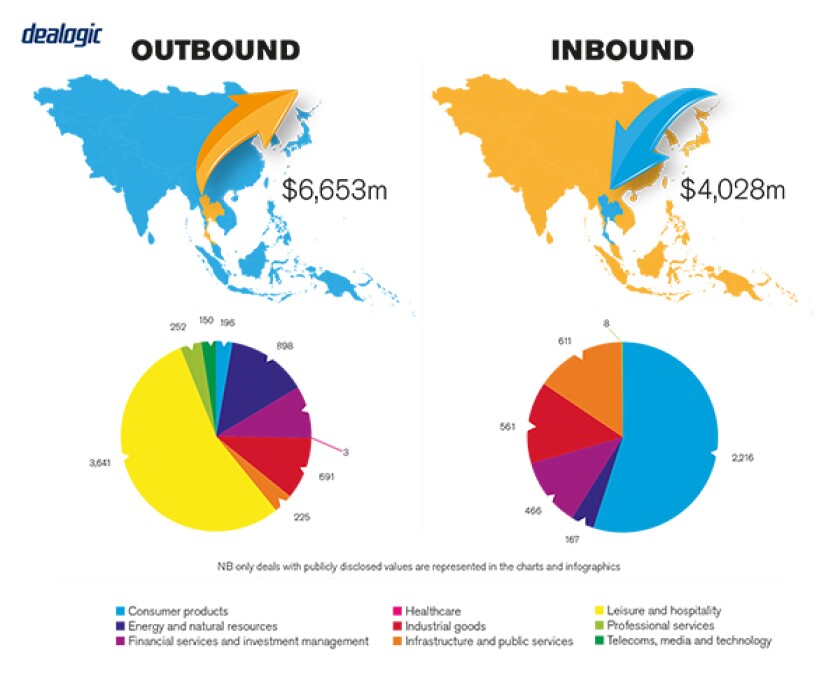

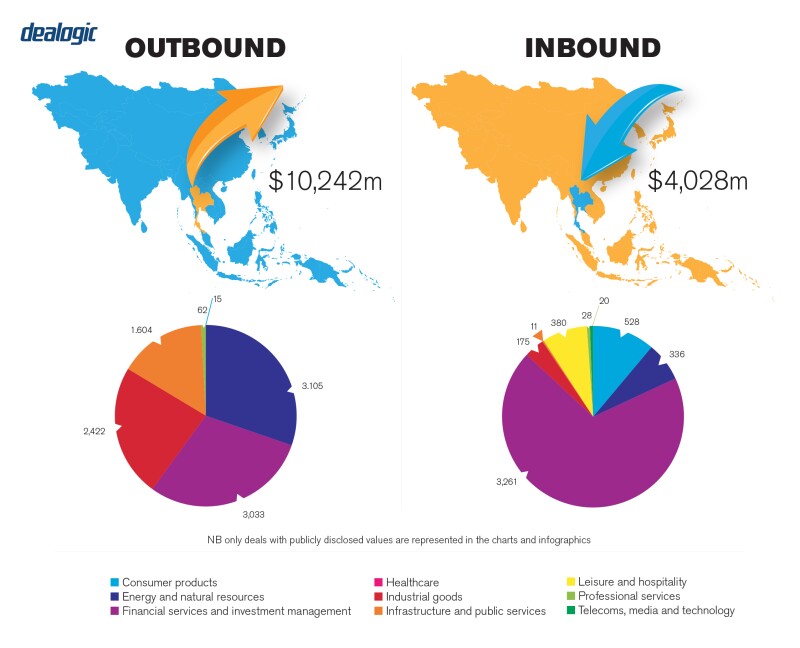

M&A activity throughout Southeast Asia, particularly in Thailand, was incredibly robust in 2019. According to UK-based financial information provider Dealogic, there were a total of 67 cross-border acquisitions within Southeast Asia up to mid-December 2019, with deal values totalling a whopping $9.6 billion, almost triple the $3.5 billion figure for 2018. Average deal size was $144 million, the highest for the past 10 years. Thailand was at the forefront of this sharp increase in outbound and cross-border deal-making, accounting for an impressive 67% of Southeast Asia's deal value. Thai dominance as Southeast Asia's most active M&A player, despite a predicted overall decline in M&A activity globally, is likely to continue into 2020 as Thai companies look to offset the impact of a weakened baht – currently being battered even further by the novel coronavirus outbreak – and low interest rates.

Although robust economic performance and regulatory certainty in recent years has seen significant growth in inbound activity, especially from China and Japan, it is likely that Thailand will follow a global decline in overall M&A transactions. Despite a decline in overall deal-making activity, outbound investments are likely to represent a greater share of M&A transactions as Thai firms use overseas acquisitions to respond to domestic challenges. Banks have been ramping up cross-border activity. Bangkok Bank's acquisition of a majority stake in Indonesia's Bank Permata–the largest ever foreign bank acquisition by a Thai commercial lender – and Kasikorn Bank's proposed acquisition of a significant stake in Myanmar's Ayeyarwaddy Farmers Development Bank are likely to be a sign of things to come in the financial M&A space. Thai banks and financial institutions will seek to diversify investments and take advantage of relaxed foreign ownership restrictions in the banking sectors of several Southeast Asian nations.

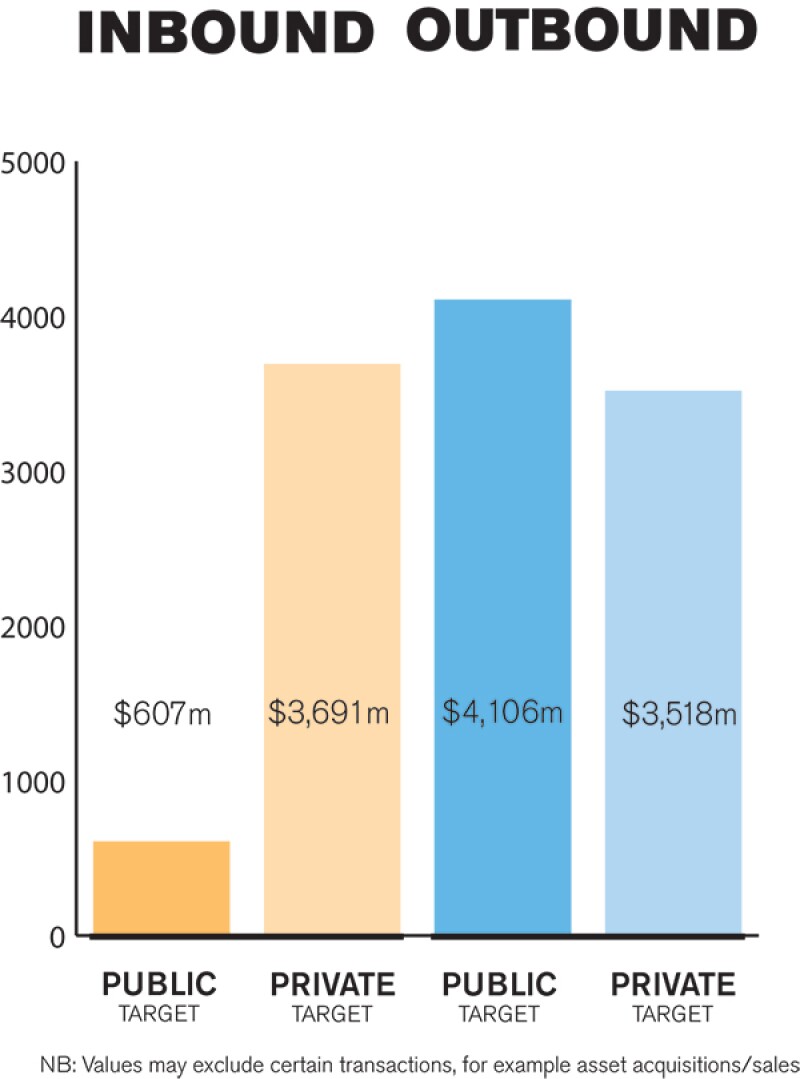

While Thai acquirers continue to be a mixture of both public and private companies, there seems to be a continuing trend towards more public companies becoming acquisition targets compared to previous years.

TRANSACTION STRUCTURES

One interesting development in 2019 was the significant increase in corporate bond issuance driven by fund mobilisation for mergers, acquisitions and business expansion. A record $1 trillion was issued, significantly outpacing the Thai Bond Market Association's full-year forecast. This kept pace with Thai corporations ramping up outbound/overseas M&A activity and is expected to continue in the first half of 2020.

|

|

Break fees are regarded as liquidated damages in Thailand and may be reduced by a Thai court |

|

|

There are many financial investors investing in start-ups and mid-size businesses, including private equity firms, venture capital (VC) firms and high net worth individuals. VC firms have been particularly active in the fintech and digital financial services space, with particular interest in healthtech, edutech, and cryptocurrency exchanges. Several financial investors also invested in pre-IPO or at IPO as cornerstone investors. Traditionally, deals involving strategic investors were more complicated in terms of structure, tax and other economic conditions.

Among the most notable recent transactions in the market was UK grocery group Tesco's planned sale of its Thai assets (comprising almost 2,000 stores in Thailand). The deal is estimated to be worth upwards of $8 billion – $9 billion and one of Asia's biggest M&A transactions for 2020. It could also be the first significant example of the upgraded Trade Competition Act in action, with regulators expected to closely scrutinise the deal. Sakon Varanyuwatana, chairman of Thailand's Office of Trade Competition Commission (TCC), said of the TCC's role in the proposed deal in a recent interview with the Financial Times: "We have to consider the operation in 360 degrees and study whether it [the deal] would have any anti-competitive structure or behaviour after the merger or not. We have the authority to prohibit the merger or acquisition if we believe it will lead to a monopoly." Accordingly, the market awaits with great interest as the TCC's scrutiny of this deal could set an important precedent for future M&A in Thailand.

Another very significant M&A deal is Bangkok Bank's winning bid to acquire an 89% stake in Indonesia's Bank Permata for $2.67 billion from Standard Chartered, beating Japan's Sumitomo Mitsui Banking Corporation and Singaporean bidders DBS Group Holdings and Oversea-Chinese Banking Corporation. The landmark deal, which represents the largest foreign bank acquisition ever by a Thai bank, is perhaps by far the most illustrative example the finance sector looking to neighbouring markets for opportunities amid a weak/uncertain domestic landscape.

LEGISLATION AND POLICY CHANGES

The primary legislation that governs private M&A transactions is the Civil and Commercial Code of Thailand. The primary body is the Department of Business Development of the Ministry of Commerce. The key pieces of legislation governing public M&A transactions are the Public Company Act BE 2535, the Securities and Exchange Act BE 2535 (Notification of the Capital Markets Supervisory Board Rules and Conditions and Procedures for the Acquisition of Securities for Business Takeovers), and the Notification of the Board of Governors of the Stock Exchange of Thailand regarding Disclosure of Information and Other Acts of Listed Companies Concerning the Acquisition and Disposition of Assets, 2004. The primary bodies are the Securities and Exchange Commission, the takeover panel appointed by the Capital Market Supervisory Board and the Stock Exchange of Thailand.

The biggest recent legislative change has been the implementation of Thailand's new merger control regulations. The TCC imposed its first penalties in three competition cases in August 2019 and is gearing up to closely scrutinise the proposed $9 billion sale of Tesco's Thai assets. M&A dealmakers are now having to give serious consideration to Thailand's now active merger control regulations when contemplating new M&A deals. This is an area that investors should pay particular attention to in the coming years as it is expected the TCC will be robust in its review of new M&A deals likely to give rise to monopoly concerns.

MARKET NORMS

With regards to standard market practice, there are no significant misconceptions about the M&A market in Thailand. However, the most overlooked area are the laws relating to foreign ownership restrictions and what impact these laws may have on M&A deals.

Inbound M&A investors most often ask about foreign ownership restrictions under Thai law. In Thailand, foreign companies are prohibited from engaging in certain restricted businesses. Accordingly, a foreign acquirer may be barred if the target company is engaging in a restricted business and the acquisition of the target company by such foreign acquirer will render the target company a foreign entity.

The main legislation governing the business of foreign entities is the Foreign Business Act (FBA), which limits foreign participation in certain business activities, including wholesale and retail, being a broker or agent and any type of service activities (including lending, leasing and consultancy). The FBA limits foreign ownership to 49.99% of shares in the target company conducting a restricted business. Approval from the Ministry of Commerce is required prior to conducting any such business. The target company may also apply for an investment promotion certificate from the Board of Investment for certain promoted businesses to benefit from a relaxation of this foreign ownership restriction.

Apart from the FBA, certain industries have specific regulations which may have separate requirements on foreign shareholding. For example, the laws governing commercial banking businesses or insurance businesses stipulate a foreign shareholding limitation of 25%, with certain exceptions. In addition, the Land Code of Thailand prohibits foreign entities from owning land unless, among other things, an investment promotion certificate is granted by the Board of Investment.

Technology is playing an increasingly important part of the M&A deal-making process. Gone are the days of physical data rooms stacked high with documents being poured over by teams of lawyers and financial advisors. Virtual Data Rooms (VDR), which are now used in almost every M&A deal, can significantly reduce some of the more labour-intensive aspects of due diligence. A well-organized VDR is an essential technology for both buyers and sellers. In addition, lawyers and other deal advisors are now able to take advantage of a number of innovative AI tools to help them slash the often lengthy due diligence process, as well as potentially reducing human error in document review. By way of example, Kudun & Partners' founder Kudun Sukhumananda believes that: "technology investment remains one of the most heavily budgeted expenses not only in traditional law firms but emerging firms that are looking to disrupt the industry promising faster and more effective legal assistance."

PUBLIC M&A

When obtaining control of a listed company, the most important considerations are the tender offer rules under the Securities and Exchange Act (SEC Act) and the Notification of the Capital Market Supervisory Board Rules, Conditions and Procedures for the Acquisition of Securities for Business Takeovers (CMSB Notification). According to the tender offer rules, if an acquirer obtains shares of any listed company which constitute up to or more than 25%, 50% or 75% of the total voting rights of the listed company, the acquirer must make a mandatory offer for all the securities. In the tender offer, an offered price must not be less than the highest price paid for shares during the period of 90 days prior to the date on which the tender offer document was submitted to the SEC.

The foreign ownership restrictions under the FBA are another consideration. Under the FBA, a foreigner is prohibited from participating in certain businesses (refer to Restricted Business Activities under the Foreign Business Act of 1999) that fall within any of the restricted categories under the FBA, including the catch-all category of "other services". For this purpose, a "foreigner" includes a company incorporated in Thailand that is majority-owned by foreign individuals/companies. In order to comply with these foreign ownership restrictions, a foreign acquirer may make a partial tender offer (PTO) for less than 50% of the voting shares of a listed company. However, this PTO structure may only work in a friendly acquisition as it requires approval from a shareholders' meeting of the target company by a vote of not less than 50% of the total votes of the shareholders present at the meeting and having the right to vote. Approval of the Office of the SEC is also required, and certain conditions provided under the CMSB Notification need to be satisfied.

A mandatory tender offer must be unconditional. However, pursuant to the CMSB Notification, the acquirer is permitted to cancel the tender offer upon the occurrence of one or more of the following events:

The occurrence of an event, after submission of the tender offer document to the SEC but within the tender offer period, which causes or may cause severe damage to the status or to the assets of the target company, which does not result from the acts of the acquirer or any act for which the acquirer must be responsible.

Any action taken by the target company after submission of the tender offer document to the SEC but within the offer period, which causes or may cause a significant decrease in its share value, provided that these events are stated clearly in the tender offer document.

In a voluntary tender offer, in addition to the above conditions provided under the CMSB Notification, it is common for the acquirer to include a condition that the tender offer can be cancelled if the number of shares tendered is less than the number of shares specified by the acquirer.

Break-fee provisions are often regarded as one of the main options for deal protection. However, the most common mechanism continues to be the use of exclusivity arrangements. We note that break fees are regarded as liquidated damages in Thailand and may be reduced by a Thai court if they are considered disproportionately high.

PRIVATE M&A

Both locked-box and completion accounts are common consideration mechanisms for private M&A deals in Thailand. Neither of them can be regarded as being dominant. In recent years, however, we have noticed a slight increase in the use of locked-box or even fixed price consideration mechanisms, especially for individual sellers who need to speed up negotiations and conclude their deals.

Unlike with public M&A, there is no concept of taking over a private company under Thai law. Therefore, a private M&A deal must be carried out through a share sale agreement containing terms and conditions as mutually agreed by the parties. The share sale agreement will contain general conditions, including warranties given by the parties being true and accurate; no occurrence of any event resulting in any material adverse change; and necessary corporate approvals being obtained.

|

|

M&A dealmakers are now having to give serious consideration to Thailand’s now active merger control regulations |

|

|

It is quite common to use the laws of a neutral jurisdiction as the governing law in a private M&A share purchase agreement. In addition, a hybrid arrangement is also sometimes used – whereby the governing law is Thai but the jurisdiction of dispute resolution (often arbitration) is a neutral jurisdiction such as Singapore or Hong Kong.

Warranty & Indemnity (W&I) insurance is generally on the rise in private M&A transactions in Southeast Asia, particularly in its ability to potentially reduce the delays and complexities associated with setting up escrow accounts to manage purchase price retention amounts and also the uncertainties that can arise in connection with the enforcement of warranty and indemnity claims in certain jurisdictions. Although W&I is certainly available for Thai M&A deals, it is perhaps not yet used so often as to be considered standard market practice. However, from a buyer's perspective, M&A deals involving countries which may have less robust laws and/or regulatory regimes or court systems are often good candidates for W&I insurance.

The most common exit strategy for an owner of a private business is to seek a larger company to buy its business through an M&A transaction. This is a win-win situation for the parties, where the seller can easily cash out and, for the buyer, it is a more efficient way to grow its business than by creating new products from scratch.

LOOKING AHEAD

Although M&A activity in Thailand is likely to remain healthy in 2020, there may be a decline in overall M&A activity, with inbound investment perhaps dropping the most. It is important to note that this is in line with the rest of the world and that it is set to rebound higher in 2021-2022. As a counterbalance to potentially reduced inbound deal flows, however, certain factors, such as the Thai Government's policy to promote investment diversification by Thai corporates, and the strong Thai baht, may lead to an increase in Thai outbound M&A deal activity in 2020.

Interestingly, China – the world's most important overseas investor – has dropped outbound direct investment for two successive years while, at the same time, overtaking Japan for the first time in 2019 as Thailand's largest investor. This could indicate a potential concentration of funds by Chinese investors in Thailand despite a decline in outbound Chinese investment overall. According to Kudun & Partners' head of China practice, Mayuree Sapsutthiporn, "China and Thailand remain very strong friends and business partners, perhaps now even more so as a result of Thailand's refusal, in stark contrast to many other counties around the world, to ban arrivals from China in the wake of the coronavirus epidemic." These gestures of friendship and trust will not be lost on the Chinese government, so it is likely that Chinese investment in Thailand will continue to grow in the coming years.

About the author |

||

|

|

Kom Vachiravarakarn Partner and co-head of corporate and M&A, Kudun & Partners Bangkok, Thailand T: +66 2 838 1750 ext. 1818 Kom Vachiravarakarn's principal area of practice is corporate and M&A, and capital markets including IPOs, debt offerings, and takeovers. He has a wealth of experience in mergers and acquisitions including the acquisition and disposal of equity interests in listed companies. His prior background as a senior legal officer with The Stock Exchange of Thailand (SET) has been instrumental in giving him the edge when it relates to offering expert securities regulatory advice. Kom has extensive experience in advising both domestic and international clients on offerings of shares (domestic and international), investment and trust units under Rule 144A and Regulation S, corporate restructuring, joint-ventures and commercial transactions, as well as real estate investment trusts and infrastructure funds. The primary industries Kom has operated in include manufacturing/industrials, renewable energy, real estate and property development, construction materials/management, engineering and food and beverages. He is listed as a Recommended Lawyer for corporate and M&A (including capital markets) by The Legal 500 Asia Pacific. He is praised by his clients for his "strong knowledge on M&A transactions and capital markets… Very helpful and flexible" in the IFLR1000 legal directory. He is also a recurring author for The Legal 500's Comparative Legal Guide for Real Estate Thailand and IFLR1000's M&A Thailand Activity Report. |

About the author |

||

|

|

Troy Schooneman Partner, Kudun & Partners Bangkok, Thailand T: +66 2 838 1750 ext. 1778 Troy Schooneman is a partner and head of the firm's international practice. Troy is engaged primarily in M&A, foreign direct investment, banking and finance and general corporate law. With a career spanning more than 25 years in Asia, Troy has extensive experience in advising a broad spectrum of Thai and international public and private companies, private equity funds and government agencies, on domestic and cross-border M&A, private equity investments, joint-ventures, project and corporate financings, real estate developments, energy projects and general corporate matters. Troy is listed as a leading lawyer in banking and finance, projects and energy by The Legal 500 and in projects and energy by The Legal 500. He is praised for "his in-depth knowledge and experience of pan-Asian markets" (The Legal 500, 2012) and "respected for his expertise in corporate matters" (IFLR1000, 2014). He obtained a BA in psychology from Monash University in 1989 and was admitted to the senior courts of England and Wales in 1999. |