The Swiss M&A market started into 2022 in great shape and with plenty of momentum coming out of an extremely busy 2021. Cross-border transactions picked up across all sectors compared to 2020 with technology, media and telecom (TMT), industrial markets, pharmaceuticals and life sciences as well as consumer markets being particularly active.

The UK came out on top as the most important jurisdiction for both Swiss inbound and outbound transactions in 2021 according to market reports and it will be interesting to see whether that stays the same this year.

The continuing rise of private equity in the Swiss M&A market also remains a hot topic and we expect this to continue in 2022.

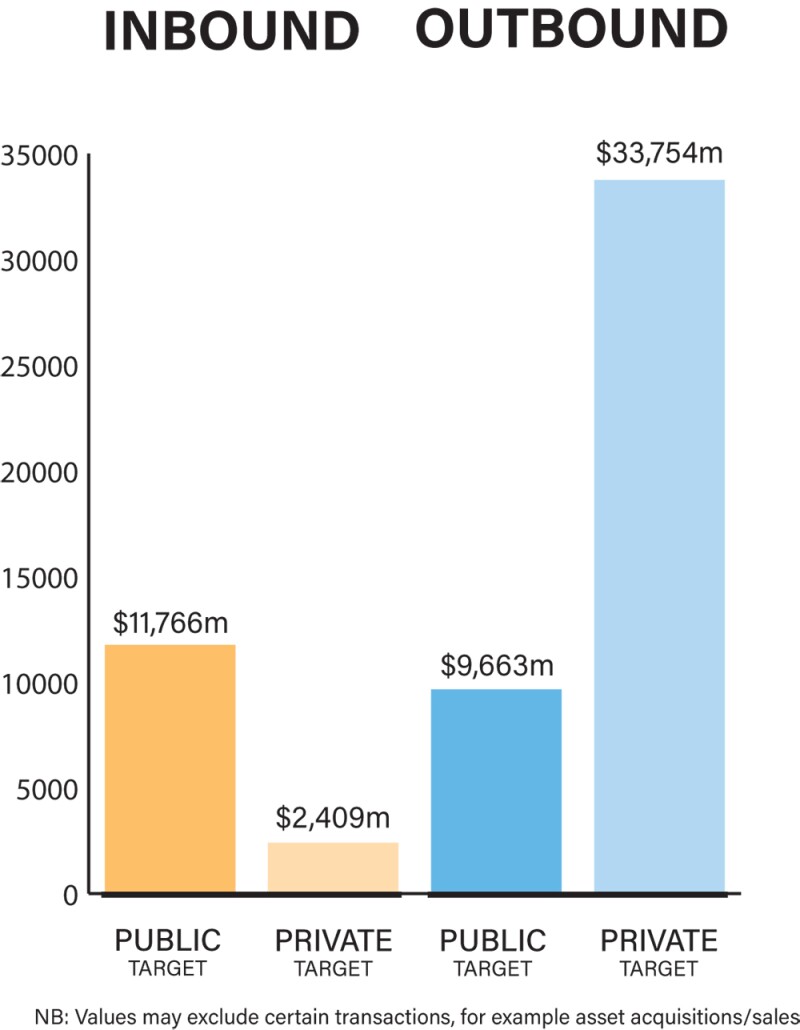

Both private and public transactions play an important role in Switzerland’s currently booming M&A landscape. While most of the record number of deals recorded in 2021 were private transaction, public deals came out on top in terms of deal value, with Novartis’ sale of its stake in Roche, CSL’s takeover of Vifor Pharma and Nestlé’s sale of part of its stake in L’Oréal all being announced towards the end of last year.

Among the largest transactions of 2021 rank Novartis’ sale to Roche of its stake in Roche and the sale by Lonza of its Specialty Ingredients business. Although very different in nature, the two transactions are both reflective of the continuing trend to focus management resources and capital on the core business. Novartis had previously already disposed of its Alcon eye care business through a spin-off while Lonza’s sale follows the disposal of its Water Care business in 2019.

Economy recovery plans

2021 was a strong year for M&A in Switzerland. Low interest rates, attractive financing conditions and economic stimulus packages certainly played their part, as did a backlog of transactions resulting from the pandemic shock in the first half of 2020.

Overall deal numbers even surpassed pre-pandemic levels and reached a record high in Switzerland in 2021 according to market reports. Thus, while the continued impact of Covid-19 certainly took its toll on certain economic sectors and the restrictions had an impact on daily life, M&A deal flow has developed positively in 2021.

|

|

“The effective date of the Swiss corporate law reform has now been set for January 1 2023” |

|

|

Market outlooks were generally optimistic going into 2022, despite continued uncertainty about Covid-19 and related developments and rising interest rates on the horizon. The first quarter of this year seems to have lived up to these positive predictions but it is currently unclear how the war in Ukraine will impact the Swiss M&A market in the 12 months to come and beyond.

Deal-making is expected to continue to be particularly strong in the TMT sector. The phasing-in of new regulations under the Financial Institutions Act (FINIA) may lead to increased M&A in the asset and wealth management sector which so far has seen rather limited deal-making activity in Switzerland.

As illustrated above, the past two years have caused various companies to revisit their strategies and focus resources on their core businesses. This has led to divestments of non-core assets and spin-offs both in private and public transactions which in turn created opportunities not least for financial sponsors. Distressed M&A activity has remained limited to date but this may pick up in the near future as economic stimulus packages come to an end and interest rates rise.

The influence of financial investors on the Swiss M&A environment has been steadily growing in recent years and we expect this trend to continue. Private equity activity in particular contributes substantially to the current Swiss M&A environment. Sponsors are seeking new opportunities to deploy their dry powder and expanding their fields of activity. For example, we are seeing more and more private equity firms partnering up with other investors in Swiss large-cap deals.

Regulatory framework

The applicable legislation and whether a regulatory body is involved at all in an M&A transaction primarily depends on whether the target is a listed company or not. Acquisitions of listed companies are governed by the Financial Market Infrastructure Act (FMIA) and certain ordinances enacted within the FMIA framework. They are subject to a number of mandatory provisions aiming to ensure equal treatment of the shareholders to whom a public takeover offer is addressed. The competent body is the Swiss Takeover Board (TOB). Decisions of the TOB may be appealed to the Swiss Financial Market Supervisory Authority FINMA.

By comparison, private M&A transactions which do not involve a public target are less densely regulated and many of the provisions of the Swiss Code of Obligations that apply to asset or share sales can be (and typically are) excluded in favor of a contractual framework negotiated between the seller and buyer. Statutory mergers are subject to the mostly mandatory provisions of the Swiss Merger Act but are rarely used for direct acquisitions.

Where securities are issued as acquisition currency or to finance an acquisition, the Financial Services Act may require that a prospectus be issued and reviewed by a prospectus reviewing body.

After the first listings of so-called Special Purpose Acquisition Companies (SPACs) were initially expected to occur during the first half of 2021 already, FINMA decided that the regulatory body of the SIX Swiss Exchange had to first enact a formal framework before any SPACs could list on the SIX Swiss Exchange. The reason for this intervention by FINMA was concerns regarding investor protection failing a specific regulation on SPACs. The Directive on the Listing of SPACs entered into force on December 6, 2021, followed by the first SPAC listing shortly thereafter. While SPACs, domestic or abroad, are expected to contribute to M&A activity in Switzerland also, the effect has so far not been very noticeable in the Swiss market.

On January 1 2022, new non-financial reporting requirements and due diligence obligations regarding conflict minerals and child labour were introduced. While these requirements and obligations will only apply to a limited subset of companies active in Switzerland, they reflect the increasing focus in the areas of ESG and corporate social responsibility.

Covid-19 has had a more noticeable impact on M&A in Switzerland than ESG related topics so far. Buyers in particular were more concerned with hedging against any undesired effects of the pandemic, e.g. through warranties addressing Covid-19 matters specifically. However, with the effects of the pandemic slowly abating and ESG becoming more prominent, we are likely to see a lot more focus both in due diligence and negotiations on ESG. Companies that are in the public spotlight in particular will put an increased emphasis on environmental, social and governance aspects in their M&A strategy.

Originally expected to enter into force in the course of 2022 already, the effective date of the Swiss corporate law reform has now been set for January 1 2023. The reform addresses a variety of areas of legislation, from traditional corporate law and the enhancement of shareholder rights to target gender quota for boards of directors and executive management boards and disclosure requirements for companies active in the natural resources industry.

Most of these changes are not immediately relevant for M&A transactions, however, there are certain exceptions such as the required shareholder approval for a delisting of shares which will need to be observed in a take-private transaction. The new capital band, which will replace the current authorised capital, will continue to allow for authority to be given to boards of directors to issue shares without the need for shareholder approval at the time of issuance.

Further, the Federal Council announced in August 2021 that it would put forward a draft bill for a Swiss investment control regime. Currently, Switzerland has very limited restrictions on investments by persons from abroad such as for residential real estate and critical infrastructures. According to the Federal Council’s announcement the investment control will be limited in scope and still very liberal. The legislation will aim to avert possible threats to public security and to prevent significant distortions of competition in the event of takeovers by investors owned by or close to foreign governments.

Market norms

The extent of investment opportunities in Switzerland is often vastly underestimated. While globally Switzerland is still perceived as a financial hub more than anything else, the breadth of innovation goes far beyond the financial services industry and includes in particular the TMT sector.

A generally favourable investment environment and the involvement of leading educational institutions such as the Swiss Federal Institute of Technology (ETH) are some of the key drivers for this. In this context, it is worth noting that Switzerland was repeatedly rated the most innovative economy by the World International Intellectual Property Association (WIPO), leading the current ranking, too.

It is generally recommended to obtain Swiss legal advice early on in the process when engaging in a proposed acquisition of a Swiss target. For example, there is often a need to obtain tax rulings prior to signing a deal, especially if the sellers are Swiss resident individuals. Market norms in the Swiss market also deviate from those prevalent in other jurisdictions, making it advisable for a foreign acquirer to familiarise itself with the Swiss market.

Further, there are certain particularities of Swiss law that should be addressed early. For example, as a buyer there is often significant due diligence work involved with establishing ownership of the selling shareholders, particularly where there is a broad shareholder base, and remedial action may be required.

The importance of technology and the use of machine learning solutions are ever increasing. However, we note that the offerings of providers are often not geared towards the typical deal size and nature of many deals in Switzerland. As the solutions available become more versatile we expect that their use will become the norm.

Public M&A

Whether in a friendly or a (rare) hostile takeover scenario, an offeror’s ultimate goal typically is to control enough voting rights to be able to not only control shareholder resolutions and the composition of the board of directors but to be in a situation where it can squeeze out any remaining minorities.

Swiss law allows for different methods to do so. In a best-case scenario, the offeror controls 98% of the voting rights following a public takeover offer, which allows for a statutory squeeze-out procedure with little risk of litigation. A squeeze-out merger under the Swiss Merger Act is subject to a 90% threshold only but minority shareholders may challenge the adequacy of the consideration. Unfortunately, from an offeror’s point of view, absent very specific circumstances it is not permissible to tie the effectiveness of an offer to the 90% threshold being reached.

Only very limited offer conditions are permissible in mandatory takeover offers. A takeover offer is mandatory if an acquirer of shares exceeds the threshold of one third of the voting rights in the target company (unless the target has ‘opted up’ to a higher threshold, which may be up to 49%, or has opted out from the duty to make a takeover offer altogether).

The conditions that may be attached to a mandatory takeover offer are essentially limited to required regulatory approvals, no judgment or injunction and certain conditions that aim to ensure that the offeror, following the consummation of the offer, can exercise its voting rights in the target.

A voluntary takeover offer may be subject to additional conditions, although we have not seen the scope of conditions change much in the wake of Covid-19. Voluntary offers typically include conditions that aim to ensure that the offeror does not need to consummate the offer if there is a material adverse change at the target.

A voluntary offer may also be subject to a minimum acceptance threshold, although the upper limit is usually around two thirds (which falls short of the 90% required for the squeeze-out merger referred to above). The TOB will typically only accept higher thresholds if the offeror held a substantial stake prior to the launch of the offer already.

Break fees are permissible so long as they are of a compensatory nature. A break fee that appears to be punitive and seeks to restrict shareholders’ freedom to decline an offer and/or accept a potential competing offer may not be enforceable.

Private M&A

The Swiss private M&A market has been a sellers’ market of late, characterised by fierce competition for suitable targets. Consequently, we are seeing not only high valuations but also generally seller-friendly consideration mechanisms. Locked box mechanisms are more frequently used than completion accounts (with the exception of certain industries, such as financial services) and both earn-outs and escrows are currently rather rare. The use of warranty and indemnity insurance (sometimes stapled) with very limited residual liability of the seller is on the rise, although still less prevalent than in other jurisdictions.

As a result of the overall seller-friendly environment, it is currently not uncommon for conditionality to be kept to a minimum in Swiss private M&A transactions. In such cases, share purchase agreements will include closing conditions only with respect to regulatory approvals (if any) and the absence of judgments prohibiting consummation of the transaction.

Switzerland’s M&A market has a strong cross-border component and therefore discussions around foreign governing law and/or jurisdictions are not uncommon when non-Swiss parties are involved. Ultimately, where these discussions land often depends on the parties’ bargaining power in the specific case. In general, however, Swiss governing law and jurisdiction tend to be applied in most transactions with Swiss targets.

The exit environment in Switzerland in 2021 was reflective of an overall busy year for M&A. Trade sales and sales to financial sponsors both played an important part but so did IPOs as confidence returned to the capital markets.

Looking ahead

The outlook for M&A activity in Switzerland in 2022 still remains positive but has certainly become more unpredictable with the recent events in Ukraine and their potential for major geopolitical shifts.

Legal practice will continue to adapt to ever-changing and increasing regulations while embracing mega-trends such as digitalisation. Amid global uncertainties, Switzerland’s stability and favourable legal framework may prove to be crucial for the further development of its M&A market.

Beda Kaufmann

Partner

Advestra

T: +41 58 510 92 87

About the author

Beda Kaufmann is a partner at Advestra. His practice focuses on M&A transactions as well as corporate law (including corporate governance) and general commercial law matters.

Private equity and venture capital firms as well as family offices and other investors retain Beda for his advice on international and domestic private M&A transactions, investments and joint ventures in various industries.

Beda also frequently advises foreign and domestic private and public companies on acquisitions and disposals (including asset deals) and other M&A transactions.

Daniel Raun

Partner

Advestra

T: +41 58 510 92 99

About the author

Daniel Raun is one of the founding partners of Advestra. A specific focus of his work is on advising foreign and domestic private and public companies as well as private equity, venture capital and other investors on acquisitions and disposals, investments, joint ventures and other M&A transactions.

Clients further retain Daniel for his advice on corporate and securities laws, in particular on aspects of disclosure and reporting by companies, investors and members of boards and management.