SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Romania has witnessed the highest growth in Europe in the second quarter of 2017, with one of the lowest unemployment rates, and therefore with interesting prospects. The country also had a good year on the M&A front due to positive macroeconomic developments and favourable prospects that have made investors turn their attention to Romania and become willing to invest in the local market.

Romania's other competitive advantages lie in an economy that is diversified and the good geographical position between the Balkan states, Central Europe and the former USSR. Moreover, the wide anti-corruption campaign and the public support it received has helped improve the image of the country.

In this context, the market was quite boisterous with transactions driven by investors and investment funds already present on the market, which wanted to strengthen their positions through organic growth but also through new acquisitions. There were also some notable new entrants. Additionally, an important role was played by the generation of local entrepreneurs whose businesses are mature enough and want to further expand or are interested in a total exit.

Healthcare, energy, oil & gas, IT and real estate remain the most attractive sectors for major investments, together with the continuing consolidation in the banking sector.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

The M&A market in Romania reached €3.8 billion in 2017, according to public sources and disclosed transactions. Overall, adding all transactions with undisclosed values, the total market reached between €4 billion and €4.6 billion, 15% higher than 2016. M&A activity continued to grow in 2017 but more remarkable was that the number of transactions reaching between €100 million and €500 million reached 15, a record performance of the past 10 years.

Overall, there were 105 announced transactions in 2017, including those whose value was not formally disclosed, 15% more than in 2016. The energy sector was the busiest in terms of transactions, followed by financial services, but increased dynamics were also seen in sectors such as and TMT (technology, media and telecom), industry and healthcare services. Investment funds were busier last year, with 13 acquisitions, the biggest of which was the takeover of A&D Pharma by Penta Investments.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

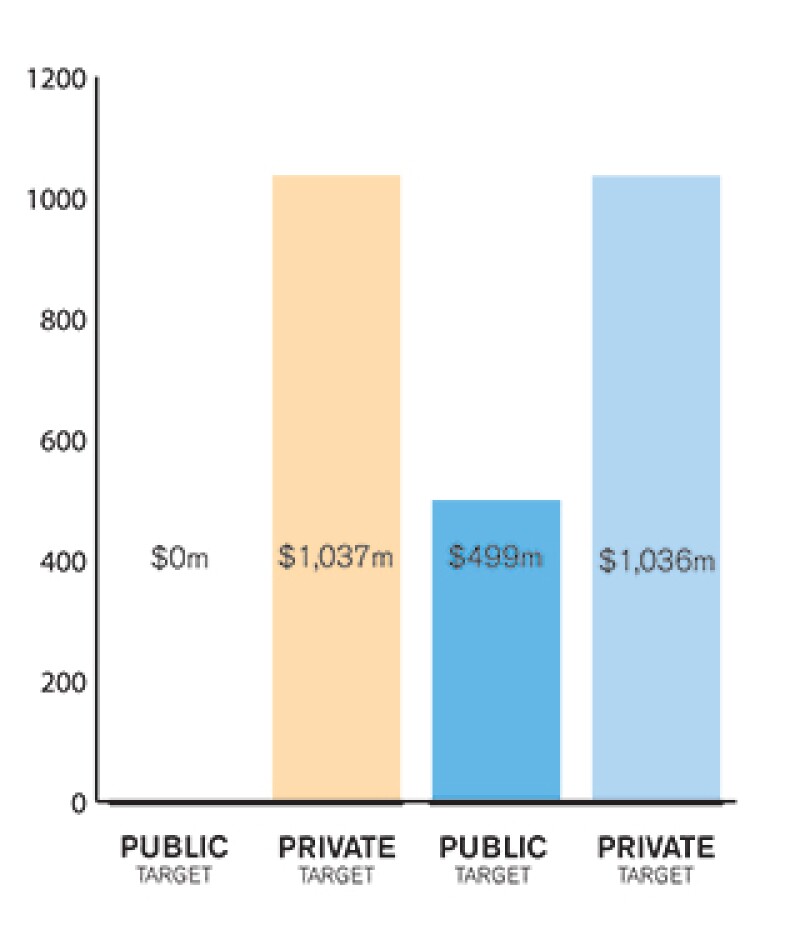

The Romanian market is mostly driven by private deals, with public investment or publicly-driven projects stalled by the Government.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

In the deals conducted recently we have often seen competitive, auction-like processes being organised by sellers to maximise profits or minimise conditions precedent or subsequent being imposed by purchasers. On this backdrop, the influence of strategic and financial investors is quite balanced by the growing bargaining power (also helped by professional consultants employed from a rather early stage) of increasingly educated sellers.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The largest transaction that has skewed the aggregate M&A data is the €401 million acquisition of 13.6% of E-Distributie Muntenia and Enel Energie Muntenia by Enel, following the conclusion of the international arbitration regarding to the privatisation of Electrica Muntenia Sud.

Among other significant transactions, we can include:

SABMiller's sale of its beer business in Romania to Asahi Breweries Europe, a transaction estimated €300 million and making part of a global deal including SABMiller's businesses in Romania, Czech Republic, Slovak Republic, Poland and Hungary, with a value of €7.3 billion;

The acquisition of A&D Pharma by the private equity fund Penta Investments was published at the end of 2017 and was the largest transaction in the pharma retail and distribution sector (deal value not officially announced);

The transaction in which Banca Transilvania acquired Bancpost, ERB Retail and ERB Leasing stands as the largest transaction in the banking sector in recent years (deal value not officially announced);

The takeover of Ecopack and Ecopaper by DS Smith (€208 million)

The listing on the Bucharest Stock Exchange of telecom company Digi was the highest IPO made by a private company on the Bucharest Stock Exchange (€193 million)

The announced acquisition of the local subsidiary of Piraeus Bank by JC Flowers investment fund, marking the first deal on the Romanian banking market for the fund (deal value not officially announced);

The largest deal in the hotel industry that took place last year was the acquisition by Revetas Capital and Cerberus of a hotel complex including Radisson Blu and Park Inn hotels (over €165 million);

The acquisition by Electrica of the shares held by Fondul Proprietatea in Electrica Distributie Muntenia Nord, Distributie Transilvania Sud, Distributie Transilvania Nord and Electrica Furnizare (€165 million);

The takeover of the Japanese car maker Takata Corporation by Key Safety Systems involved Takata's local facilities in Arad and Sibiu (the transaction value of $1.58 billion globally)

The association between Atterbury Europe and Iulius Holding, the Iullius malls operator (value not officially disclosed);

The acquisition by which Vitruvian Partners became one of the shareholders of Bitdefender, the largest Romanian software provider, by acquiring 30% stake into the company was the largest IT&C transaction last year (Bitdefender's value was set at over $600 million);

The takeover of Hungarian operator Invitel Tavkozlesi by Digi Hungary (€140 million);

The agreement between Globalworth real estate investment company and Griffin Premium for the acquisition of a majority stake in the Polish company (value not officially notified);

The announced acquisition by Chimcomplex SA Borzeşti of some of Oltchim's assets (€127 million); and

The transaction by which OTP will take over Banca Romaneasca, which awaits the NBR's approval (value not officially announced).

2.2 What have been the most significant trends or factors impacting deal structures?

We have seen a variety of deal structures being shaped and performed in the M&A market, but most often parties elect locked box or debt free-cash free purchase price mechanisms with holdback amounts, sometimes held in escrow accounts for periods which generally may range from six months to three years to cover potential events such as tax provisions, major litigation outcome etc. Price adjustments are also seen frequently, especially in case of targets acting in highly regulated environments, where financial results depend to a significant extent on a regulatory authority such as in the energy distribution or in the pharma sector.

Other key factors or trends impacting deal structures include frequent presence of material adverse change or events as well as merger control filing provided as condition precedent (usually as a result of regulatory requirements) but also a quite frequent expectation from sellers to contractually treat VDR content as representing disclosed information and to limit seller liability by buyer knowledge. Negotiating various caps on seller's liability has also become a frequent trend on the market.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key legislation governing M&A transactions is represented by:

Law No. 287/2009 – the Civil Code (Codul Civil);

Law No. 31/1990 – the Companies Law (Legea Societatilor);

Law No. 21/1996 – the Competition Law (Legea Concurentei);

Law No. 227/2015 – the Tax Code (Codul Fiscal).

Specifically, for public M&A transactions, Law No. 24/2017 concerning the issuers of financial instruments and market operations (Legea nr. 24/2017 privind emitenţii de instrumente financiare şi operaţiuni de piaţă) is applicable.

The main regulatory bodies governing M&A transactions are:

The Competition Council (Consiliul Concurentei);

The Supreme Council of State Defense (Consiliul Suprem de Aparare a Tarii)

The Financial Surveillance Authority (Autoritatea de Supraveghere Financiara) – the supervisory authority regulating listed companies and financial markets, supervising public takeover offers.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The Romanian legal framework is aligned with the EU legal framework and apart from constant changes in tax legislation, it has not suffered significant changes in the last couple of years.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Apart from new amendments to tax legislation, no significant changes of the actual legal framework impacting the M&A market are expected in the foreseeable future.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

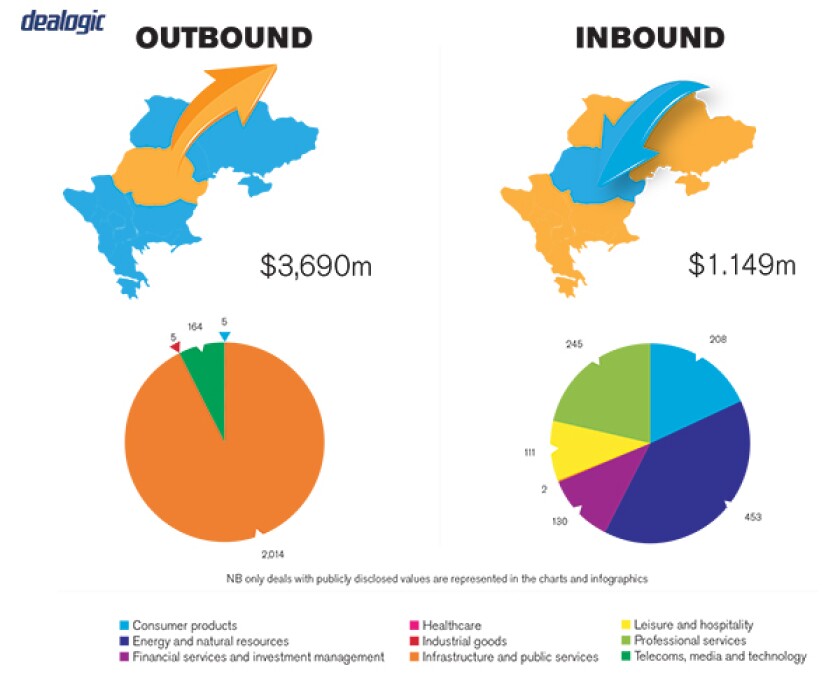

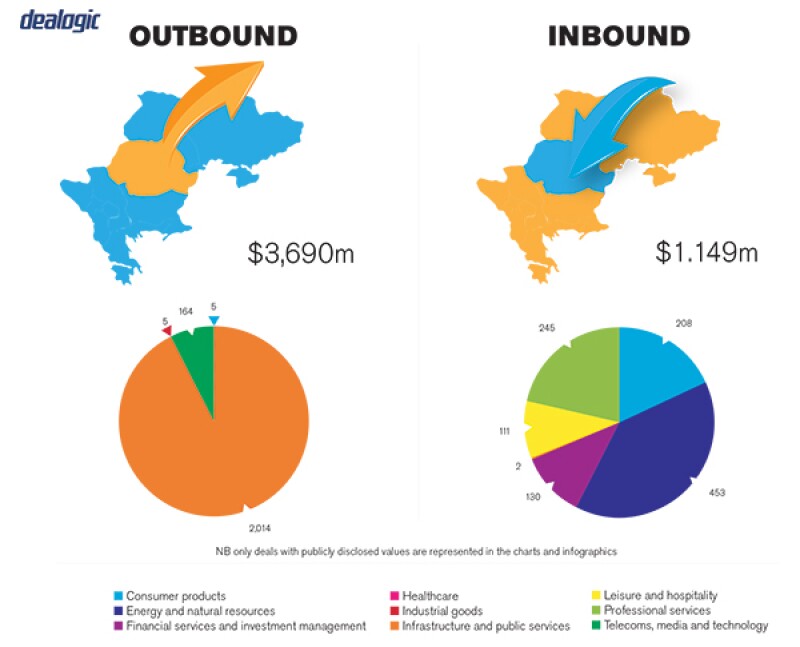

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

Most issues usually arise from poor due diligence, where corporate and intellectual property aspects tend to be overlooked. Furthermore, foreign investors tend to impose on the local sellers agreements structured on the common law standards. However, such agreements may contain legal obligations which do not always have a correspondent in the Romanian legal framework, generating misunderstandings which are in turn translated into a cumbersome negotiation process.

It is therefore advisable to involve a legal counsel in the deal from the earliest stages thereof, in order to avoid weaknesses and hidden dangers of clauses which are common law-specific and which have no correspondent under the Romanian legislation and also in order to simplify the contract negotiation process.

The parties to an M&A transaction also tend to focus on the payment mechanism and representations & warranties. Although these are vital provisions of a sale-purchase agreement, due care is also required in what the actions at closing and post-closing liabilities & indemnifications are concerned.

Another particularity inherent to M&A transactions refers to the Competition Council's merger control as far as transactions subject to notification to the Supreme Council of State Defence are concerned. Although the legal provisions regulating the operations subject to control from the Supreme Council of State Defence and the inherent procedure have been introduced in 2011, the procedure is still unclear and there are several contradictions within the legal provisions on this matter. For example:

i. It is still not clear which operations are subject to control from the Supreme Council of State Defence – all operations posing a risk to the state security or only those operations subject to merger control from the Competition Council; and

ii. the procedure itself is obscure – what happens in case the Supreme Council of State Defence does not issue the clearance within the legal term for the issuance of the clearance from the Competition Council). Furthermore, although the Competition Council is bound to notify the Supreme Council of State Defence, in practice, both authorities are notified at the same time.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Most questions related to M&A transactions come from foreign investors and mainly target corporate and real estate aspects, which have some specifics under the Romanian legal framework.

The most overlooked area concerns the seller's intellectual property. Due diligence in this respect tends to be at a very high level and therefore fails to expose fundamental issues. This is usually inherent to M&A transactions in the IT sector, where the seller does not always own full intellectual property rights over the software it is developing (intellectual property matters are also overlooked by business owners and managers) and such issues usually arise shortly after the transaction becomes public and the actual intellectual property owners begin to make compensation claims.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Seeking local advice and involving a team of counsels (legal, financial and tax advisors) as early as possible is mandatory for a successful transaction. Thus, the inherent risks could be successfully mitigated and the pitfalls and hidden dangers mentioned above could be thoroughly assessed in order to meet the expectations and needs of the parties involved.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

A public company is deemed to be controlled, if either of the following conditions is met:

a) An individual or a legal entity holds the majority of the voting rights (50%+1); or

b) An individual or a legal entity holds the right to appoint or revoke the majority of the administration, management or supervisory bodies, being, at the same time, shareholder of said company; or

c) An individual or a legal entity is a shareholder and controls on its own, based on an agreement concluded with other shareholder of said company, the majority of the shareholders' voting rights; or

d) An individual or a legal entity has the power to exercise or effectively exercises a dominant influence or control.

5.2 What conditions are usually attached to a public takeover offer?

The procedure inherent to a public takeover offer is regulated by Law No. 24/2017 concerning the issuers of financial instruments and market operations (Legea nr. 24/2017 privind emitenţii de instrumente financiare şi operaţiuni de piaţă). A public takeover offer is issued in order to acquire more than 33% of the voting rights of the public company and is subject to prior approval by the Financial Surveillance Authority (Autoritatea de Supraveghere Financiara).

Furthermore, depending on the specifics of the transaction, prior clearance from the Competition Council (Consiliul Concurentei) may be necessary.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees in public M&As tend to have a different regime in Romania depending on whether the deal is mandated by Government or Government-owned companies or issuers as opposed to cases where the client is a purely private entity. In the first category, break fees are usually excluded from the outset by relevant tender documentation, while in the second category such fees are generally subject to parties' negotiation.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

All consideration mechanisms above are common in M&A transactions taking place in Romania. However, in specific sectors, locked box mechanisms are increasingly used in the detriment of classic mechanisms such as completion accounts, since post-closing subsequent price adjustments are no longer needed, both parties have the certainty of the transaction price and the negotiation process is usually swifter.

Nevertheless, escrow and earn-outs (especially when there is a high discrepancy between the seller's and the buyer's expectations in terms of transaction price) are the most used consideration mechanism in the Romanian M&A market.

5.5 What conditions are usually attached to a private takeover offer?

Within the confines of the applicable legal provisions, the parties are free to structure the M&A deal according to their best interests and to choose the mechanisms they deem most appropriate, such process not being regulated in any way (opposed to a public takeover offer).

However, depending on the specifics of the transaction, prior clearance from the Competition Council (Consiliul Concurentei) may be necessary.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Usually, in case the target company is incorporated and functioning under the Romanian laws, the governing law is the Romanian law and the competent courts for dispute resolution are the Romanian courts. However, there are transactions where the parties provide a foreign governing law which is applicable only for those parts of the agreement where, according to the international private law provisions within the Civil Code, the governance of the Romanian law is not mandatory (e.g., aspects inherent to a Romanian legal entity such as shareholders' rights and obligations, functioning of the management bodies, acquiring and losing the capacity of shareholder, legal entity's liability towards third parties, etc. are mandatorily governed by the Romanian law).

Furthermore, in the recent years, appointing national or international arbitral courts for dispute resolution became more and more common in M&A deals, especially in more complex and higher valued transactions, in order to avoid the usually long timeframes until a final solution is awarded by the common courts of law and to ensure that the matter is resolved by highly experienced individuals in complex M&A transactions.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Such insurance mechanisms are not widely used because of the usually high costs imposed by the insurance companies. However, the classic bank performance letters are widely used for warranting the obligations undertaken by the parties and as the market is maturing and the insurance companies are becoming more competitive in what such specialised products are concerned, the use of such insurance mechanism will definitely become more common.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

The local market is becoming increasingly active in transactions involving exits, either via IPOs or otherwise, especially as local businesses are evolving and, in some notable cases, expanding outside the national borders. In the last years, the market has witnessed total or partial exits from both initial founders and investment funds (one of the biggest private equity funds in Romania received €1.1 billion from exits in 2017). In the same trend, in 2018 another round of high-profile exits is expected (e.g., a major player in the local telecommunications industry is contemplating its exit, the value of the transaction being estimated at around €100 million).

As far as IPOs are concerned, the market is starting to heat up, with a round of high-profile listings on the Bucharest Stock Exchange in 2017 (the biggest player in the local telecommunications industry has made the largest IPO to date for a private company – more than €200 million).

Furthermore, local companies are becoming more active in expanding their business internationally by acquiring foreign companies. For example, the Romanian National Company for the Transport of Natural Gas manifested its interest in the acquisition of the majority stake in Greece's gas pipelines' operator, as part of the latter's privatisation procedure.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

For 2018, we predict that M&A activity is going to continue at a steady pace and even increase, driven by both European and non-European buyers that need to expand into new markets and by Romania's fast-growing economy and relatively stable environment. On the backdrop of a good 2017 from an M&A market perspective, with a strong rise in deal numbers (13%) and values (by an impressive 63%) as compared to the previous year, we expect major deals to continue to take place in a variety of sectors such as energy and utilities, wholesale and retail, finance and manufacturing and IT.

About the author |

||

|

|

Miruna Suciu Managing partner, Suciu Popa & Asociatii Bucharest, Romania T: +40 374 494 944 F: +40 374 094 490 With 19 years of experience at the forefront of business law, Miruna Suciu is recognised as one of the most experienced practitioners in mergers & acquisitions/privatisations. Suciu regularly advises a significant portfolio of top-tier corporate clients, investment funds, private equity and banks in a variety of cutting-edge transactions of both domestic and international dimension in takeovers, extensive due diligence analysis, regulatory matters and M&A financing, as well as bid and tender preparation and assistance during tender procedures. |

About the author |

||

|

|

Andrei Hâncu Senior associate, Suciu Popa & Asociatii Bucharest, Romania T: +40 374 494 944 F: +40 374 094 490 Andrei Hâncu's practice is focused on M&A and corporate and commercial law, as well as on intellectual property and data protection. He has been involved in significant M&A transactions – share and asset deals, mergers, spin-offs – and has advised high profile companies on various corporate matters. Hâncu has also been involved in data protection legal matters, with a special focus on the GDPR and IP, including due diligence, management of IP assets, infringement of IP rights and counterfeiting. |