We live in interesting times. The Philippines is just coming out of two years of economic stasis under one of the most restrictive protocols worldwide during the Covid-19 pandemic. Stymied for so long, Philippine business has a new-found dynamism and is intent at creating businesses and institutions that are sustainable and more resilient to disruptive events such as Covid-19, and M&A is playing a crucial role.

The Philippine economy is also opening up. Long-awaited government initiatives to attract foreign investments are underway and are expected to reinvigorate and even reinforce cross-border deal-making. The local M&A market is peaking.

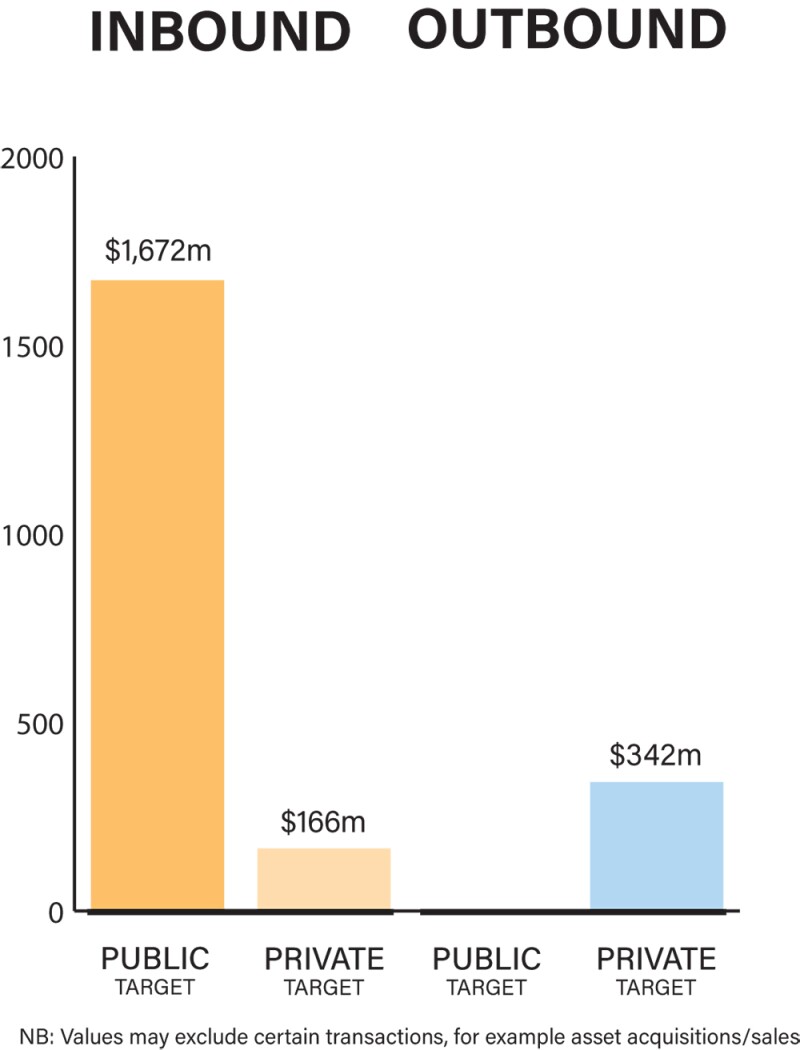

Both private and public companies are driving M&As. Interestingly, however, most of the private outfits that completed the noteworthy M&A transactions in 2021 were either subsidiaries or affiliates of public companies, indicating the size of these transactions required the financial muscle only listed companies have. This signals that more and more companies would need to tap the capital markets, a track that already became apparent since the beginning of 2020.

Capacity building and corporate restructuring were two central themes for M&A transactions in 2021.

In 2021, lawyers of Serrano Law were transaction counsel to publicly-listed companies, SM Investments Corporation (SMIC), the biggest conglomerate in the Philippines, and Chelsea Logistics and Infrastructure Holdings Corp., in SMIC’s acquisition of a controlling stake in, and the corresponding exit by Chelsea from listed 2GO Group, the largest integrated shipping and logistics company in the Philippines, undertaking a mandatory tender offer for a value of up to PHP9.8 billion.

The transaction drew mixed reactions from the market but I saw it as a bold yet strategic divestment by Chelsea amid the pandemic and a synergistic consolidation by SMIC. In another transaction, a Singapore-based private equity fund also bought a significant minority stake in 2GO, bringing their expertise in both shipping and logistics. These transactions ensure that 2GO Group has capacity moving forward to recover from the near absence of business activity during Covid-19.

A regulatory issue concerning the repurposing of a listed leasing company and its proposed sale is pending resolution by regulators. The Securities & Exchange Commission (SEC) suspended the Registration Statement of this listed leasing company saying that it was no longer accurate since it was changing its primary purpose, despite the fact that the company had no ongoing offer of securities and that it had fully and timely disclosed its repurposing and sale. This stand of the SEC has put into question past back-door listing transactions, and the consistency of regulation by the SEC.

The ongoing transaction for a local bank’s acquisition of Citi’s onshore consumer banking business calls attention to the need to harmonise merger review in highly-regulated industries such as the banking sector. A multi-agency accord was recently signed by the Philippine Competition Commission (PCC), the Bangko Sentral ng Pilipinas (BSP) and the SEC, among others, aimed at streamlining processing time of bank M&As. Notably however, the draft rules do not seem to address the need for cooperation on transactions subject of compulsory notification to the PCC.

Economic recovery plans

Private business geared up for the anticipated post-pandemic acquisition opportunities. The Philippine capital market bucked the trend and in terms of value, made the Philippines the second largest initial public offering (IPO) market in Southeast Asia at a point in 2021. Despite the lockdowns and the unprecedented slowdown of the economy, there were milestone IPOs in 2021 and the total capital raised was refreshingly impressive relative to the past decade. Instant noodle producer, Monde Nissin, raised $1.0 billion, making it the Philippine’s biggest equity IPO to date.

Real estate investment trusts (REIT), a much-ignored fund-raising instrument for quite some time, was reconfigured by the government to become more attractive to issuers and investors alike. REITs were repeatedly tapped during the pandemic starting with the Ayala Corporation REIT launched in August 2020. The trend continued in 2021 when four other REITs debuted on the PSE. Philippine businesses wanted to be ready when the economy reopened and a number of companies have built up their war chests.

In an encouraging turn of events, the local M&A sphere was very busy in 2021, even livelier than pre-pandemic levels. Undeniably, however, the drivers for increased deal flow can still be linked to the ongoing pandemic.

Times of crisis can equally be unfortunate but at the same time rife with opportunity. Both publicly-traded companies and private entities completed significant acquisitions in the consumer goods, food chain, logistics and pharmaceutical industries. Following SMIC’s consolidation of control of logistics giant, 2GO Group, another leading business group, Ayala Corporation, through a subsidiary, acquired Air21, another major player in the logistics industry.

In spite of the pandemic, Citi bid out and sold its consumer banking business in the Philippines to Unionbank for a hefty $908 million premium.

There is consensus that M&A deal flow will continue to be strong in the next 12 months.

After keeping investors’ wallets sealed for so long and banks’ non-performing loans (NPLs) surprisingly turning out not as catastrophic as feared, there is an availability of capital and financing for acquisitions. This manageable rise in NPLs means that banks are more capable of restarting their lending activities, as seen by the steady increase in the banking system’s loan growth in the latter part of 2021. Banks will also have the potential to reverse the billions in provisions booked in 2020 and 2021, which will boost their capital position and allow them to lend more, particularly to potential M&As.

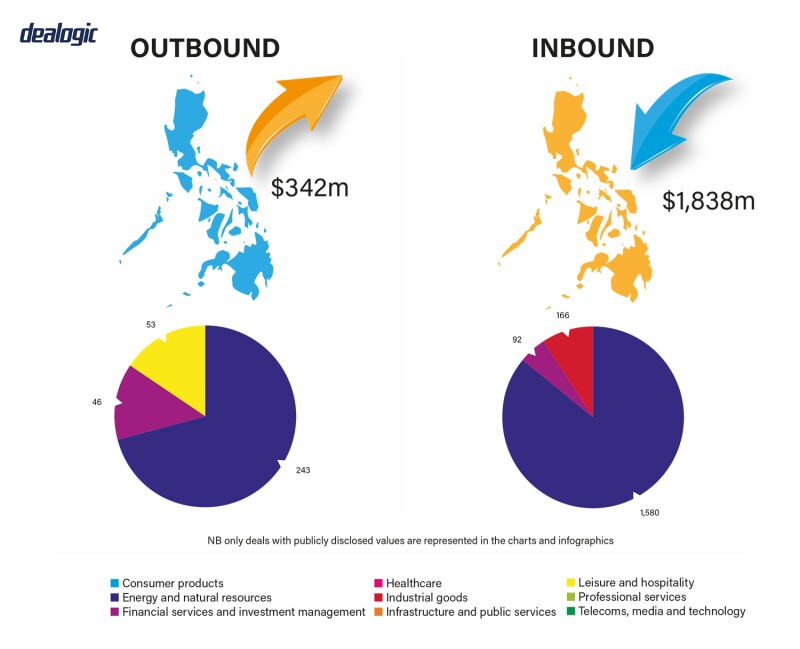

The increased deal flow can also be attributed from a valuation perspective to the fact that many companies listed on the Philippine Stock Exchange (PSE) are now trading below book value, making these shares attractive for acquisition. With the prolonged economic stagnation, the book values of private companies have likewise plummeted to historic lows. Opportunities for a good buy in the Philippine market abound and are compelling, as is shown by the increasing inbound M&A pattern in the past year.

Another major driver for the increase in M&As is the legislated two-year exemption from merger review by the PCC under the Bayanihan to Recover as One Act (BARO). The law exempted deals below $1 billion from PCC review to promote capacity building amid the pandemic, increasing review threshold from a meager $48 million pre-pandemic.

|

|

“Legislation is in place to support M&A in the Philippines, particularly foreign investments” |

|

|

This was welcomed by the business sector after a long clamor for the increase to avoid unnecessary transaction delays and regulatory costs. On the other side, the PCC has expressed reservations on the wisdom of this exemption and issued reminders to the business community to carefully review its applicability to their own transactions.

Industry consolidation more than a trend, became a necessity. In the banking sector, among the industries hit by the pandemic, the BSP announced last year that it is reviewing four bank mergers, which include the merger of two government-owned banks and the merger of two publicly-listed banks with their respective affiliates. This allowed excess capital to be integrated into the parent banks.

Several publicly-listed companies also announced share-swap transactions, allowing the entry of new investors, cash infusion and property contribution to these companies without any retail capital raising activities which are subject of more rigorous registration requirements with the SEC.

Looking at the 2021 completed M&A transactions, the pandemic has had a sobering effect on business. The reversals brought about by the pandemic and the corresponding restrictions have created an impetus for consolidation in specific sectors. Medium-sized or family-owned companies are also selling out, partnering up or merging with bigger outfits to ensure recovery, growth or even survival.

An increase in distressed M&As and reorganisations continue. Players that have financed acquisitions with borrowings had to restructure their loans and sell the businesses they had acquired in order to pay down those loans.

The uncertainty created by the pandemic forced many leveraged business owners to make tough decisions and dispose of some of their non-core investments. This trend created complex transactions where lenders under separate loan agreements are agreeing to share on the assets acquired by their common borrower, restructure loans, share collateral and accept equity-linked securities. Joint ventures where capitalists will be allowed entry into what were previously controlled investments and operating companies to manage liability profiles.

Global private equity funds not previously operating in the Philippines have made significant forays likely capitalising on the prevailing investment-advantageous conditions. A Singapore-based fund invested in the Philippine logistics sector and is now sharing its expertise to grow that company’s market and modernise its operations.

A US-based investment company deployed an estimated $500 million in energy, telecommunications, technology, hospitals and healthcare and is now committed to increase its exposure in the Philippines several times over. Another Singapore-based fund has been given approval to operate one of six digital bank licenses granted by the BSP.

Legislation and policy changes

M&A transactions in the Philippines are primarily governed by the Revised Corporation Code, the Securities Regulation Code and recently, the Philippine Competition Act. The implementing bodies of these laws are the SEC and the PCC. In certain highly-regulated industries, approval of primary regulators such as the BSP, the Insurance Commission, Maritime Industry Authority and the Energy Regulatory Commission are required prior to completion of M&A transactions. In apparent acknowledgement that this multi-layered and multi-agency approval process in the Philippines may delay transactions, these agencies are currently entering into inter-agency agreements to streamline M&As.

It is also crucial that the legislative and government policy landscape is ideal for M&A. Our lawmakers have been proactive and creative. Legislation is in place to support M&A in the Philippines, particularly foreign investments. The recently enacted Republic Act No. 11647 known as an ‘Act Promoting Foreign Investments’ introduced amendments to the Foreign Investments Act of 1991, easing restrictions, reducing capital requirements and allowing 100% foreign ownership in start-ups.

Moreover, since the two-year exemption under BARO ends September 2022, more M&As are anticipated in the coming months.

The revamp of the Philippine National Internal Revenue Code, or the Comprehensive Tax Reform Program (CTRP), initiated by Republic Act No. 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN), continues, making the Philippines more attractive to foreign investors. The Corporate Recovery and Tax Incentives for Enterprises (CREATE), while increasing certain transactional taxes for the acquisition of shares, reduced corporate income tax from 30% to 25% retroactive to July 2020, making the Philippines more competitive with its neighbours. This rationalisation and reduction in taxation, it is hoped, will make the Philippines a preferred destination for investments and generate business activity that will fast-track economic recovery.

Regulatory changes which have direct impact on M&As primarily aimed at protecting the investing public are espoused by regulators. The SEC took the lead and decreed that the disposal of corporate property and assets amounting to at least 51% of the corporation’s total assets shall be considered as sale of all or substantially all of the assets of the company, which by law requires at least two-thirds stockholders’ approval.

The BSP also exposed drafts of a circular on the transfer of significant ownership of banks, the latest version of which regards any acquisition of at least 10% of the voting shares of banks as significant ownership and thus, require prior BSP approval. The PSE is also seeking stricter regulation of reverse takeovers or backdoor listings and has released draft rules which provide for a six-month lock-up of acquired shares, with shares of stockholders owning at least ten percent (10%) locked up for one year from closing. This may more appropriately address the reservations of the SEC on acquisitions and repurposing of listed companies.

The much awaited and closely monitored amendments to the Public Service Act were certified urgent by Congress last February and just signed by the President into law. These amendments make a distinction between a public utility, limited by the Philippine Constitution to 40%-foreign ownership, and a public service. This game-changing legislation allows 100% foreign ownership in capital-intensive and hi-tech dependent industries such as airlines, railways and telecommunications.

Market norms

For a very long time, offshore investors have keenly eyed the Philippines but were limited by constitutional and statutory restrictions on foreign investment, and thus has been the subject of several country studies. There seems to be no significant misconceptions about the Philippine M&A market.

The Philippines still being a protectionist economy, most questions revolve around the allowed foreign ownership rules in certain sectors, their application and interpretation.

Green or blue bonds, or sustainable fund-raising has become the new norm. BDO Unibank, the largest bank in the Philippines, recently, successfully completed in January 2022 the biggest bond offering by a Philippine issuer and the biggest sustainable bond at that, catapulting the Philippines to become the second biggest issuer of sustainable bonds in Southeast Asia. Proceeds from such issuances are limited in use and to be loaned out to companies engaged in sustainable projects and acquisitions. More and more ESG-grounded provisions are now being added to transaction documents to ensure that these limitations are respected by borrowers that avail of this type of financing.

Technology has enabled faster and more efficient completion of M&A transactions, particularly in the area of due diligence, with VDRs and remote management interviews making the process more convenient.

Public M&A

Recently, public M&A continue to be mostly negotiated and consensual contracts for the acquisition of certain shareholders’ stake in listed companies that lead to control. With the required corporate and regulatory approvals, including mandatory tender offers, hostile or competitive bids are rare.

The cornerstone conditions to public takeovers are still the mandatory tender-offer rule and the continuing and comprehensive disclosure rules, geared towards the protection of the investing public, especially minority shareholders. As these are already protective protocols, Covid-19 or related legislation has had little impact.

Break fees in M&A transactions have for quite some time been written into purchase agreements as a deposit payable at signing forefeitable under certain conditions. Of late, the trend in deal-making is to fix the amount of this deposit rather than a percentage of transaction value and to expand the conditions for its forfeiture, closer to simple failure to close.

Private M&A

Use of completions accounts remains to be the preferred pricing practice but recently, parties to M&A transactions are resorting to locked box mechanics for certainty of pricing and ease in obtaining clearances from tax authorities for transfers. Warranty and indemnity insurance still remain mostly unexplored in the Philippines, perhaps because of many factors that add to uncertainty of risk exposure for insurance providers.

Use of foreign law as governing law has started to become infrequent for M&A transactions in the Philippines. However, with increasing globalisation, choice of venue provisions in case of arbitration is seeing resurgence. Regional arbitration centers are conducting frequent campaigns in the Philippines, even to private companies and practitioners in M&A for the use of their mediation services. More and more provisions are needed and are being introduced to address the undeniable global aspects of M&A transactions in the Philippines.

Looking ahead

2022 promises a continuing consolidation course credited to a confluence of drivers which, on their own, are conducive and should invigorate the M&A market. Barring any more unforeseen developments, the M&A market in the Philippine will be vigorous. Capital markets, particularly REITs, and bank financing will be tapped to fund these acquisitions, promising considerable work for practitioners.

Though there is an ardent hope that the Philippine economy will stage a rebound and expand, the environment is still fraught with challenges. Internationally, there is the current tension in Europe and locally, the pivotal 2022 Philippine National elections may, with a new administration, revamp the rules and policies for M&A transactions. Caution is still very much a prevailing spirit but in times like these, fortune favours the bold.

Elmer B Serrano acknowledges and thanks his partners at SERRANO LAW, Tephanie M Gandia and Phil Ivan A Chan, for their contribution to the M&A Report 2022: Philippines.

Click here to read all the chapters from the IFLR M&A Report 2022

Elmer B Serrano

Managing partner

Serrano Law

T: +632 8651 7509

E: elmer.serrano@serranolawph.com

About the author

Elmer B Serrano is the managing partner at Serrano Law. His vast M&A experience spans three decades and includes providing strategic advice and solutions on several of the largest and most notable M&A across a wide range of industries.

Elmer was awarded ‘Asia Best Lawyer’ by IFLR for banking and finance, capital markets, M&A, one of only two exclusively recognised lawyers in the Philippines. This comes after being consistently recognised as a ‘highly regarded leading lawyer’ in the same fields by IFLR 1000.

Elmer holds a Juris Doctor degree and a BS Legal Management degree from Ateneo de Manila University. He is a Certified Associate Treasury Professional and was among the top graduates of the Trust Institute of the Philippines in 2001.

Phil Ivan A Chan

Partner

Serrano Law

T: +632 8651 7409

E: philivan.chan@serranolawph.com

Phil Ivan A Chan is a partner at Serrano Law. He has extensive experience in M&A, banking, mining and energy law, gaming, immigration, real estate, insurance, and corporate restructuring projects.

Phil has been recognised by the Legal 500 as a ‘Recommended Lawyer’ in antitrust and competition and immigration.

Phil graduated with a Juris Doctor degree and a BS Legal Management degree from Ateneo de Manila University.

Tephanie M Gandia

Partner

Serrano Law

T: +632-8651-7409

E: tephanie.gandia@serranolawph.com

Tephanie M Gandia is a partner at Serrano Law. She specialises in corporate law.

In 2021, Tephanie was awarded ‘Asia Future Leader’ by IFLR, the first and only one recognised from the Philippines. She is also consistently recognised as a ‘Rising Star’ in M&A, Banking and Finance and Capital Markets by IFLR 1000. The Legal 500 also ranked Tephanie as a Rising Star in corporate and M&A and a Recommended Lawyer in antitrust and competition.

Tephanie holds a Juris Doctor degree from the University of the Philippines. She graduated cum laude for her BA Political Science degree from the same university.