Market overview

With uncertainty around economic growth and the threat of recession, 2022 and 2023 year to date (YTD) has proven one of the most challenging periods for the leveraged finance market since the 2008 financial crisis.

Supply and geopolitical shocks in the aftermath of Russia’s invasion of Ukraine, rising interest rates, inflation, and energy and fuel price hikes have offset central banks’ monetary policy tightening. Furthermore, the failure of three US banks and the global bank Credit Suisse caused additional stress to the financial markets during this period and led to a material rise in risk premiums and volatility.

Some optimism creeped back to the UK in June, as inflation fell to 7.9% amid a sharp drop in fuel prices, and again in September, when rates fell to 6.7%, easing forecasts of Bank of England interest rates hikes ahead. However, despite UK inflation dropping to its lowest level in more than a year, it remains the highest among the G7 group of advanced economies and more than three times higher than the Bank of England's official 2% target.

Secondary markets were significantly hit throughout 2022 and 2023 YTD, leaving borrowers and investors facing higher debt pricing, while primary issuances had to accommodate issue discounts and overall higher yields to maturity than seen in the past few years.

As new issuance volumes were significantly lower, many borrowers turned to refinancings and ‘amend and extend’ solutions, while others preferred alternative sources of funding, including private sources of capital, stepping away from the broadly syndicated institutional market. Term loan A financings also resurfaced as a source of capital and a way for lenders to alleviate risk and uncertainty given current macroeconomic pressures, while product mix between high-yield and term loan B borrowings remained in line with past trends.

In 2022 and 2023 YTD, large declines in debt issuances and shifts across structures have led to slightly higher defaults, but despite the financial strain due to macroeconomic headwinds and rapidly increasing interest rates, default rates have not risen dramatically.

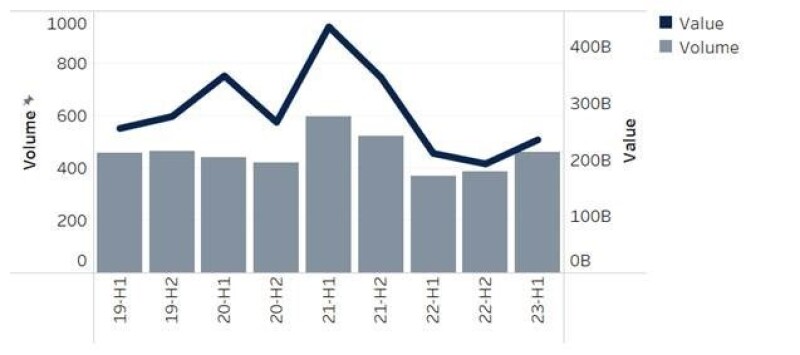

Europe, Middle East, and Africa combined bonds and loans volume and value

Source: Refinitiv

Furthermore, while European and UK bank equity prices have partly recovered, spreads on corporate bonds remain slightly elevated and risky debt issuance has been subdued, especially in the leveraged-loan market. Volatility remains high, particularly for gilts, and even though the UK gilt market liquidity conditions have improved overall since March and largely recovered compared to the fourth quarter of 2022, bid-ask spreads for 10-year UK gilts have remained elevated, reflecting the fact that uncertainty over the direction of policy rates remained high.

The inverted yield curve is also a ‘tell’ of investors’ more pessimistic short-term view and expected return to stability in the medium to long run.

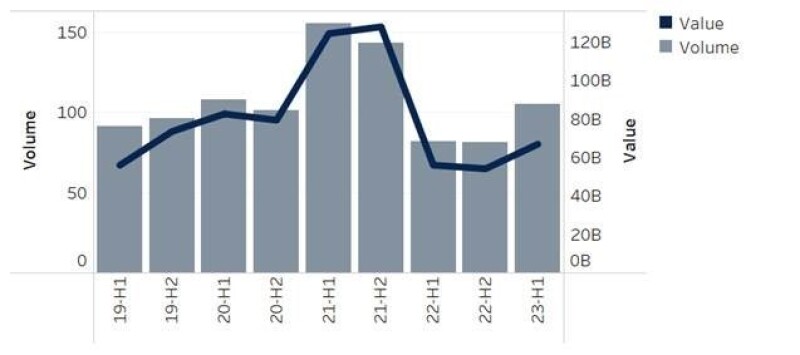

UK combined bonds and loans volume and value

Source: Refinitiv

Market participants have also turned to green and sustainability-linked financing, which is expected to become even more widespread in the coming years. ESG features continue to be a hot topic in leveraged finance, with a significant amount of European leveraged loans now including sustainability-linked features.

Digital bonds also emerged as a potential new technology and financing option. Although regulatory uncertainty still exists as the relevant regulatory bodies work to develop and harmonise standards for these types of issuances, blockchain technology is expected to impact the wider syndicated markets in the coming years.

Market outlook

The leveraged finance market outlook for 2023 and 2024 remains positive while the economy continues to battle inflation, recession concerns, and further supply shocks. Corporate borrowers will still need to navigate the slow economic growth and rising benchmark rates. Also, the leveraged finance market tracks M&A and private equity transactions as a source of funding, and volatility in that space results in uncertainty as to the strength of the market in the near term.

Many issuers and sponsors will have to choose between raising prices to protect operating margins or lowering prices to protect market shares and volumes, while facing higher coupons at refinancing in the short and medium term. Meanwhile, the challenge for investors lies in the potential volatility of spreads and prices. They will need to consider whether dry powder in private credit will be sufficient to support deal-making into 2024.

Approaching debt maturities in 2025 and 2026 will likely involve traditional deleveraging techniques, as well as an increase in debt buybacks and ‘amend and extend’ arrangements. The market should also expect to see more leveraged loan defaults, which will most likely lead to stressed issuers engaging in liability management exercises. In conjunction, issuances will likely have an increase in investors protections in the loan agreements to limit uptiering and dropdown transactions. All in all, the coming years could provide the opportunity for these strategies to propel and evolve the leveraged finance market forward to see a resumption of earlier activity.

Alternative sources of capital

Direct lending

The private credit market in the UK and Europe has exploded over the past five to ten years. In the past ten years, the private credit market in UK/Europe has grown sixfold. The term ‘private credit’ encompasses a wide range of products: direct lending, distressed investing, special situations, and mezzanine and venture debt. Direct lending, which represents the largest category (about 44% of the asset class), is a form of debt financing which a lender or club of lenders:

Directly negotiates with, and provides to, a borrower without intermediaries such as investment banks; and

Typically provides with a view to holding such debt on its balance sheet (as opposed to syndicating it in the market).

In addition, direct lenders are taking an interest in new jurisdictions; in particular, the emerging markets. For example, in Poland, regulatory restrictions on bank lending and the mandated mortgage holiday have severely impacted lending from local banks, and direct lenders are stepping in to fill that space. The authors expect to see this trend continue across markets as direct lenders seek yields in more non-traditional spaces.

The historical ‘sweet spot’ for direct lending tended to be the middle of the mid-market, where companies with EBITDA of around €5 to €30 million (about $5.3 million to $32 million) operate, although these numbers have increased. At this size, deals are more likely to be on a bilateral basis, meaning that direct lenders have a greater level of control to negotiate terms, documents, and structure.

However, given the growth in the amount of capital available for direct lending, caused by the increase in the number of direct lending funds and the average size of such funds, direct lenders have been under pressure to deploy their capital on larger and larger deals. As direct lending fund sizes grow, managers are having to fund bigger deals to put their capital to work efficiently. This means that the size of the average direct lending deal has been getting larger.

An increasing number of direct lending deals (particularly given the increasing size) are now on a ‘club basis’ as direct lenders steer away from taking on the full risk of a deal. Sponsors may prefer this club approach, as it gives them the comfort that one of the lenders is more likely to be available to fund an add-on or to provide any additional debt. However, a club of lenders does mean that lenders do not get one of the key historical benefits of direct lending: the ability to have one-on-one access to borrowers, and the flexibility and opportunities that this typically provides.

At the large end of the market, not only is there more competition among direct lenders looking to put capital to work, but they are also competing with the syndicated loan and high-yield bond markets that traditionally served this space. However, given the recent inflationary pressures and interest rate rises, activity in syndicated offerings and high-yield debt has significantly declined over the past 18 months. The balance between syndicated loans, high-yield bonds, and direct lending can be expected to fluctuate over time, with direct lending potentially accounting for a larger piece of the pie than in prior cycles.

While the syndicated loan market and high-yield market will recover in the near term, with the banking system under pressure and interest rates staying at heightened levels, sponsors and borrowers will look for longer-term partnerships. Given this, and with direct lenders offering additional flexibility, reliability, and speed of execution, the direct lending market will continue to grow.

Direct lending workouts

Direct lenders typically lend with a view to holding the debt on their own balance sheet. This means that they have different behaviours and risk appetites at the point at which the initial loan is made, and when there is some form of distress involved. Given the expectation that direct lending will continue to grow along with the current macroeconomic environment, there is likely to be an increase over historical levels of direct lending borrowers in distress.

Given the lender cohort (a single or small club of lenders), the use of statutory compromise processes upon distress is unlikely to be overly relevant for direct lenders, as there are usually sufficiently small numbers of creditors that a consensual transaction is often feasible and the costs of using a statutory process are disproportionate.

As such, in most distressed scenarios, a consensual deal between the lenders and sponsor is likely to be the preferred option, although the overall financial position of the borrower and the group of which it forms part will drive this. If this plan is viable, then transactions may well proceed with a sponsor equity injection, asset sales, and/or a refinancing, or, if debt service is an issue, a sharing of the equity with the sponsor, provided they make some form of contribution as part of the transaction.

For reputational reasons (and this is expected to specifically be the case with direct lenders), lenders can, at times, be reluctant to take formal enforcement action and will often work with the debtor to stabilise the business in the short to medium term via a forbearance agreement, with the forbearance conditional upon the debtor taking steps to ensure a process is put in place to progress a consensual transaction, often involving some form of refinancing or sale process.

Product-specific developments and regulatory reform, and benchmark change

The global legal/financial landscape has continued to develop in 2023 despite macroeconomic headwinds. Below are some of the key market and regulatory updates for finance providers and borrowers to be aware of.

ESG

The European ESG landscape is still constantly evolving through the development of further ESG regulations and market practice in 2022 and 2023.

As of 2022, the market is demanding that borrowers under sustainability-linked instruments are required to test sustainability performance targets on instruments dating back two years or more. Additionally, sustainability-linked instruments are also more frequently including an ESG-linked interest margin ratchet. If the ESG rating on the testing date shows an adequate level of improvement on the benchmark rating, the ESG target is deemed to have been achieved and the ESG margin ratchet applies.

In November 2022, the European Commission adopted the Women on Boards Directive to rebalance gender across boards of listed companies. At least 40% of non-executive director and 22% of executive director roles must be held by members of under-represented genders by June 30 2026.

The Corporate Sustainability Reporting Directive (CSRD) was finalised in December 2022 and will begin to take effect from the start of 2024. This broadens the scope of non-financial company reporting and includes directions for the reporting format and standards. The CSRD will impact EU and certain non-EU companies.

Additionally, the Carbon Border Adjustment Mechanism (CBAM) Regulation, which will implement the carbon border tax, was adopted in May 2023. This intends to limit moving carbon-intensive production outside the EU to countries that have lower carbon emission standards and restrict importing more carbon-intensive products to those produced in the EU. The CBAM will apply from October 2023, requiring companies to report carbon emissions without paying the tax yet. Permanent application will start in 2026.

In February 2023, the European Council and European Parliament reached provisional political agreement on a voluntary standard for EU green bonds (EuGB), which will ultimately require issuers intending to use the EuGB label to ensure all proceeds are aligned with the EU taxonomy where such companies are already covered by this EU taxonomy. The EuGB standard is expected to be formally adopted and finalised in October 2023.

Digital bonds

New technologies enabling the creation of digital bonds have mostly been tested in smaller contexts and are yet to come to the wider syndicated markets.

The EU is beginning to establish the regulatory groundwork through the Markets in Crypto-Assets Regulation, which came into force in June 2023 and will begin to take effect in stages from June 2024. The regime will create a structured market aligned to those of more traditional financial instruments, including transparency and disclosure obligations, licensing, approvals and supervision, operating requirements, governance measures, participant protections, and prohibitions on market abuse. Furthermore, the DLT Pilot Regime Regulation, which has applied since March 2023, sets up an environment to test share and bond issuances, trading, and settlement via distributed ledger technology (DLT) under a time-limited pilot programme, giving market participants an opportunity to test new digital technologies that might otherwise be restricted or prohibited under existing regulations.

In February 2023, the UK Jurisdiction Taskforce – one of six taskforces of the LawTech Delivery Panel, an industry group which aims to support digital transformation of UK legal services – published its legal statement on the issuance and transfer of digital securities under English private law (the 2023 Legal Statement). The aim of the 2023 Legal Statement was to build on a similar legal statement made in 2019, which built confidence in English law as a jurisdiction for developing and operating assets based on blockchain/DLT, by stating that digital securities can indeed be accommodated and supported by English private law. On the regulatory side, the UK is in the process of establishing its own cryptoasset regulatory framework and digital securities sandbox.

While regulatory uncertainty exists as regulatory bodies work to develop and harmonise standards for digital bond issuances, blockchain technology is expected to become an element of more deals, particularly the use of private blockchain ecosystems for private offerings as issuers and investment banks test the benefits of blockchain technology (for example, the innovative $50 million transactional placement by UBS in December 2022 of digital securities on a permissioned blockchain) before it is adopted more widely in the syndicated markets.

CMBS maturity wall

Commercial mortgage-backed securities (CMBS) have suffered continued obstacles since the COVID-19 pandemic, with lockdowns shuttering hospitality and retail spaces, and office spaces shifting to cater to the increasing prevalence of working from home. This filters down to the quality and quantity of commercial mortgages available for new CMBS issuance, and the performance of loans already packaged into CMBS.

A significant number of outstanding CMBS loans are due to mature in 2023 and 2024, with interest rates rising and devalued underlying real estate collateral, leading to commentary of a ‘wall’ of CMBS maturity with limited market appetite for rollovers. This has added significant strain on valuations, pitting borrowers and lenders against each other in a stalemate. With the expected amount of upcoming loans maturing, refinancing all these properties will be very difficult.

There have been very few new UK and European CMBS deals over the past 18 months and there is a sense that CMBS investors are focusing mainly on high-quality CMBS transactions with relatively low loan-to-value ratios.

Secured Overnight Financing Rate

On June 30 2023, the last rates based on the London Interbank Offered Rates (LIBORs) were published. However, work remains, in some jurisdictions more than others, to address legacy transactions and to understand what rate a USD LIBOR contract may switch to following this date. Further efforts will also be needed to transition away from interbank offered rates in some non-LIBOR currencies and to comply with the latest regulatory guidance on the use of robust contractual fallbacks to avoid the need for a rerun of the LIBOR transition process.

A number of mechanisms can provide a temporary reprieve or technical solution for unremediated contracts; namely, synthetic USD LIBOR, the US Adjustable Interest Rate Act, and the ISDA 2020 IBOR Fallbacks Protocol. Nonetheless, all market participants with unremediated legacy contracts should do the following:

Assess what interest rates will apply to those contracts after June 30 2023 (for example, a contractual fallback rate, a statutorily imposed replacement rate, or synthetic LIBOR); and

Actively continue to progress amendments to the interest rate terms of legacy contracts wherever possible.

There are no plans for EURIBOR to cease, but European regulators have recently reiterated their guidance for parties to ensure that their EURIBOR-based contracts include robust fallbacks should EURIBOR become unavailable.

Uptiering transactions

On June 6 2023, the US Bankruptcy Court for the Southern District of Texas ruled in favour of Serta Simmons Bedding LLC's (Serta’s) Chapter 11 reorganisation plan, confirming the reorganisation plan and validating Serta's 2020 non-pro rata uptiering exchange offer (the Uptiering Transaction).

Uptiering involves moving a group of creditors to a better position in a corporate financial structure vis-à-vis other lenders. While the judgment appears to give the green light to certain uptiering transactions in the US, several obstacles/protections remain in the European market. Regardless of geography, it is clear, now more than ever, that careful drafting is required to preserve or deny the flexibility required for these transactions.

Although the decision in the US to approve the Uptiering Transaction, and the continuing loosening of terms, has led to concerns that similar transactions could become a feature in Europe, certain factors continue to present a barrier to similar transactions in Europe. From a practical point of view, the leveraged finance community in Europe is smaller and generally more collaborative than in the US. However, as the market becomes increasingly challenging and terms become increasingly flexible, this unity might be tested.

The main impediment to uptiering in Europe is that English law or Loan Market Association-style facilities agreements in Europe (SFAs) typically prohibit loans ranking senior to the facilities (with some exceptions) and changes in the order of priority. Although some large-cap SFAs now permit loans ranking senior to the facilities subject to a cap on size, changes to the order of priority remain an all-lender matter.

In the current market, it seems almost inevitable that European borrowers will at least start to consider the full range of options potentially available to them, even if only as a bargaining chip.

With European leveraged finance poised to enter a prolonged period of uncertainty, borrowers, lenders, investors, and sponsors need to be acutely aware of what they are, and are not, permitted to do under their documents.