1 Disclosure of sustainability information in securities reports

1.1 New disclosure items

The disclosure of sustainability information in securities reports began in Japan with the annual securities reports for the fiscal year ending March 31 2023, due to the revision of the Cabinet Office Ordinance on Disclosure of Corporate Information, etc. that entered into effect on January 31 2023.

The revision is based on the recommendations outlined in the Financial System Council Disclosure Working Group report Building a Capital Market for Long-Term Corporate Value Enhancement, published in June 2022. The report proposed establishing a dedicated section in securities reports to provide sustainability information in an integrated manner, making it easier for investors to access the information necessary for investment decisions. The disclosure is structured around four key elements:

Governance;

Strategy;

Risk management; and

Indicators and targets.

The new items required to be disclosed are as follows:

Governance – a description of the governance structure related to sustainability-related risks and opportunities, including the structure and roles of the board of directors and any committees established voluntarily.

Strategy – for human capital, a description of the human resource development and the internal environment development policies, as well as any items of risk and opportunity that the company has identified and the measures taken to address them, based on each company’s judgement of their significance.

Risk management – a disclosure of the processes used to identify, assess, and manage sustainability-related risks and opportunities, including identification and assessment methods and reporting processes.

Indicators and targets:

A description of the details of indicators related to the human resource development policy and the internal environment development policy, as well as the targets and results achieved based on the indicators;

A disclosure of the “ratio of female managers”, the “rate of male employees taking childcare leave”, and the “wage gap between men and women”; and

Each company should determine the necessity of disclosure and, for example, include information such as greenhouse gas emission reduction targets and actual performance figures.

In addition to these, as described below, sustainability-related financial statements in securities reports will be required to be disclosed in accordance with future Sustainability Standards Board of Japan (SSBJ) standards.

1.2 Trends in greenhouse gas emissions disclosure

As noted above, greenhouse gas emissions disclosure is at the discretion of each company. While not legally mandated, proactive disclosure is encouraged.

According to the Current Status and Challenges of Sustainability Information Disclosure in Securities Reports, prepared by KPMG Azusa Sustainability Co., Ltd. in October 2024, the disclosure rate for the fiscal year ending March 2024 was approximately 34% of listed companies for scope 1 emissions (direct emissions from business activities) and approximately 35% for scope 2 emissions (indirect emissions from the use of electricity, heat, and steam created by other companies). This indicates that a significant number of companies have yet to disclose such information. Furthermore, the report states that only about 15% of listed companies disclosed information on scope 3 emissions (indirect emissions other than scope 1 and scope 2, including those from the supply chain) for the same fiscal year, making it even less common.

In Japan, the GX League was organised by the Ministry of Economy, Trade and Industry in 2023 to support the transition towards carbon neutrality. The league is comprised of companies that endorse green transformation initiatives, and these companies collectively account for more than 50% of Japan’s CO₂ emissions. Given that these companies have set emission reduction targets and are actively working towards achieving them, it is expected that the number of companies disclosing such information in their securities reports will increase in the future.

2 SSBJ standards

Japan has been developing Japanese standards consistent with International Sustainability Standards Board (ISSB) standards and published the SSBJ standards on March 5 2025. This article will describe the background to the development of the SSBJ standards, how it will be applied, if it differs from the ISSB standards, and the timeline for its application.

2.1 Establishment of the SSBJ

The SSBJ was established in July 2022 within the Financial Accounting Standards Foundation in response to the establishment of the ISSB in November 2021. This decision was based on feedback from market participants highlighting the need to develop sustainability disclosure standards in Japan and to contribute opinions on the development of international sustainability disclosure standards.

The SSBJ has two major roles, as follows.

2.1.1 Development of Japanese standards

The SSBJ is developing the Sustainability Disclosure Standards (the Japanese Standards) for use in Japan’s capital markets. From the perspective of ensuring confidence in Japan’s capital markets, the SSBJ is developing the Japanese Standards to ensure that they are of high quality and internationally consistent.

Given that the ISSB is established for the purpose of developing international sustainability disclosure standards at the request of market participants, it would be useful for market participants to make the Japanese Standards consistent with the content of the ISSB standards, which are considered to be a comprehensive global baseline. The SSBJ is therefore considering the establishment of a Japanese standard that is consistent with the ISSB standards.

In developing Japanese generally accepted accounting principles (GAAP), consideration may be given to requirements specific to Japan in response to the needs of market participants, or the relationship with various peripheral systems such as laws and regulations related to sustainability. However, the basic principle is that sustainability-related financial information prepared in accordance with Japanese GAAP should not significantly impair international comparability.

Research activities are also conducted on items of interest to market participants in developing standards.

2.1.2 Contribute to the development of international sustainability disclosure standards

The SSBJ’s basic policy is to disseminate opinions to actively contribute to the development of international sustainability disclosure standards of high quality to ensure that the sustainability disclosure standards used in Japan are of high quality. Specific activities include submitting comment letters in response to ISSB exposure drafts and requests for information, and disseminating opinions at international meetings such as the Sustainability Standards Advisory Forum established at the ISSB.

Market participants’ expectations for reflecting Japan’s thinking in international sustainability disclosure standards are increasing, and it is an important task for the SSBJ to enhance its presence and influence in the international sustainability disclosure standard-setting arena. To this end, the SSBJ is actively seeking to collaborate with standard-setters and organisations in other countries.

In addition, with regard to the results of the aforementioned research activities, those that are considered to be capable of disseminating information internationally are actively disseminated.

2.2 Publication of the exposure draft of the SSBJ standards

On March 29 2024, the SSBJ published an exposure draft of the sustainability disclosure standards (the SSBJ Standards) that it is developing. The SSBJ developed sustainability disclosure standards for Japan that are aligned with the ISSB standards and incorporate them into securities reports.

Initially, the SSBJ developed its standards on the premise that the SSBJ Standards would be applied to all companies submitting securities reports. However, the Financial Services Agency (FSA) indicated that “the application of the SSBJ Standards could start with companies that prioritise constructive dialogue with global investors, such as Tokyo Stock Exchange Prime-listed companies (‘Prime-listed companies’) or a subset thereof.” In response, the SSBJ adjusted its approach and has disclosed standards designed for application to Prime-listed companies.

2.3 Establishment of working groups

At the 52nd general meeting of the Financial System Council, held on February 19 2024, the minister of state for financial services requested a review of the disclosure and assurance of sustainability information. In response, an expert-led Working Group on the Disclosure and Assurance of Sustainability Information (the WG) was established.

The WG decided to study the SSBJ Standards’ applicability, timing of applicability, and how sustainability information should be assured.

The documents of the Financial System Council and the first WG indicated that it is important that sustainability information be disclosed in the future in compliance with specific standards to increase comparability and provide useful information to investors.

2.4 The SSBJ Standards

2.4.1 Disclosure standards

It is envisioned that the SSBJ Standards will be incorporated into the annual securities report. The WG has been discussing this point.

From the perspective of international comparability and the practical burden on companies, many committee members expressed the view that it is important for the SSBJ Standards to be equivalent to the ISSB standards, which serve as the international baseline. They emphasised that ensuring the functional alignment of the SSBJ Standards with the ISSB standards is essential. Furthermore, the committee members expressed their support for the policy of incorporating the SSBJ Standards, which are designed as sustainability disclosure standards equivalent to the ISSB standards, into the Financial Instruments and Exchange Act regulations.

2.4.2 Interoperability with other systems and standards

The WG also discussed the importance of the FSA and other related organisations working closely with international organisations and other countries to ensure that the SSBJ Standards are recognised as functionally equivalent to the ISSB standards and to ensure interoperability.

In addition, some expressed the opinion that inter-agency coordination should be sought for various domestic systems related to sustainability, such as disclosure under the Law Concerning the Promotion of the Measures to Cope with Global Warming and emissions trading in the GX League. There was also an opinion that it is important to ensure interoperability of greenhouse gas emissions in practice, since calculation based on International Organization for Standardization and other standards is already in place, in addition to calculation based on the Greenhouse Gas Protocol.

2.4.3 Introduction of an assurance system

At the third WG, many members expressed support for requiring the introduction of an assurance system one year after the mandatory application of the SSBJ Standards, as priority should be given to the early introduction of disclosure standards for assurance as well.

Since the fourth WG, discussions have continued on the scope of assurance and who should be responsible for it, and at the fifth WG, it was proposed and decided to establish an expert group on assurance of sustainability information under the WG, and the first meeting was held on Wednesday, February 12 2025.

The future of assurance, including voluntary frameworks, is an issue for further study, and the following five issues have been presented in the WG secretariat’s documents since the third meeting:

Scope, level, etc. of sustainability assurance;

Sustainability assurance business leaders;

Assurance standards and ethical and independence standards for sustainability assurance operations;

Inspection and supervision of sustainability assurance business performers; and

The role of self-regulatory organisations.

2.5 Relationship and difference between the SSBJ Standards and the IFRS standards

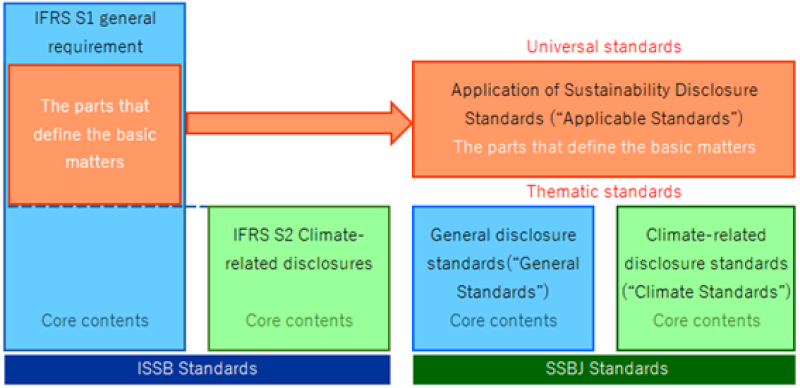

The relationship between the SSBJ Standards and the International Financial Reporting (IFRS) standards is shown in the figure below.

In developing a high-quality, internationally consistent SSBJ standard, the SSBJ concluded that it would be useful for market participants to make it consistent with the ISSB standards. Therefore, in the SSBJ’s draft, the SSBJ proposes to incorporate all the requirements of IFRS S1 and IFRS S2, and, where appropriate, add Japan-specific options that entities may choose to apply in lieu of the requirements of the ISSB standards.

As a result, an entity that does not choose the Japan-specific option would disclose in accordance with the IFRS Sustainability Disclosure Standards. On the other hand, an entity applying the Japan-specific option may or may not comply with the IFRS Sustainability Disclosure Standards.

As Japan-specific options, for example, the SSBJ Standards allow consideration of the Japanese translation of the Sustainability Accounting Standards Board Standards when no applicable disclosure standard exists for items such as risks identified by a company. Additionally, they provide for the consideration of the original text before its revised translation.

Regarding the reporting period, while international standards require it to align with the reporting period of the related financial statements, the SSBJ Standards permit the use of the most recent financial statements submitted to the authorities if another legal reporting framework has been selected.

Furthermore, while international standards require the provision of information on contractual instruments for scope 2 emissions, the SSBJ Standards allow the use of market-based emissions calculations.

In addition, certain items have additional stipulations (e.g., disclosure of units) that are not included in the IFRS Sustainability Disclosure Standards. However, even if an entity discloses in accordance with these provisions, it is not required to obtain information beyond what is necessary to make IFRS sustainability disclosures.

Furthermore, even when the SSBJ Standards are similar to the IFRS standards, some parts of the SSBJ Standards rearrange the order of the provisions of the IFRS Standards and reword the terms, primarily to prioritise the readability of the SSBJ Standards for Japanese companies.

2.6 Schedule

Japan’s inaugural sustainability disclosure standards (i.e., the SSBJ Standards) were published on March 5 2025 by the SSBJ.

The current roadmap for the application of the SSBJ Standards is as follows:

Voluntary application starts in the fiscal year ending March 31 2026;

Mandatory disclosure for companies with a market capitalisation of JPY3 trillion or more (69 companies) for the fiscal year ending March 31 2027;

Mandatory disclosure for companies with a market capitalisation of JPY1 trillion or more (179 companies) for the fiscal year ending March 31 2028; and

Mandatory disclosure for companies with a market capitalisation of JPY500 billion or more (294 companies) for the fiscal year ending March 31 2029.

3 The impact of the Trump administration’s anti-ESG and anti-DEI policies on Japan

The Trump administration in the US has brought about major changes in US ESG and diversity, equality, and inclusion (DEI) policies, and companies have been significantly affected.

Also, as of March 10 2025, there is no movement among US institutional investors to relax DEI-related voting criteria for Japanese companies.

In this regard, at this time, there has been no public announcement that the above-mentioned disclosure regulations and the plan regarding such regulations in Japan will be changed.

On the other hand, Sumitomo Mitsui Financial Group, which owns one of the Japanese mega-banks, has left the Net-Zero Banking Alliance (NZBA), and Nomura Holdings, Inc., which owns one of Japan’s leading securities companies, is also considering leaving the NZBA.

In light of this situation, there is a possibility that disclosure regulations may be affected in the future, so close monitoring is necessary.