Ever since the emergence of financial technology and distributed ledger technology, how companies can obtain external funding to finance their business has evolved significantly. Security token offerings (STOs), being one method, is currently at the forefront of the fundraising discussion and has gained serious momentum in recent years.

Hong Kong STO landscape

The asset tokenisation industry has moved more into the mainstream as corporations recognise the increased market potential and demand. In 2023, the global tokenisation market reached $2.87 billion and is expected to reach $6.89 billion in 2027. The US, Germany and Switzerland lead in terms of STOs launched and are capitalising on this promising fundraising market.

Noting the success of cryptocurrencies such as Bitcoin and Ethereum, as well as the rise of cryptocurrency exchanges, Hong Kong has begun to position itself to benefit from this next important wave of capital investments and market opportunity. Notably, the Securities and Futures Commission of Hong Kong (SFC) published the “Statement on Security Token Offerings” in March 2019 (STO Statement), which not only discussed relevant requirements for conducting STOs, but also symbolised the welcoming attitude of the SFC towards STOs and virtual assets in general.

The Hong Kong Government is also committed to building and promoting a sustainable fintech landscape. In October 2022, Hong Kong’s Fintech Week 2022 commenced with the Financial Services and the Treasury Bureau of Hong Kong releasing a policy statement covering the Government’s plans for developing virtual assets. This included a discussion on its vision, approach, new virtual assets service provider regime, green bond tokenisation and retail access to cryptocurrencies. In Hong Kong’s 2023-24 Budget, the Government has committed to allocating HK$50 million to expedite Hong Kong’s Web3 ecosystem development, in particular, to devise appropriate policies and provide a sustainable environment for promoting virtual assets.

More specifically, the SFC has launched a new licensing regime (VATP Regime) for virtual asset trading platforms (VATPs) which became effective in June 2023. The regime is a licence framework for VATPs and looks to harness investors’ confidence. The SFC follows the principle of “same business, same risks, same rules” and aims to provide robust investor protection and manage key risks.

What is an STO?

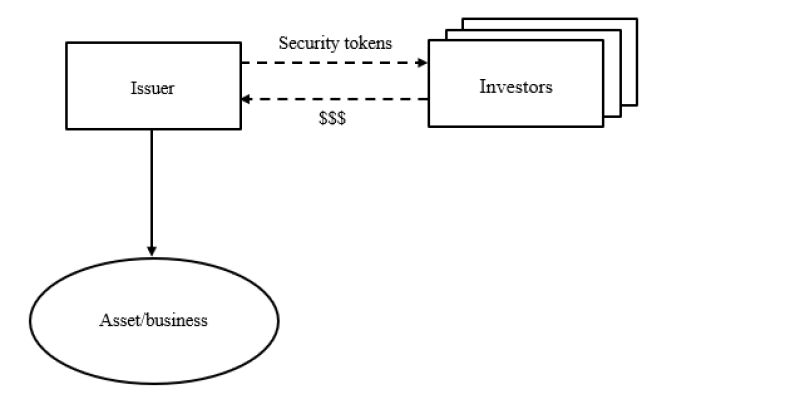

STO is a fundraising method involving the offering of security tokens to investors. A security token is referred to in the STO Statement as a “digital representation of ownership of assets (e.g. gold or real estate) or economic rights (e.g. a share of profits or revenue) utilising blockchain technology”. A security token holder is typically entitled to rights similar to those of a traditional security, for example a bond token holder may receive coupon and principal payments. The issuance and subsequent transactions are recorded and cryptographically secured on a distributed ledger.

A simplified transaction structure of a STO is illustrated below:

From the above transaction structure, we have the following general observations:

For Hong Kong offering purposes, STOs would normally be subject to securities laws and regulations, particularly the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) (SFO) due to the “security” nature of the tokens;

Historically, the issuer will look into ways to avoid regulatory scrutiny (e.g. classifying the token as a non-security token) in order to reduce compliance costs. However, this attitude has begun to change, especially in view of the LUNA/Terra debacle and the FTX collapse; and

STOs provide the opportunity for real world asset (RWA) tokenisation. But one should note the reminder published by the SFC in June 2022, where non-fungible tokens (NFTs) which cross the boundary between a collectible and a financial asset (such as fractionalised or fungible NFTs structured in a form like “securities”, or in particular, interests in a “collective investment scheme” (as defined in the SFO)) would nevertheless be subject to regulatory scrutiny.

Advantages and challenges of STOs

Advantages

Fractionalisation of RWA and enhancement of marketability and liquidity

Traditionally, assets such as real estate, art and intellectual property rights cannot be easily divided and transferred and are perceived as illiquid assets. These assets are less readily monetised in the capital markets. With the introduction of STOs, ownership of such assets is fractionalised into small, tradable portions in the form of a security token which in turn creates more investment options for investors, increasing the level of market activity and liquidity of such assets. The security tokens can also be traded and settled in an instantaneous and around-the-clock virtual asset market, thereby further unlocking the liquidity of such assets.

Transparency, accountability and cost effectiveness

Compared to traditional investment, STOs could provide greater transparency and accountability in the investment process. Security tokens are generally created on a blockchain platform, trading of such would leave an unalterable and transparent record of ownership and transactions. Investors are therefore able to track their ownership interests in real time and develop a comprehensive understanding of the performance of their investment. With the automatic recording and automation of transactions via the use of smart contracts, investors could enjoy greater certainty and accountability of transactions. As the Web3 ecosystem develops and Web2 finance becomes more decentralised, transactions including STOs will become more cost-effective resulting from less involvement of intermediaries.

Challenges

Uncertainty and inconsistency of compliance requirements

The regulations governing STOs vary by jurisdiction due to different levels of regulatory development. This can affect the compliance requirements for STOs, as issuers, investors and intermediaries will need to adhere to different sets of laws and regulations, depending on the geographical location of the underlying asset or business. Furthermore, as security tokens are usually traded across borders, stakeholders may face obstacles in complying with different regulatory regimes. For instance, China has near-banned STOs and similar token offerings while Japan has amended and adapted its securities legislation to regulate STOs.

Further, the compliance requirements for STOs can differ based on the type of asset being tokenised. Tokenising intangible assets such as stocks, bonds or intellectual property may invoke separate sets of compliance rules and require different underlying structures when compared to tokenising a tangible asset such as property or artwork. Requirements for STOs further vary depending on the type of investors involved. For example, STOs in Hong Kong should comply with applicable securities laws, and security tokens can only be offered to “professional investors” as defined in the SFO.

Regulations on anti-money laundering

Owing to the anonymous nature of virtual asset ownership, heightened risks of money laundering and other illegal activities associated with STOs are a major concern. Since existing regulations of some jurisdictions may not necessarily mandate an anti-money laundering and counter-financing of terrorism (AML/CFT) and know-your-client (KYC) process for initial purchasers and subsequent traders of security tokens, it becomes difficult for trading platforms and brokers to conduct comprehensive AML/CFT and KYC checks.

Additionally, due to the anonymous and speedy nature of security tokens trading, digital tracing of security tokens could be far more complex than reviewing cash transactions. As STO investments can be funded by unnamed payment methods such as cryptocurrencies or prepaid debit cards, identifying the parties involved and tracking the flow of funds would become more challenging, and perpetrators may move illicit funds across borders and conceal the source of their funds. Supervising virtual asset trading would call for much effort in enhancing and designing the regulations on AML/CFT requirements.

Opportunities for issuers, investors and intermediaries

Regulatory dividend

Prior to the introduction of STOs, the market, especially in the US, relied on initial coin offerings (ICOs) for a swift and easy way of fundraising via virtual assets. However, the inadvertent breaches of legal and regulatory obligations of many ICO structures and cases of fraudulent ICOs had generally deterred investments in virtual assets since the ICO bubble collapsed in early 2018.

Nevertheless, the “securities” nature of STOs brings it within the purview of existing securities legal frameworks of many jurisdictions, including Hong Kong, where regulators can scrutinise the STO process in a more systematic manner. Different jurisdictions are also devoting more effort into adapting and updating their regulations on STOs to bring greater certainty to the market.

In Hong Kong, following the amendments to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615 of the Laws of Hong Kong), the new VATP Regime stipulates the regulatory requirements of virtual assets trading on exchange platforms. VATPs, are now required to be licensed and comply with additional governance, disclosure, AML/CFT and onboarding requirements. VATPs should also obtain relevant SFC licences (Types 1 and 7) to carry out security token trading activities. Consequently, fundraising by conducting legally compliant STOs in Hong Kong would now be exempted from the uneasiness of being caught illegal as ICOs, and efforts could now be more concentrated on fulfilling the requirements as officially and clearly publicised. Issuers would accordingly enjoy a “regulatory dividend” by legitimatising its STOs.

Hong Kong’s and other international initiatives to regulate STOs are expected to offer stronger protection for all stakeholders and promote confidence among investors.

Capturing investment needs of high-net-worth and institutional investors

With higher risk tolerance, high-net-worth (HNW) individuals and professional investors are more willing to invest in innovative technologies and emerging asset classes. STOs match the demand of these HNW investors. Indeed, these HNW and institutional investors often easily fall within the definition of “professional investors” under the SFO.

As a leading global financial hub, Hong Kong has always been the ideal investment destination for HNW individuals. Hong Kong’s recent VATP licensing regime combined with its dedication to develop Web3 have further attracted many global financial technology and blockchain firms to set up their offices in the region. With these features, Hong Kong offers an excellent environment for STOs. Issuers can design more bespoke STOs, exploit Hong Kong's business-friendly tax regime and regulatory framework, and fully leverage on the unsatisfied demands of HNW and professional investors. This can allow issuers to tap into a new source of capital funding and increase exposure of their brand and business among the HNW investors.

Broadened fundraising and investment options

By enabling fractional ownership of assets, STOs provide issuers with an alternative to raise capital, as they can now divide and offer ownership of assets to such a degree that was previously difficult to achieve. Such flexible division also allows issuers to offer only part of their assets to raise funds from various parties while keeping most of the interest in that asset.

For investors, the range of assets available for investment is significantly widened as assets such as collectible, intellectual property and real estate would become more readily tradable. The capital threshold of investing in valuable assets is also lowered as such assets are split into smaller and affordable portions. Investors can limit their investment risks by acquiring the portion of ownership based on their own risk tolerance levels through purchasing the corresponding amount of tokens. Accordingly, STOs provide great flexibility for investors to diversify their investment portfolio and adopt different investment strategies.

Our services

Our team is experienced in acting on a full spectrum of security offering structures. With our extensive knowledge in traditional equity and debt capital markets and thorough understanding of the unique issues relating to financial technology and virtual assets, we are competent at advising clients throughout the entire process of an STO.

We can assist in establishing the necessary legal structure for conducting an STO, advise on the major legal and regulatory issues and prepare the relevant legal and transaction documents. We also advise on related issues including preliminary cross-border restructuring, licence applications and asset tracing.

We look forward to the continuous evolution of the STO landscape and the exciting market opportunities that lie ahead.