Localised options in a wider market

Are there financial products used in discrete markets or situations that may have a wider appeal?

Leveraged finance debt issuance has fallen off a cliff in 2022, with many market participants not expecting a rebound until sometime in 2023. The factors affecting global markets are well known, and include:

Political/economic factors including the the invasion of Ukraine by Russia, energy availability, soaring inflation, global instability; and

Market factors like widening interest rates, investor concerns over documentation, no large impending 'refinancing wall' forcing borrowers to market.

In the first half of 2022, the leveraged loan market maintained its stability despite interest rate hikes which triggered volatility within credit markets. Loans proved more resilient due to their floating interest rate nature allowing them to hold value. For this reason, issuers turned to floating rate loans rather than fixed rate bonds as their preferred debt instrument in an effort to attract investors. However, the focus of investors has broadened outside that of rising rates as they grow wary of potential defaults as the global economy continue to contract. For now, default rates are still below historical averages and a huge default wave is not expected in the short term given the mass refinancing done by companies in 2021 when borrowing conditions were optimal. Another potential threat to the leveraged loan market however may be posed by a possible decline in demand from collateralised loan obligations (CLOs) in the event of a mass downgrade of borrower credit ratings.

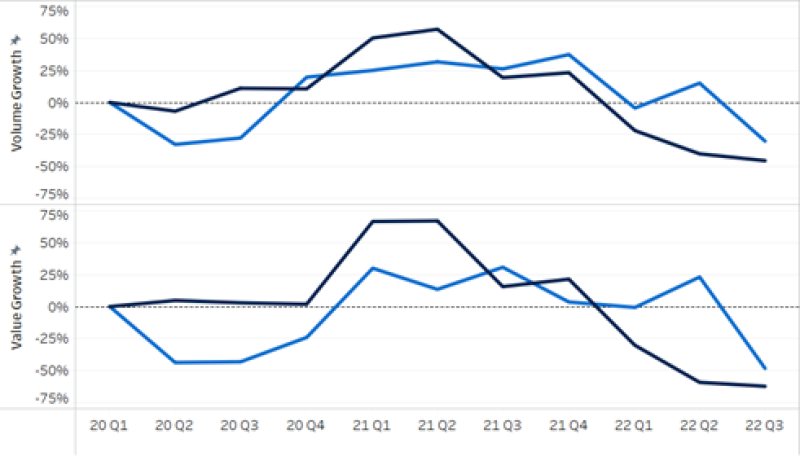

The graphs below show volume and value growth in the leveraged debt markets in 2021 and 2022:

Source: Refinitiv

Many were surprised that the international financial markets substantially played through the recent Covid-19 pandemic (other than in sectors like travel and leisure, retail, etc.), and in some cases even excelled in the locked down environment. Current market dynamics, though, are likened more to the 2008 financial crisis, and are hitting – with different impacts – across all sectors, industries and financial products.

This article gives a snapshot of the current state of the primary debt financial products (bank debt, high yield (HY) bonds and direct lending) with international appeal in the leveraged or acquisition finance context, then considers alternate products that:

Are available only in discrete (or local markets), such as the Schuldschein in Germany, Nordic Bonds in that region, the Sukuk in MENA and, particularly in more recently emerged markets like the CEE and CIS, local-bank-led credit facilities; or

Are seen (not always accurately) as being used only in specific circumstances or having complexity as a barrier to entry, such as securitisations, lombard loans, sale/leasebacks, real estate finance and ABLs/RBLs/CLOs.

Could any of these local or discrete financial products have a broader appeal across new industries and jurisdictions?

Global leveraged finance first choices – Bank/bond/direct lending

The primary sources of leveraged finance debt financing have evolved significantly over the last several years with the global emergence of the Term Loan B and movement of the direct lending market from discrete mid- and low-cap opportunities to a viable alternative for large cap deals (representing in some cases a substantial majority of the funds required to complete an M&A or private equity transaction).

The following table gives high-level consideration to these products and some of their key current market features.

Bonds | Loans | Direct Lending | |

Key points | Yield and call protection | Floating rate pricing | Highest pricing. More hands-on lenders. May include additional lender requirements. |

Governing law | New York law (high yield bonds) Minority – English law | England and Wales | England & Wales |

Quantum | >$300 million | All | Historically <$500 million but now jumbo deals for certain credits. |

Interest | Fixed (generally) or floating | Floating | Floating |

Trading | Publicly traded, listed | Generally not listed | Not listed |

Covenants | Incurrence | Maintenance and/or Incurrence | Maintenance and/or Incurrence |

Lender base | Largest (international institutional investors) | Average (Syndicate of banks) | Smallest (private lenders) |

Call protection | Non-call half-life (make-whole) | Generally no but soft call | No |

Process length | Longest (2-3 months) | Average (1-2 months) | Fastest (1 month) |

Execution | Requires capital markets window | Private (no window needed, although may be dependent on markets for pricing) | Private (no window needed, generally always available, although may be onerous) |

Documentation | Offering memorandum – extensive disclosure | Loan agreement (private) | |

Financials | Disclosure requires financials and auditor involvement (comfort letters) | Not required other than in connection with limited DD | |

Due diligence | 10b-5 standard due diligence | Limited | |

Amendment/ consent process | Most complex - Majority holders (90% for money terms). Requires consent solicitation process. | Average – consent required from several lenders (smaller group than bonds). Majority/ super- majority thresholds | Easiest – consent required from lender (or lender group) which is a smaller pool |

Transferability | Yes – publicly traded | More limited (privately held) | Most limited |

ESG | Can be green bond (use of proceeds) and/or sustainability-linked (interest/redemption ratchet/premiums) | ||

Information undertakings | Requires least frequent/onerous reporting. Annual & quarterly reports (sometimes only semi-annual) | More frequent reporting (annual, quarterly and monthly). Historically requires budget and other additional reporting | More frequent reporting (annual, quarterly and monthly). Historically requires budget and other additional reporting |

Other choices

Jurisdictional alternatives

Aside from the globally available choices described above, many countries or regions have developed and implemented unique debt products. Reasons include:

Political or religious protocols that require unique elements;

Preference of certain investors for local law alternatives;

Market knowledge or practice that permit lenders/investors to offer better pricing, terms or ease of execution;

Liability considerations;

Funds needed in local currency; and

Local market participants developing unique products.

Select jurisdiction-specific credit pools:

Schuldschein | Typical quantum between €20-500 million and maturity of 3-10 years. Private placement (deed-based financial instrument) – bilateral loan agreement which is exempted from any complex MiFID II regulation and does not require any securities prospectus. Low documentation obligations with easy and streamlined execution. Generally unsecured and less restrictive regarding covenants. Germany law governed. |

Nordic bonds | Typical quantum between $10-100 million and maturity of 3-5 years. Limited disclosure and due diligence. Terms are generally more restrictive than HY bonds (including maintenance covenants). |

Sukuks | Commonly referred to as an ‘Islamic bond’. Represent pro-rata ownership rights to the underlying assets (i.e., those funded by the proceeds). There is no fixed/floating rate interest, return depends on the underlying asset. Require a disclosure document (prospectus). Governing law depends on jurisdiction where issuer is incorporated. |

Local market options | Typical quantum between US$10-100 million and maturity of 3-5 years. No disclosure and limited due diligence. Used to raise local financing for working capital or local projects. Generally in local currency. Terms are generally more restrictive than HY bonds (including maintenance covenants). |

These local sources of debt financing allow corporates to tap into a complimentary (and often separate) investor base as a source of capital as opposed to the global international capital markets.

For larger M&A transactions the investor/lender base may prove insufficient, but they often provide a viable alternative for ongoing requirements for working capital or smaller M&A. Generally, these local financing options broadly provide for more streamlined and less onerous processes, although this may come at the cost of more onerous ongoing obligations or tighter covenants/restrictions.

Specialist alternatives

In addition to regional products, another place to look for additional financing alternatives is products that are used in specific fact circumstances, to see if those products can be expanded into other areas. Considerations include:

Typically require certain specific asset classes as security;

Need for assets, borrowers/issuers/guarantors to support other debt simultaneously; and

Existing debt profile permission.

Securitisations | Typically a two-part process: Company identifies and pools assets into a portfolio, which it sells to a special purpose vehicle (SPV), typically off-balance sheet, generating cash for the company; and The SPV funds the acquisition by issuing securities to third-party investors, who receive interest payments funded by the cash flows generated by the portfolio. A small but growing portion of the securitisation market incorporates ESG features (e.g. the assets sold to SPV meet ESG criteria, or the funds generated by the securitisation will be used for ESG purposes). While yet to feature significantly in emerging markets, securitisation is a popular option in the US, Europe and Asia. In the European context, the first quarter of 2022 showed an increase in securitisation issuance to €64.3 billion, an increase (+31.6%) compared to Q1/2021 as well as an increase vs. comparable periods in non-Covid affected years. The US recorded over US$950 billion in the same time period. |

Sale/leasebacks | Two-part process in which a company converts non-cash assets into working capital, while maintaining full operational control over the assets: Company sells assets to an investor for cash; and Company enters into a long-term lease with the new owner. Popular asset classes for sale and leaseback transactions include real estate, aerospace and shipping. |

Real estate finance | General finance term used to describe transactions where lenders provide loans backed by real estate assets to either (a) fund the purchase of revenue-generating business property or (b) to generate cash income streams (e.g., rentals) through investment. Projected cash flows and LTV (loan to value) are key metrics (for borrowing and ongoing maintenance, liquidity measure and ability to pay back the borrowing. |

Lombard loans | A loan granted by a bank or private credit provider secured by a portfolio of securities (often held with the same credit provider). Borrower retains voting / other rights in respect of the securities. Collateral may be sold (or more collateral demanded) if it declines in value. |

ABLs/RBLs/CLOs | Many sophisticated finance products share similar constructs based on the value of, and access to, underlying assets. Key examples include: ABLs: asset-backed loans backed by pools of assets, or collateralised by the cash flows from a specified pool of underlying assets. RBLs: reserved based loans made against an oil and gas field or a pool of oil and gas assets. MBLs: mortgage-backed loans and ABLs backed by principal and interest payments on a portfolio of mortgage loans. CDOs/CLOs: collateralised debt/loan obligations backed by a pool of securities or leveraged loans. These differ from other types of securisations in raising funds for the special purpose vehicle which exists to acquire and sell debts in the secondary market (with a fund that manages that SPV hoping to benefit from performance fees and other incentives relating to such investments). |

Conclusion

Market participants are always looking to develop and refine new financial alternatives for debt lending. Products typically develop and achieve market acceptance over time, and then adapt to changing market dynamics.

Multiple factors determine which financial product is used in a particular situation, from objective criteria such as pricing and maturity to more subjective criteria such as product familiarity and industry precedent.

The products described above provide a snapshot of debt financing alternatives that may be available to access both in traditional forums and also potential new uses. On one hand, modifying an existing product to fit a situation would seem like an easier undertaking than starting from scratch. On the other hand, protocols for many of these products are well established, and may be difficult to recut to satisfy a new product, jurisdiction or industry need or educate a new audience. In any event, it's an idea worth considering.