The 2021 UK M&A market witnessed a resurgence of deal value and volume to pre-pandemic levels and beyond, with a strong seller’s market and extremely competitive deal processes for resilient assets (and even for less obviously attractive assets).

The elevated levels of M&A were driven by renewed optimism underpinned by the success of the vaccine rollout, the low-interest environment, private equity sponsors seeking to deploy significant funds, and strategic divestment and consolidation across the wider market (particularly within the high-tech industrial and infrastructure sectors).

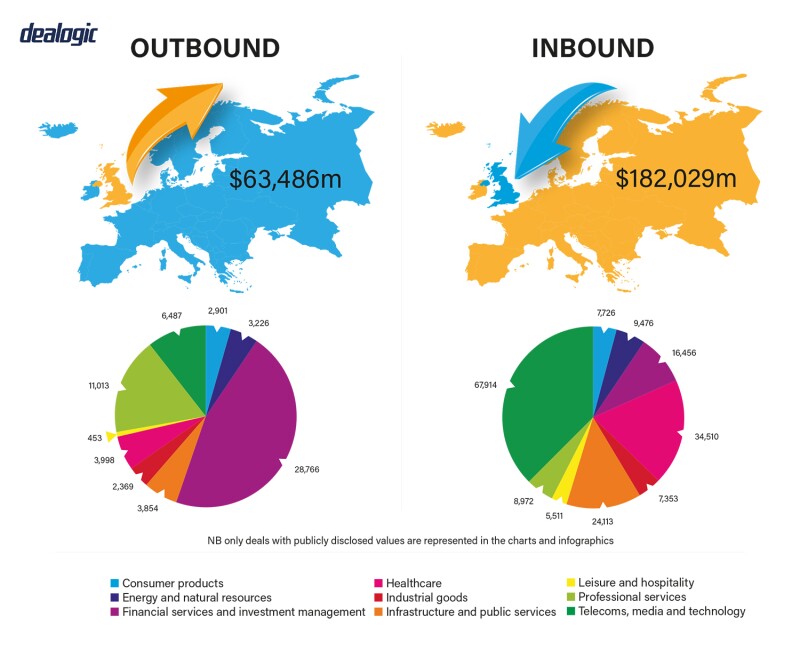

According to Dealogic, deal value rose to $322 billion in 2021 from $281 billion in 2020.

The use of listed special purpose acquisition companies (SPACs) as an exit method and route to the public markets continued in the UK, although investor concerns over sponsor voting and the need to produce ‘fair and reasonable’ statements around conflicts of interest caused dealmakers to reflect on the regulatory and fiscal framework for SPACs in Europe, and the complexities of each deal.

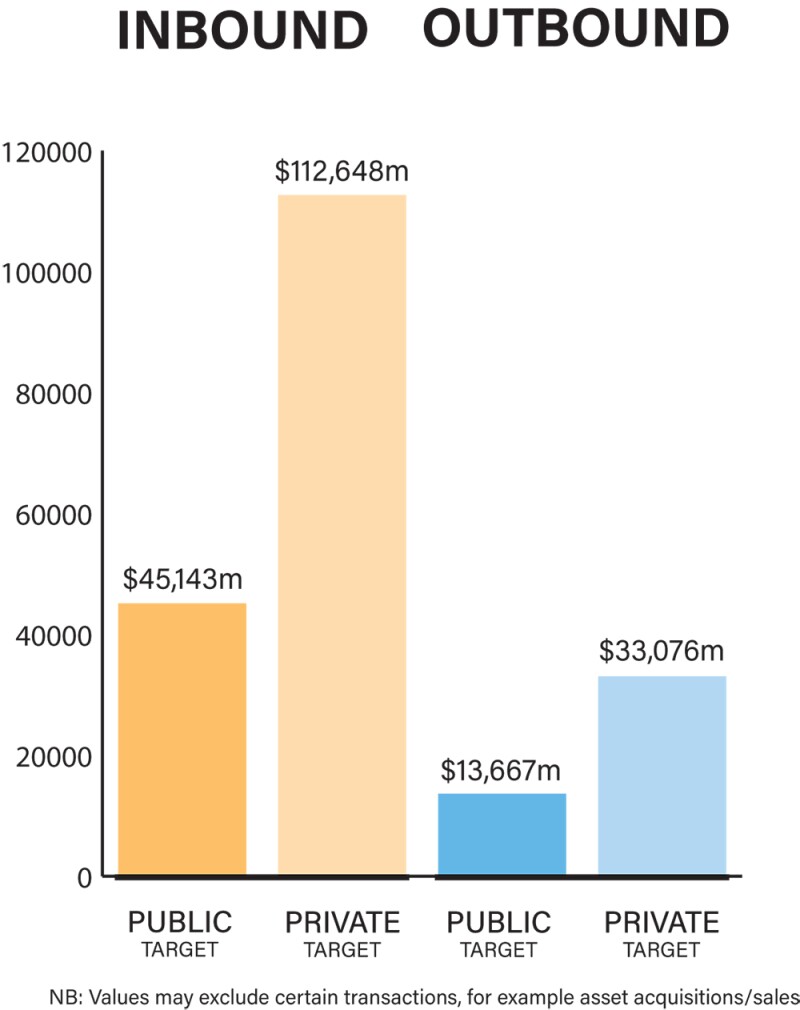

Both public and private M&A transactions play an important part in the UK market, with private M&A deals making up a far higher number of UK target M&A deals. Public takeovers have a prescribed process under the City Code on Takeovers and Mergers (the Takeover Code), as administered by the Panel on Takeovers and Mergers, whereas the structure and process of private acquisitions are a matter of negotiation between the buyer and seller.

Among other notable deals, Latham & Watkins advised on Viasat’s $7.3 billion combination with Inmarsat, a deal that highlights how transformative transactions in critical industries are increasingly recognised as a key mechanism for corporates to achieve innovation and drive customer choice. Latham also advised 888 Holdings plc on its £2.2 billion (approximately $2.96 billion) agreement to acquire the international (non-US) business of William Hill International.

Both these transactions highlight how large-scale M&A deals, particularly for experienced acquirers, remain strategically important as a means to achieve both scale and scope to extend product portfolios but also consolidate market position in an uncertain market.

Economic recovery plans

M&A activity witnessed a strong recovery and unprecedented rise in 2021. The inbound UK M&A deal value in 2021 was nearly double the inbound UK M&A deal value in 2019 before the pandemic (although outbound M&A deal value in 2021 did experience a dip). The real estate, leisure and hospitality sectors all saw a decrease in M&A activity, whereas the technology, retail and healthcare sectors witnessed increasing activity and a more robust performance.

The extent to which the war in Ukraine, the imposition of sanctions and export controls on Russia, and related geopolitical, financial, and commodity volatility will impact the global M&A outlook is hard to predict. Some geographies, sectors, and businesses have seen immediate effects, while for others the implications will become clear in time.

|

|

“The inbound UK M&A deal value in 2021 was nearly double the inbound UK M&A deal value in 2019 before the pandemic” |

|

|

Environmental, social and governance (ESG)-related factors are also increasingly significant drivers for change in M&A, driven initially by investor and consumer demand, and now by legislative developments across multiple jurisdictions. Following the COP26 summit in November 2021, a growing trend towards political action and regulation to combat climate change will, in turn, drive demand for companies that align with key sustainability metrics.

In terms of the impact of Covid-19 on M&A disputes, pandemic-related challenges in certain sectors have led to an increase in insurance and insolvency litigation. Furthermore, the uptick in M&A has led to an increase in shareholder disputes, failed M&A disputes and other transactional litigation.

When comparing deals that signed during the 12 months prior to February 2020 (pre-Covid-19) and deals that signed during the 18 months after February 2020 (post-Covid-19), there has been little change in the prevalence of the majority of key deal terms surveyed in the 2021 Latham & Watkins Private M&A Market Study (the Study).

Notably, suggestions that Covid-19-related uncertainty would encourage increased consideration and inclusion of material adverse change clauses and other buyer-friendly accommodations were not borne out.

Private equity (PE) firms have been very active in the UK M&A market in 2021. The Study found that private equity buyers accounted for 57% of all transactions surveyed. This level of appetite and influence is driven by record levels of cash and buoyed by the relative weakness of the pound sterling.

Increased competition for a limited number of high-quality private sale mandates has led PE funds to look for better value in the public M&A markets. The UK M&A market has also witnessed a significant increase in shareholder activism seeking to secure higher offers for a target company prior to backing a bid. Despite a decline in activity by activist shareholders during the pandemic, activism is expected to play a key participative role, and challenge, to M&A transactions in the next few years.

Legislation and policy changes

The Companies Act 2006 applies to public and private companies registered in the UK. While the Companies Act does not govern M&A activity as such, its requirements dictate how deals by UK companies are implemented.

The acquisition of private companies is a matter of negotiation between the buyer and seller, and no regulated offer process is required. In non-regulated industries (i.e. other than financial services, telecoms, media, pharmaceuticals), deals are not typically subject to input from regulatory bodies, save for competition and foreign direct investment (FDI) matters.

Public acquisitions are governed by the Takeover Code.

The end of the Brexit transition period on December 31 2020 marked the end of the European Commission’s status as the one-stop shop for the review of mergers relating to the UK meeting certain monetary thresholds. This means that if a merger satisfies the jurisdictional thresholds of the EU Merger Regulation and the UK’s Enterprise Act 2002, the Competition and Markets Authority and the European Commission may now conduct parallel assessments of the same merger in their respective jurisdictions.

The UK’s National Security and Investment Act (NSI Act) came into force on January 4 2022, granting powers to the Secretary of State for Business, Energy and Industrial Strategy (BEIS) to screen a broad range of transactions on national security grounds, allowing BEIS to block or impose conditions on deals. Due to its retroactive application, the NSI Act is already impacting deals. Early consideration of NSI Act-related timing implications will likely impact M&A timelines going forward.

The Pensions Regulator gained enhanced powers in 2021. Unlike the NSI Act, the Pension Schemes Act 2021 will not have retrospective effect. However, it expands the circumstances in which the Pensions Regulator can exercise existing moral hazard powers.

The Pension Schemes Act also creates new moral hazard powers that can be exercised against any ‘person’ and includes penalties that encompass criminal sanctions. Given the increasing political and public pressure on the Pensions Regulator, dealmakers should anticipate increased scrutiny of deals that involve a defined benefit pension plan going forward.

The impact of Covid-19 has caused challenges for companies, but overall the lasting impact of Covid-19 on deal terms appears limited. This short-term impact largely mirrors what was seen at the time of the financial crisis in 2007/2008.

ESG issues have become increasingly important for corporates in recent years. A wider range of deal provisions are being considered in light of their potential to enhance the ESG outlook of acquisitions.

While ESG-linked M&A deal terms such as ESG warranties and indemnities have largely remained off the table for auction processes (often due to the compressed timetables imposed on bidders), on suitable deals we have seen early interest in the PE space for ESG-linked terms, such as ratchets to help foster stakeholder alignment on the importance of post-completion ESG enhancements to an acquired business.

Merger control scrutiny is tightening – agencies are scrutinising the suitability of buyers and market dynamics more closely and imposing greater evidentiary burdens on merging parties. Strategic management of merger control from the outset is key to ensure successful deal execution.

Rising regulation of tech innovation is also noteworthy. In the UK, for example, the Financial Conduct Authority (FCA) is pursuing a formal transformation programme and intends to be more assertive. Stakeholders should therefore expect a more interventionist-approach from the regulator prepared to ‘test [its] powers to the limit’.

Market norms

UK companies can be acquired by way of a share purchase (i.e. purchasing all the shares of the target company) or an asset purchase (i.e. purchasing all the assets of the target company) but, as a matter of UK domestic law, M&A transactions between private UK companies cannot be consummated by way of a merger by absorption.

The Companies Act does provide for mergers for UK public companies, but these provisions are generally not used and a scheme of arrangement is more commonly seen. This is in contrast to other jurisdictions where mergers are frequently encountered.

One area that is often overlooked by parties involved in M&A transactions: buyers do not usually attend to consolidation of group companies immediately after closing, resulting in continued administrative and financial burdens (e.g. filing annual accounts) to maintain dormant or inactive subsidiaries.

Dealmakers are increasingly using artificial intelligence technology to conduct more efficient due diligence in M&A transactions.

During the pandemic, dealmakers have made extensive use of virtual meeting technology and electronic signature platforms to negotiate and close transactions, and this trend looks set to continue.

Public M&A

A bidder may choose to stake-build in order to obtain control of a public company. However, depending on the time of such acquisition and form of consideration, stake-building may set a floor price and fix the form of consideration for any future offer. Furthermore, acquiring 30% of the voting rights in a public company will require a bidder to launch a mandatory cash offer for the remainder of the shares it does not own.

In addition, any dealing giving rise to speculation, rumour or an untoward movement in the public company’s share price may mean an announcement is required (if the acquirer is considering making an offer for the whole company), while disclosures will also be necessary once certain thresholds of ownership are crossed.

A takeover offer will usually be subject to an extensive set of conditions, including: securing acceptances carrying more than 50% of the voting rights in the target (or, in the case of a court-sanctioned scheme of arrangement, the requisite 75% target shareholder approval), antitrust and regulatory approvals, the bidder’s shareholder approvals, listing of consideration shares (when applicable), and conditions dealing with the state of the target’s business.

A bid cannot be subject to conditions that depend on the subjective judgement of the bidder. Additionally, seeking to rely on a material adverse effect or similar bidder protective condition to not proceed with an offer requires the consent of the Takeover Panel, which applies a materiality test with a high bar (requiring the circumstances to be of considerable significance and aiming to strike at the heart of the purpose of the transaction) before it will permit an offer to be lapsed.

In public takeover offers, break fees (when the target pays the prospective buyer) are now largely prohibited, whereas reverse break fees (when the prospective buyer pays the target) are not prohibited. Only in limited circumstances can a break fee be offered: for example, a break fee may be offered to a ‘white knight’ making a bid in competition with a hostile offer that has already been announced (subject to such fee being de minimis and payable only upon the first offer becoming or declared wholly unconditional).

If the bidder is a UK public company and subject to the UK Listing Rules, and the total value of the reverse break fee exceeds 1% of the market capitalisation of the bidder, the bidder’s directors will need to treat the reverse break fee as a material transaction (which, among other things, requires shareholder approval). If the bidder controls more than 10% of the target, a reverse break fee may also constitute a related party transaction for the purposes of the UK Listing Rules.

Private M&A

According to the Study, which examined more than 320 deals signed between July 2019 and June 2021, 49% of deals included a locked-box mechanism, 26% of deals included a completion accounts mechanism and 25% of deals did not provide for price adjustment. This trend is consistent with results from the previous four editions and reflects the continuing seller-friendly nature of the UK M&A market.

The proportion of deals analysed that include an earnout has continued to rise in recent years. In the UK, earnouts featured in 13% of deals, compared to 7% in the 2020 edition. This change reflects a growing number of ‘acquihire’ transactions and strong deal volume in sectors that traditionally favour earnouts (including technology and biotech deals).

In private M&A, the conditions to closing that are included in a purchase agreement will vary based on the circumstances of each transaction. Historically, conditionality beyond regulatory and antitrust clearances is uncommon, but the increasing role of regulation in deal making is having an impact.

The prevalence of FDI approval conditions continues to increase, corresponding with the increased number of jurisdictions with FDI regimes, and the high-value, high-profile and strategically significant nature of a number of deals included in the Study: 15% of deals analysed included FDI approval as a condition, up from 11% in the 2020 edition and 10% in the 2019 edition.

Purchase agreements relating to UK companies and assets are typically governed by English law and are subject to the jurisdiction of the English courts. For global transactions, depending on the location of the parties and their advisers, purchase agreements are frequently governed by English law (since it is viewed as stable, impartial and commercial, with a developed litigation infrastructure) but may alternatively be subject to the laws and courts of another jurisdiction, such as New York.

The 2021 exit environment was strong – 2021 witnessed the busiest IPO market since 2014. The market encountered innovative deal structures such as the emergence of SPACs in the UK and direct listings. In some instances, sellers employed dual-track or triple-track exits.

The FCA rule changes that came into effect in 2021 (including the removal of certain barriers that apply to listing through SPACs, permitting a limited form of dual class share structure on the premium segment, and reducing the free float level from 25% to 10%) are expected to further encourage exits.

Looking ahead

From a confident M&A outlook at the start of 2022, to a more uncertain outlook towards the end of Q1 2022 – the war in Ukraine is having a dampening effect on dealmaking. Deals with direct exposure to Russia or Ukraine have largely halted, while elsewhere much depends on the individual circumstances of each deal – some deals remain unaffected, while others are influenced by cautious parties. Transactions are proceeding, albeit with lessened debt financing availability and tightened terms in some cases, but the long term impact of geopolitical, financial, and commodity volatility on the global M&A outlook remains unclear. Notwithstanding recent events, we expect that the market will likely remain ‘seller-friendly’ as sellers continue to seek greater certainty as to a buyer’s financial ability and covenant strength. Further, following the recent changes to UK regulations post-Brexit, acquirers now face greater regulatory burdens when they target UK companies, particularly in sensitive industries. However, with the right level of planning and timely engagement with regulators, dealmakers can continue to successfully execute transactions.

Click here to read all the chapters from the IFLR M&A Report 2022

Nick Cline

Partner

Latham & Watkins

T: +44 20 7710 1087

Nick Cline is an M&A lawyer at Latham & Watkins, with more than 20 years of experience. He focuses on UK and international, cross-border M&A, corporate reorganisations, and joint ventures and is a member of the firm’s executive committee.

Nick has extensive experience advising UK plc and international client boards and legal teams on their most complex M&A matters, as well as advising them on their day-to-day corporate advisory needs. He is ranked by legal publications and rated highly by clients.

Robbie McLaren

Partner

Latham & Watkins

T: +44 20 7710 1880

Robbie McLaren is a partner at Latham & Watkins, and serves as global vice chair of the firm’s healthcare and life sciences industry group and co-chair of the London corporate department.

Robbie’s practice focuses primarily on cross-border M&A, joint ventures and emerging companies. He represents clients who primarily operate in the life sciences, healthcare, and technology industries. He is highly regarded by clients and ranked by legal publications.

Douglas Abernethy

Partner

Latham & Watkins

T: +44 20 7710 4760

Douglas Abernethy represents clients in a range of complex corporate finance and M&A matters, with a particular focus on public takeovers and take-private transactions.

Douglas delivers pragmatic and commercially driven advice on M&A matters to multinational PE firms, financial institutions, and UK-listed companies. He represents clients in connection with significant acquisitions and divestitures involving assets in a diverse range of industries. He also advises financial institutions serving as lenders and advisors to parties on M&A transactions.

Christian Roberts

Associate

Latham & Watkins

T: +44 20 7866 2817

Christian Roberts is an associate in the London office of Latham & Watkins and a member of the firm’s corporate department.

Christian advises clients on M&A, PE, joint ventures, venture capital and general corporate matters. He previously trained at a magic circle law firm