955 on limited liability companies regarding corporate matters;

The Greek Competition Act (Law 3959/2011) and Council Regulation (EC) No 139/2004 regarding merger control aspects;

Law 4601/2019 on corporate transformations; and

The relevant provisions of the Geek Civil Code, provided the parties opt for Greek law as the governing law of the transactional agreements.

In terms of regulatory bodies, transactions meeting the jurisdictional thresholds prescribed by the Greek Competition Act must be notified to the Hellenic Competition Commission (HCC) and a standstill obligation is imposed on the parties involved not to consummate the transaction until it has been cleared by the HCC.

Other than that, depending on the type of M&A transaction, the following regulatory bodies may need to be involved in the process:

The Bank of Greece, as regards financial and credit institutions (or the European Central Bank as regards the Greek systemic banks) and insurance companies;

The Hellenic Capital Market Commission, as regards listed entities, investment firms and any other entities supervised by it;

The Regulatory Authority for Energy; and

The Hellenic Gaming Commission.

As regards recent legislative developments, the Greek Competition Act was amended in January 2022. The amendments introduced significant changes to the competition law framework in Greece, including amendments to applicable merger control rules. Most notably, the HCC has been empowered to impose remedies in Phase I clearance decisions.

The HCC could previously only impose remedies in the context of Phase II clearance decisions, which often resulted in transactions being upgraded and scrutinised in Phase II investigations due to the fact that an unconditional clearance under Phase I would be deemed inappropriate under the specific circumstances.

Although these developments have been welcomed as a step in the right direction, deal makers should be cognisant of the fact these changes in turn mean higher scrutiny of even non-problematic transactions meeting the jurisdictional thresholds and prolonged timelines. The local regulator has been very active recently and is generally inclined to assess notified transactions in detail by sending out multiple requests for information to the parties involved and potentially other market players as well.

Covid-19 inevitably changed the perceptions of both executives and deal makers in their M&A endeavours in multiple ways. Risk allocation and walk away rights are carefully negotiated, while valuation of the targets and projections of their future performance are highly debated. The use of pandemic-specific terms may be less frequent today, but the vast majority of deals now include a contingent pricing component as a compromise and means of risk sharing.

Covid-19 has also shown the world the road towards digitalisation. Businesses worldwide are transitioning to a new digital era, deal makers have their eyes set on targets operating in the software/IT industry and deals are now reaching completion through the use of modern tools of remote due diligence, digital signatures and platforms such as DocuSign.

Finally, environmental, social and governance considerations are becoming a crucial driver of how businesses are run and how M&A activities are planned in the context of risk assessment and value creation. Most notably, the Greek government has been pushing for changes to the country’s regulatory regime for renewable energy, aiming to facilitate the transition to greener sources of energy. In the same spirit, it is anticipated that in the future boardroom decisions on M&A strategies will be based even more on a need to invest responsibly and sustainably.

Following the adoption of the EU Foreign Direct Investment (FDI) Screening Regulation, there has been a tightening of regulatory regimes regarding foreign investments in many EU countries. Greece, however, does not yet have a formal FDI screening mechanism in place. Greek law only provides for certain restrictions regarding foreign ownership in border areas. It is expected that Greece will soon adopt an FDI screening mechanism in line with the standards of the EU FDI Screening Regulation.

Market norms

Over the past decade, Greece has been severely hit by economic recession with the country’s four systemic banks reaching a critical point just a few years ago. These events led to a feeling of distrust in the Greek M&A market and were commonly misinterpreted as lack of business opportunity in Greece. Slowly but surely the country has bounced back and is going through a period of political and economic stability, while the Greek government continues to enact legislation, such as a new law regarding strategic investments, providing considerable incentives to investors.

All these developments have helped Greece regain some of its attractiveness as an investor destination, as is evident from some of the latest investments by multinationals in innovative business sectors. These include Microsoft’s first data centre region in Greece as part of the GR for Growth digital transformation initiative and Pfizer’s digital innovation hub in Thessaloniki.

The most frequently asked questions surrounding M&A transactions tend to relate to taxation. The optimal tax outcome is highly sought by all parties involved, whether in the context of an exit or for a strategic investment through a holding entity, and to a large extent it determines the transaction structure and pricing mechanisms.

However, parties do not devote the same effort and planning to actions following completion of an M&A transaction and integration of the new business. This can lead to operational hurdles, especially if no transitional services agreements have been put in place.

Technology has never been as important as it is in today’s M&A lifecycle. Covid-19 has effectively changed the way businesses are run and the way deals are made. Remote working has become the norm and executives and dealmakers have adapted to this new reality. Due diligence exercises are now mostly, if not exclusively, conducted remotely, even with drones replacing the traditional site visits in some jurisdictions.

The landscape is the same with respect to M&A objectives. Innovation and technologies such as artificial intelligence and the internet of things have created multiple market opportunities, which allow for greater scale at a lower cost. These factors combined with the abundance of investor capital will certainly lead to a further increase in deal activity in the tech sector in 2022.

Public M&A

Obtaining control of a public company in Greece can be structured in the same way as for private companies, i.e. through a share deal, an asset deal or a corporate transformation, while Law 3461/2006 regulates takeover bids for listed Greek companies. The latter distinguishes between a voluntary offer and a mandatory offer if a person holds more than one-third of the voting rights in the company being acquired. The offeror is required to publish an information memorandum including sufficient information, as prescribed by law, which will enable the recipients to form an opinion on the offer.

In the case of hostile transactions, the prospective buyer will unavoidably possess less information on the company and will need to assess the risk of the company’s board of directors issuing a negative opinion. This would also be submitted to the Hellenic Capital Market Commission and the company being acquired and thereafter notified to the employees of the company (or their representatives).

Under Greek law, a public takeover offer may not include any conditions, except regarding obtaining any regulatory approvals and the issuance of any securities that are offered as consideration.

Private M&A

In private M&A, Greek transactional practice appears to be more inclined to the use of completion accounts in relation to price adjustment mechanisms. This allows the parties’ financial advisers to negotiate the principles applicable to such accounts and to provide for a resolution process in case of disagreement, conducted by an independent third party.

The use of locked box has been fairly limited due to the lack of reliable financial data in most cases, but it is becoming more popular, due to the transition to a more seller-friendly environment. Earn-outs as a means to incentivise sellers to continue to perform in key positions of the targets are more frequently seen, and short-term escrows are viewed as a fair compromise for allocating risk of breach of warranties and indemnities.

Over the years, both sellers and buyers have become more sophisticated in their M&A objectives and are now adopting a pragmatic approach when it comes to the conditions for consummation of a transaction. The completion of the due diligence to the buyer’s satisfaction is always the first step towards this objective. Following that, the most common conditions encountered in transactional documents of private M&A deals are:

Obtaining regulatory approvals, including merger clearance if required;

Obtaining waivers in case of change of control, mostly with respect to financial agreements or other key agreements of the business; and

Completion of any agreed corporate restructurings/transformations, such as spin-offs and demergers.

In 2020 and (less so) 2021, the non-occurrence of a MAC event was also regularly negotiated as a condition to completion, but this would receive major pushback from the sell-side, with the parties most of the time compromising on an extended list of pre-completion covenants.

In private M&A transactions involving Greek entities, the parties tend to opt for a combination of Greek law and arbitration in a neutral seat. Nevertheless, depending on the parties’ negotiating power, share purchase agreements may be governed by a foreign law that will regulate their contractual relationship. The disposal of the shares is usually then effected through a separate share transfer agreement, which is governed by Greek law.

The exit environment in Greece remains relatively dynamic, with trade sales in the lead, but with some noticeable exits coming from the Greek start-up community. This should come as no surprise as a number of Greek start-ups took advantage of the trend for digitalisation and secured more than a few solid financing rounds. An uptake in exits should be expected in 2022, particularly from institutional investors who have weathered the Covid-19 storm and are now aiming for higher valuations of their stakes.

Looking ahead

The Greek M&A market witnessed a record year in 2021 and the first months of 2022 suggest that the same dynamic will continue throughout this year. The lessons learned from the pandemic are the key to unlocking value going forward. Corporates, deal makers and their advisers appear to be committed now more than ever to delineating clear M&A strategies and implementing robust plans to navigate any challenges down the road.

The trend for consolidation of activities is likely to continue, with businesses focusing on their core operations and divested assets creating new opportunities in the market. There are still significant amounts of uncommitted capital, especially by private equity investors, which will be a vital driver of M&A in 2022 on the buy-side.

Increased M&A activity in the field of disruptive technologies is also expected, as part of the worldwide shift to digital business models.

Click here to read all the chapters from the IFLR M&A Report 2022

Stefanos Charaktiniotis

Partner

Zepos & Yannopoulos

T: +30 210 6967082

Stefanos Charaktiniotis is a partner at Zepos & Yannopoulos. He has extensive experience in M&A, cross-border corporate transactional work, corporate restructuring and financing projects.

Stefanos also carries out legal due diligence, drafting and negotiating share purchase and ancillary agreements and undertakes all formalities required for the implementation of acquisitions.

Stefanos acts for technology companies, their investors and management on M&A, PE and other corporate transactions. He has also experience in antitrust, advising businesses operating in Greece through local subsidiaries or distributors on their compliance with antitrust specifications of EU and Greek antitrust law. Stefanos lectures on M&A and corporate law at the University of the Aegean.

Stathis Orfanoudakis

Senior associate

Zepos & Yannopoulos

T: +30 210 6967217

Stathis Orfanoudakis is a senior associate at Zepos & Yannopoulos. He focuses on M&A, corporate, commercial, competition and intellectual property law.

Stathis has experience in international business transactions, including the establishment of joint ventures, share and asset deals and corporate restructurings.

Stathis’ practice covers a wide range of matters pertaining to EU and Greek competition law, from merger clearance filings to representation of clients before competition authorities, as well as antitrust corporate compliance. He also regularly advises international and domestic clients on corporate and commercial matters of their day-to-day operation, including the negotiation and drafting of commercial contracts.