Despite the continued challenge posed by the Covid-19 pandemic and geopolitical tensions in south Asia, the market has shown strong signs of recovery. M&A volumes hit a record high in 2021, with over 80 deals valued at more than $75 million each. The surge in investments is partly attributable to the policies of the Indian government, such as the productivity linked incentive scheme introduced under the larger ease of doing business initiative.

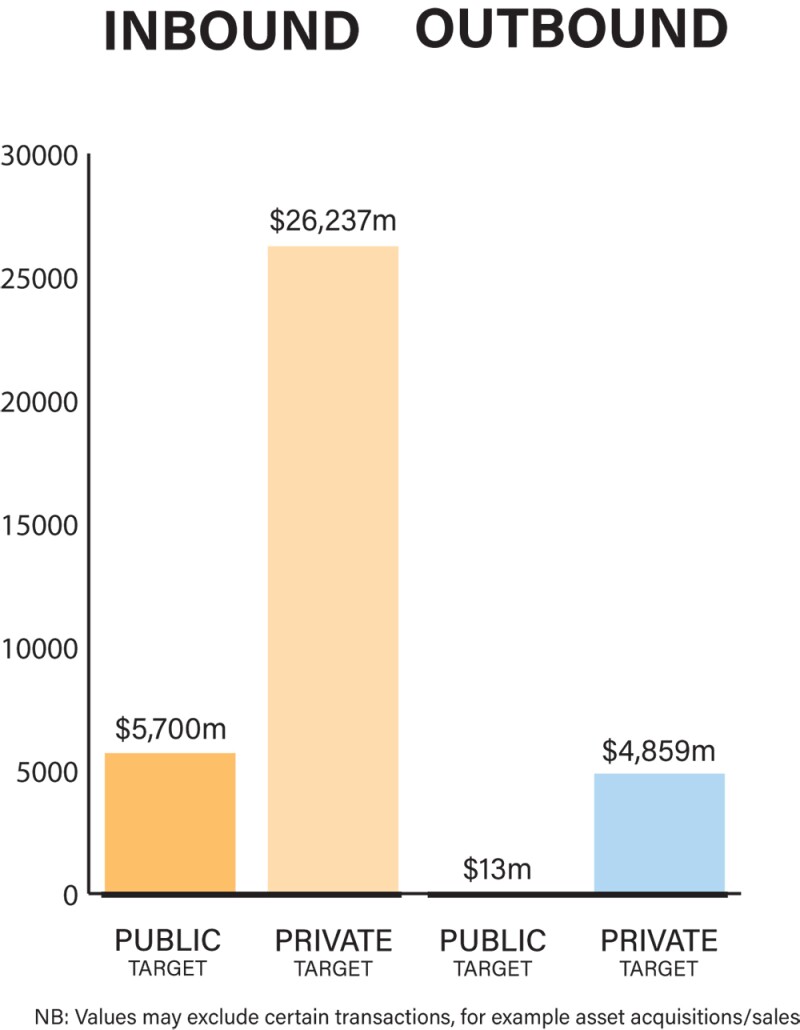

2021 has seen significant activity in both private and public M&A deals, though the former is more prevalent. With the easing of listing norms and a record number of entities choosing to go public in 2021, the year witnessed a strong listing of major Indian start-ups, with Zomato leading the trend, followed by the likes of Nykaa, PayTM and Policybazaar.

The tussle between Amazon, Reliance Industries and Future Group regarding the acquisition of Future Group retail was a highlight of contentious deal-making in 2021. One of the largest acquisitions, it was halted by the Supreme Court in 2020 on account of allegations by Amazon of violation of contractual obligations owed to it. The Competition Commission of India (CCI) then suspended Amazon’s 2019 deal with Future Group itself. The parties are now disputing the matter before various fora including arbitration and the Supreme Court of India.

In 2021, Dewan Housing Finance Corporation became the first financial services company to be referred into a corporate insolvency resolution process by the Reserve Bank of India. This led to an acquisition by Piramal Capital & Housing Finance involving a deal value of approximately $5 billion.

Economic recovery plans

M&A deal flow saw a decline in the first half of 2021, but accelerated to hit a three-year high later in the year. The pandemic brought with it several opportunities for growth and scalability, especially in sectors such as technology, healthcare and renewable energy.

The consolidation of market players has been a driving force behind M&A transactions. Tech Mahindra and Infosys looked toward outbound entities, while Byju’s acquired Aakash Education, White Hat Jr and Toppr Technologies.

|

|

“With the easing of listing norms and a record number of entities choosing to go public in 2021, the year witnessed a strong listing of major Indian start-ups” |

|

|

The continued effect of the measures taken by India’s foreign exchange regulator to curb opportunistic acquisitions of Indian companies (known as ‘Press Note 3’) during the pandemic brings a level of uncertainty. The extant foreign exchange regulations were amended so investors from countries sharing a land border with India would need prior government approval to make investments.

Pursuant to the ease of doing business initiative, there have been several regulatory changes. On the domestic front, changes such as the Ministry of Corporate Affairs (MCA) 21 project have ensured easier compliance mechanisms and access to government services. Foreign exchange regulations for inbound investments have also been relaxed. Recently, investments under the automatic route were opened up for the telecoms, defence and insurance sectors.

In addition to Press Note 3 regulation, the major factors influencing deal structures include a favourable initial public offering (IPO) environment and an increased participation of private equity (PE) players in M&A deals.

The rise in the number of smaller, private entities opting to take the public route through special purpose acquisition companies (SPACs) to list in foreign countries was noted by Indian regulators. While Renew Power did engage in a SPAC listing, current regulatory norms in India are not conducive for a ‘de-SPAC’ or the reverse merger essential to the SPAC IPO process.

With an increasing number of foreign and institutional investors investing in promoter-run companies in India, there is a welcome focus towards principles of corporate governance and shareholder activism. For instance, the shareholders of Balaji Telefilms refrained from approving the company’s decision to pay salaries to its managing director and its joint managing director.

Legislation and policy changes

The key laws governing Indian M&A activity include:

Companies Act, 2013: Administered by the MCA, the Companies Act is the primary legislation governing companies, capital raising and mergers.

Securities Regulations: The securities markets are regulated by the Securities and Exchange Board of India (SEBI). The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Code) governs substantial stake acquisitions in publicly listed companies. The SEBI (Delisting of Equity Shares) Regulations, 2009 governs take-private transactions.

Foreign Exchange Management Act, 1999 (FEMA): Administered by the Reserve Bank of India (RBI) and the government of India, FEMA and the rules issued by the government of India thereunder as well as the associated RBI regulations regulate capital inflows and outflows.

Competition Act, 2002: The CCI, the regulator established under the Competition Act, accords antitrust approvals.

Income Tax Act, 1961: Administered by the Income Tax Department, the Income Tax Act along with double tax avoidance treaties govern the tax treatments.

Insolvency and Bankruptcy Code, 2016 (IBC): Administered by the National Company Law Tribunals, the IBC regulates auction sales under a corporate insolvency resolution process.

The Companies Act was amended to allow public companies to list their securities on foreign stock exchanges. Additionally, companies listing only their ‘non-convertible debentures’ and ‘non-convertible redeemable preference shares’ will not be regarded as ‘listed companies’, thereby easing the compliance requirements. Such changes are clearly intended to ease the compliance norms required for a company to raise capital through exchanges in the domestic and international public markets.

Indian regulators placed restrictions on funds operating out of the Caymans as it is on the Financial Action Task Force watch list. Additionally, as a result of the Press Note 3 policy mentioned above, investments from China and Hong Kong have fallen by 72% to $952 million in 2020 from $3.4 billion in 2019.

While environmental, sustainable and corporate governance (ESG) investing is still at a nascent stage in India, there are signs that portend increased popularity. India’s target of producing 450 gigawatts of renewable energy by 2030 and to have net zero carbon emission target by 2070 is likely to keep the renewable energy sector thriving. ESG assets under management in India have increased from INR26.3 billion (approximately $350,000) in 2019 to INR123.2 billion in 2021 – indicating a healthy increase in ESG fund inflow.

A framework for cross-border insolvency under the IBC is under consideration by the government after it received comments from stakeholders. Additionally, an intended amendment to India’s competition regime could allow for a shift from the traditional asset and turnover thresholds now in place.

The proposed amendment allows the government to determine thresholds using additional criteria including the value of the deal. Similarly, the Personal Data Protection Bill 2019, a compliance heavy regulation, is now proposed to be replaced by an entirely new statute which reduces compliance requirements to make it more conducive for business operation – specifically for the start-up ecosystem.

Market norms

Foreign investors continue to be sceptical of the Indian judicial system. However, the government has consistently taken steps to revamp the court system and allow for easier enforcement of foreign arbitral awards. The cross-border insolvency framework mentioned above is an example of this.

Common mistakes made by investors dealing with the Indian M&A market include: (i) failure to undertake detailed diligence, especially in regulated sectors; and (ii) disengaging advisers at the end of the negotiation stage, thereby exposing investors to closing and post-closing compliance complications.

There is greater involvement of technology in M&A – including the use of artificial intelligence for e-discovery, intelligent data rooms, as well as contract review.

Public M&A

There are two ways for an acquirer to secure control in a publicly listed company in India: triggering either a voluntary or a mandatory tender offer. Under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011, barring certain exemptions, an agreement for the acquisition of 25% or more voting rights or control of a publicly listed company requires the buyer to tender a public offer to further acquire at least an additional 26% of target shares.

Acquirers should also ensure that a minimum public float (prescribed at 25%) is maintained unless the target is delisted pursuant to the transaction. Delisting has proved to be challenging in India and is undertaken through a reverse book-building process to determine offer price, yielding a significant premium. If the discovered price is unacceptable, an acquirer may make a counter-offer that must not be less than the book value (which comes with its own set of challenges).

A recent amendment to the regulations now allows an acquirer to make a combined delisting and takeover offer at a fixed price; this in turn allows for delisting of the target company in an open offer acquisition in addition to increasing the timeline to complete the delisting process among other amendments.

Public takeovers may require mandatory regulatory approvals, including those from sector-specific regulators. These regulatory approvals may be conditional or may prescribe additional compliance.

Break fee provisions are at a nascent stage in India. However, the uncertainty caused by the pandemic has resulted in an increased use of such provisions. While the payments of break fee and reverse break fee are largely untested and may impose regulatory hurdles such as a requirement of prior approvals from the RBI and SEBI, recent transactions such as the Sony-Zee deal feature such a provision.

Private M&A

Locked box mechanisms have gained acceptance in recent years. Deferred payment, earn-outs, escrow and other deferred payment structures are gaining popularity considering the market volatility brought about by the pandemic. Of these, earn outs are especially gaining relevance since they incentivise key resources to remain part of the company until the acquirer can establish control and presence in India. Stakeholders should note that such arrangements face additional time and quantum restrictions imposed by the exchange regulators in case of cross-border deals.

Warranty and Indemnity insurance is not very common in India and both enforcement timelines and premiums on insurance coverage are substantially higher than in matured markets. However, due to an increase in cross-border deals, the market for such insurance products is growing rapidly.

Uncertainties regarding protections under India’s tax treaties’ rulings have also led to greater demand for tax warranties insurance.

There is no practice of private takeover in India, as private companies impose restrictions on the transfer of shares, and each instance of the transfer must be approved by the board of directors. In the event the board rejects the transfer of shares, the transferor/transferee may approach the concerned tribunal to appeal against the rejection.

Indian law usually governs private M&A transactions. However, cross-border transaction documents for dispute resolution generally provide for foreign-seated arbitration in Singapore, New York or London.

In 2021, PE exits in India passed $38 billion, setting a record high. There was substantial increase especially in the technology and energy sectors. Sequoia’s exit from 1mg and Softbank’s exit from BigBasket, both acquired by the Tata Group, were a few noteworthy exits.

With 65 mainboard IPOs, the year witnessed a boom in the primary market with several of these having an issue size of over INR20 billion and eight over INR50 billion. IPOs were also largely used as an exit route by PE players such as Sequoia and Blackstone, who exited from Stove Kraft Limited and Sona BLW Precision Forging respectively.

Looking ahead

With the opening of several sectors and investor-friendly reforms brought in to facilitate the ease of doing business in India, we anticipate an increase in the quantum of investments made in the country in the future.

The boom in the public M&A practice is expected to continue with more entities opting to go public in the domestic and foreign markets. Further, greater participation by investors could mean an increase in the volume of average-sized deals.

ESG investments and conducive government policies are expected to result in an increased investment in this space. Other sectors that are likely to see increased investment include electronic systems, healthcare and pharmaceuticals and food processing.

Click here to read all the chapters from the IFLR M&A Report 2022

Harsh Pais

Partner

Trilegal

T: +91 22 4079 1062

Harsh Pais heads Trilegal’s corporate practice and focuses on M&A and private equity. He advises extensively on cross-border acquisitions (involving public and private targets) and joint ventures.

Harsh provides strategic counsel to clients on matters involving change of control transactions, corporate governance, securities laws, troubled joint ventures and crisis management. He is also experienced in providing transactional and regulatory advice to clients in regulated industries, such as financial services, infrastructure, and TMT.

Harsh holds a significant position at FICCI, the apex chamber for commerce and industry in India, as member of its National Committee on Corporate Laws. He has past experience at a major international law firm in New York and is additionally qualified in the UK and New York.

Clarence Anthony

Partner

Trilegal

T: +91 80 4343 4610

E: clarence.anthony@trilegal.com

Clarence Anthony is a corporate partner at Trilegal. He focuses on M&A, joint ventures, and private equity investments. He regularly advises on general corporate advisory matters.

Clarence has led a wide range of complex transactions including cross-border acquisitions and divestures, private equity investments into regulated industries and exits in contentious circumstances. A number of these mandates have been in sectors such as technology, healthcare, financial services, nutrition, and renewable power.

Clarence represents a number of prominent clients including Mensa Brands, Brookfield, KKR/JB Chemicals, Falcon Edge/Alpha Wave, HIG, Mitsui, DEG, Stillfront Group, IBM, Fortinet, Flobiz (Mybillbook), Mitel, and Rossell Techsys. He also headed the legal and compliance function of Embassy Office Parks REIT on secondment from Trilegal.