This is part one of a two-part series outlining how the capital markets can help listed companies struggling as a result of the coronavirus pandemic. Part two, which looks at debt capital markets, is available here.

Over the past few months, global stock markets have experienced high levels of volatility and general uncertainty in light of the economic disruptions caused by Covid-19. The unprecedented nature of the coronavirus pandemic and its impact on global economies makes it difficult to predict with any certainty how long Covid-19 will continue to meaningfully affect financial markets. This provides challenges for many listed companies that need to raise capital in the short to medium term, particularly those that require funding on an urgent basis to meet upcoming debt or other contractual commitments, or to simply satisfy ongoing working capital requirements with insufficient other sources of liquidity. As the United States Federal Reserve chair Jerome Powell recently cautioned: "The recovery may take some time to gather momentum, and the passage of time can turn liquidity problems into solvency problems." Notwithstanding stock market volatility, the equity capital markets provide a number of options that many companies will be eager to explore, including private investment in public equity (PIPE) and follow-on equity offerings.

Private investment

As liquidity concerns have crystallised and come under additional scrutiny, businesses are finding it more difficult to secure conventional sources of funding in a timely manner. One possible solution for listed companies seeking to raise capital and boost balance sheets may be a PIPE transaction. Such transactions, in which common or preferred shares or convertible debt, in some cases with warrants, are issued at a set price to investors, allows the issuer to raise capital not otherwise available in the public markets. It can do this more quickly and cost effectively than other more heavily regulated means of equity capital raises, such as public offerings.

In some jurisdictions, PIPE investments are often coupled with pre-emptive offers to existing shareholders to give such investors the opportunity to provide some of the required funding and avoid significant dilution of their shareholdings. PIPE deals may present a number of advantages to issuers such as the speed in raising capital (possibly one to two weeks depending upon jurisdiction), lower transaction expenses than public offerings, streamlined pre-transaction disclosure materials (or potentially no such disclosure materials, depending on jurisdiction) and failed transactions not impacting the market, as transactions are disclosed only after definitive investment commitments.

|

|

The equity capital markets provide a number of options that many companies will be eager to explore |

|

|

PIPE deals are commonly used in a rescue situation or when market prices do not fully value a company. They often involve relatively short-term investors who will look for a clear exit route. Private equity investors often seek, and in some cases will require, influence over management (such as by obtaining board representation and possibly seeking anti-dilution or negative control rights). In some cases, companies have used a PIPE as a defensive tool with the addition of a substantial investor with rights to board representation aligned with existing management creating additional confidence in the company's leadership. For some issuers, PIPEs may be seen as a last resort given the pricing discount often entailed and because they may provide governance rights for the investor that a company does not want to relinquish.

The regulation, and thus the use, of PIPEs varies between jurisdictions. In what will be one of the first UK PIPEs in more than a decade and a possible sign of things to come, it has been announced that the private investment firm Clayton Dubilier & Rice is investing in the London Stock Exchange-listed building products supplier SIG.

In some jurisdictions, including much of Europe, investor sentiment is traditionally opposed to non-pre-emptive offers that dilute existing investors, and there may be significant legal hurdles and institutional investor guidelines issues that complicate the structuring of PIPEs. In those jurisdictions, PIPEs have historically only been used by troubled small-cap companies with limited options to raise capital through traditional financing options (such as underwritten public equity offers, debt and convertible securities offerings, and bank finance).

One particular challenge that a company may need to address when structuring a PIPE relates to any hedging element. When stock markets began their precipitous fall in March, several countries, including Austria, Belgium, France, Italy, and Spain imposed temporary short selling bans. Although such bans were lifted as markets stabilised, they could potentially be reimposed in the future. If the structure of the PIPE has a hedging element (for instance, as a convertible bond or warrant) then consideration will need to be given as to whether there is a ban on short selling of the issuer's stock, and what exceptions may be available.

In other jurisdictions, PIPEs have been a longstanding feature of the markets – for example, in the US, the size, diversity and volume of PIPEs increased dramatically during the global financial crisis of 2008-2009 and we are again witnessing a significant spike in the wake of Covid-19. In the US, there is a relative lack of restrictive regulation for PIPEs, particularly for companies whose charters authorise so-called blank check preferred stock. The primary considerations include certain stock-exchange mandated shareholder approval for issuances at or above 20% of the outstanding voting stock or certain insider participation, a notification requirement under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, for issues above a certain level (approximately $94 million) and, for foreign investors, notification and approval considerations under the Committee on Foreign Investment in the United States (CFIUS) regulations.

See our article PIPEs unblocked, finally?, previously published in IFLR, for further discussion on PIPEs.

Existing shareholders asked to dig deep

While shareholders typically hope to enjoy the benefits that owning a stake in a company can bring, the flipside is that, during times of financial stress, they may be called upon to support the business by injecting further capital to help ensure a company remains viable and able to continue trading. We are now beginning to see a wide range of companies making calls on existing shareholders via a variety of follow-on equity offerings (also sometimes referred to as secondary capital raisings, although these usually involve the resale by a shareholder of its existing securities). These include rights offers, open offers and placings, although the exact terminology and options available will vary between jurisdictions.

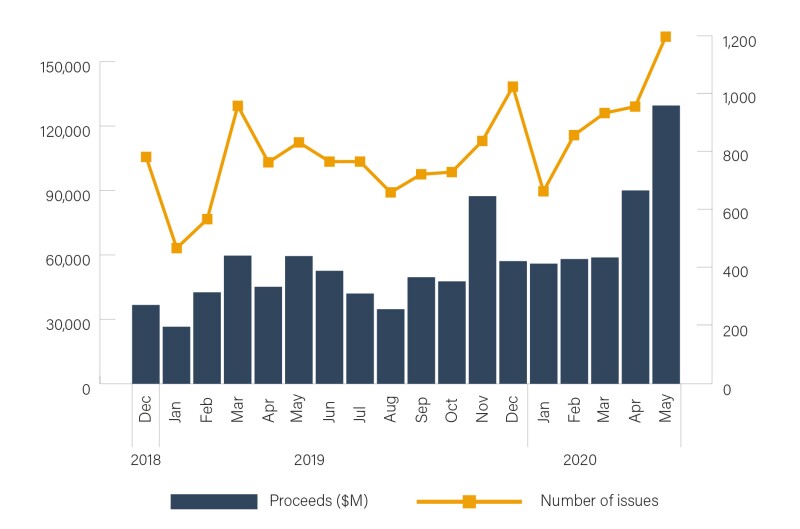

Globally, the number of follow-on offerings increased 20% from 1,805 in the first quarter of 2019 to 2,174 in the first quarter of 2020, with the proceeds raised rising 34% to $172.88 billion. During Q1 2020, there was a steady rise in the number of offerings and the proceeds raised.

As time has passed and the scale of the health crisis and its economic impact have become clearer, companies have been in greater need of capital and liquidity. The result of this is that global issuance volume rose to 1,028 in May 2020, with total proceeds rising significantly, to $129.54 billion. This represents an increase in proceeds of 44% from $90 billion from 835 issues for the previous month, with total proceeds more than doubling from the $59.45 billion from 736 issues recorded in May 2019.

|

|

We are now beginning to see a wide range of companies making calls on existing shareholders |

|

|

In the UK, the most common structure adopted by companies with premium listings which have undertaken pre-emptive secondary capital raisings in recent years have been rights issues that involve an offer of new shares, for cash, made to existing shareholders on a pre-emptive basis. Pre-emption means that the rights to subscribe the shares are first offered to the existing shareholders in proportion to their existing holding in order to prevent a dilution of the shareholding when the number of shares increases. Shareholders on the register of members at a designated record date are issued with a pro rata entitlement to so-called nil paid rights for no consideration. Nil paid rights entitle the holder to subscribe for the new shares being offered by the issuer at an offer price, which will be set at a – usually significant – discount to the market price to encourage takeup. Rights are also separately tradable securities, so even shareholders who do not participate can extract some value by selling the rights on market during the offer period and so be compensated for the dilution of their shareholding when the additional shares are issued.

For shareholders who take no action, also known as lazy shareholders, underwriters will endeavour to build a book of demand, then place in the market the shares represented by the rights that were not taken up, known as the rump. If the rump placing is successful, attaining a price per share above the issue price, any excess above the issue price (less expenses) is distributed to the lazy shareholders. If the rump placing is not successful, underwriters take any shares unable to be placed (the stick) at the issue price. Issuers like rights issues because, either way, they get the same proceeds as if all shareholders had taken up their rights.

A less common form of pre-emptive issue is an open offer. This allows for a pro rata offer of new shares, for cash, to be made at a narrower discount to the market price than would be the case for a rights issue. An open offer is again made to shareholders on the register of members at the record date but, in contrast to the nil paid rights issued in a rights issue, an open offer entitlement cannot be traded. Except in very rare cases, shareholders who do not subscribe for new shares in an open offer do not receive compensation and are also diluted.

Open offers are less popular with many shareholders due to this inability to trade the right. One advantage to open offers, though, is that where shareholder approval is required, the notice period for the general meeting may run concurrently with the open offer period. If the shareholders vote down the open offer, then the new shares are simply not issued. Underwriters will seek to place any shares representing allocations not taken up by existing shareholders with third party investors.

As an alternative to a pre-emptive issue structure, a placing allows for a non-pre-emptive issue of new shares (or sale of treasury shares) for cash to selected or preferred subscribers. In many jurisdictions, company law provides shareholders with pre-emption rights, and so a waiver of such rights may first be required. Shareholders typically consider pre-emption rights a fundamental anti-dilutive protection measure for shareholders. In a sign of the impact of the Covid-19 crisis on company balance sheets and the urgent need to raise capital to maintain solvency, the UK's Pre-Emption Group issued a statement on April 1 recommending that investors, "on a case-by-case basis, consider supporting issuances by companies of up to 20% of their issued share capital on a temporary basis, rather than the 5% for general corporate purposes with an additional 5% for specified acquisitions or investments, as set out in the Statement of Principles". If a company requires this additional flexibility, then it should consult with major shareholders and fully explain the circumstances underpinning the decision. The recommendation for investors to apply additional flexibility is currently in place on a temporary basis until September 30 2020.

Follow-on offerings

Source: Refinitiv

In Australia, the ASX has also announced temporary emergency capital raising relief, which will expire on July 31 2020, unless the ASX decides to remove or extend such relief. Key to the ASX's relief measure is that it will temporarily allow an uplift from the standard 15% placement capacity to 25%, provided that any placement is made in conjunction with a follow-on accelerated entitlement offer or share purchase plan, in each case, at the same or lower price than that offered under the placement.

A placing typically involves a launch announcement, limited marketing (if any), and then a bookbuild undertaken by an investment bank, with the results of the placing being announced ideally prior to market open the next day. It is popular with issuers because they can be undertaken on a relatively tight timetable, as neither a prospectus nor a shareholder meeting is usually required. Several underwriting options are available, including best efforts/reasonable endeavours, backstop, bought deal or various forms of upside sharing. Although in the UK, these have rarely been sized greater than 10% of issued share capital (to comply with guidance) they can now go to 19.9% without publishing a prospectus (based on the EU Prospectus Regulation).

|

|

As time has passed and the scale of the health crisis and its economic impact have become clearer, companies have been in greater need of capital and liquidity |

|

|

In some jurisdictions, it is common to see a placing combined with an open offer in what is known as a placing subject to clawback. Under this structure, the new shares are placed with institutional investors who effectively underwrite the issue. The placing is subject to an open offer being made to existing shareholders to take up their pro rata entitlements. This, therefore, provides an opportunity for existing shareholders to clawback shares from placees. The price paid for the new shares is usually at a discount to the current market price of the existing shares. Placees will buy shares not taken up by the existing shareholders, thus ensuring the success of the offering.

In the UK, all of the follow-on offerings described above can also be combined with a cashbox structure. No difference is apparent to subscribing investors, as they still pay cash for new shares, but technically the issue of the new shares is for non-cash consideration (being the shares in the cashbox company into which the cash proceeds from the subscribing investors will have been channelled). The advantages of this structure are that it permits an issue of new shares without necessarily requiring a disapplication of statutory pre-emption rights, which can be useful for timing reasons, for convenience (investors in problematic jurisdictions can be excluded) or in order to generate distributable reserves. Employing a cashbox structure to a cash placing as a means of avoiding compliance with statutory pre-emption rights has recently fallen out of favour, although it remains to be seen whether investor bodies and commentators will feel as strongly during turbulent times such as we are currently experiencing.

Recovery and renewal

With the onset of the pandemic in 2020 and the initial shock to markets, both companies and individuals have become more resilient as they adapt to the changing landscape. While government intervention schemes have put the global economy on life support as we move into the next phases of recovery and renewal, alternative transactions in the capital markets will still present opportunities for both companies and investors to seize capital raising and investment opportunities. As during the global financial crisis, listed entities have turned to such capital markets transactions as an efficient and viable solution to mitigate the uncertainties and pave a way forward, and are expected to continue to do so.

Please stay up to date with further developments at Baker McKenzie's Beyond Covid-19 Resource Center.

This is part one of a two-part series outlining how the capital markets can help listed companies struggling as a result of the coronavirus pandemic. Part two, which looks at debt capital markets, is available here.

|

Lisa Fontenot Partner Baker McKenzie, Palo Alto |

|

Kenny Kwan Partner Baker McKenzie, Singapore |

|

Roel Meers Partner Baker McKenzie, Brussels |

|

Mark Bell Lead Knowledge Lawyer Baker McKenzie, Singapore |