The Genesis

This article captures personal thoughts on how the digital ecosystem has caught up on us. For what it is worth, the '2000, 2008, and 2012 debt crises' or 'debt cycles' – depending on whether you take a cynical or macro view of the global financial markets – must be acknowledged for creating the impetus and final onslaught on Wall Street's monopoly on the playbook, and on its narrative – especially on deciding who lives and who ends up picking up the pieces.

This repeated rinse, repeat, cycle finally resulted in the genius use of a distributed ledger technology to create a technological movement that was designed with built-in smart contracting language to effectively function as a new form of currency. It also had a brilliant mathematical formula that, in effect, conjured a monetary and fiscal policy that ensured it remained a robust but fair generative spring that would last, theoretically, until around 2140 and presumably create a new world order in the financial markets.

As a pioneering digital currency, bitcoin had its fair share of arrows on its back. But it has now arisen to be the chosen one – well, at least for now. Perversely, it can be questioned whether bitcoin is now even able to hold down a function as a true currency – it has appreciated exponentially over the last few years so much so that it is no longer meaningfully regarded as a medium of exchange – it is simply and purely a store of value.

It's moniker – Digital Gold – is certainly well earned. However, one must look upon bitcoin as a movement – a philosophy – a narrative that has begun to etch out a permanent pathway for generations beyond the Zs to come. And that pathway is no longer leading to Wall Street. This pathway is metaphorically being digitally created on main street, side streets and mud trails all over the developing virtual worlds.

Digital currency ecosystem

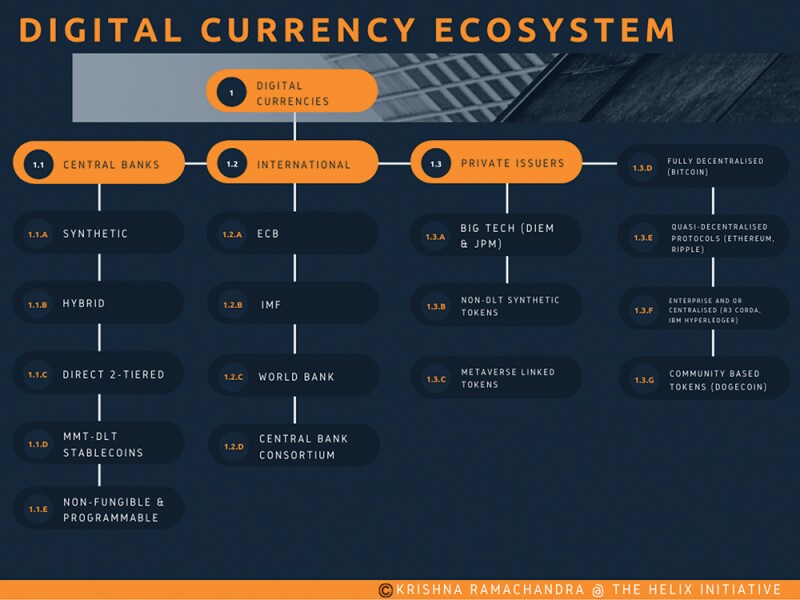

The 'digital currency ecosystem' diagram best illustrates how digital currencies are likely to develop – but perhaps more importantly, how they will come to co-exist in the digital universe.

Much as there is on-going debate about the advent of various types of central bank digital currencies, the steroid-induced programmable digital tokens will certainly be vogue among central banks as they can now start programming to personalised citizenry. This will no doubt be the order of the day as economies around the world start dropping their interdependency on a peg to other G-nation currencies or an irrelevant basket of goods which do not accurately account for the true rate of inflation.

Idiosyncrasies and nomenclature

Navigating the digital currency requires one to keep an open mind to accept new ideologies around social behavioural patterns that are promulgated by the creators and early adopters of this technology. Here is where an argument can be made that there will be the emergence of a new economic theory on money, capitalism and scarcity.

Benefits and incentives economic theories will also be redrawn. One established narrative I have observed is what I have termed the 'Doge-Collective'. This refers to a sort of 'me too' fervour that drives members of the community to keep the faith and withhold breaking ranks. This collective creates a certain narrative that disregards age old principles on financial market technicals or 'fundamentals'. Simply put, this is 'power to the people' displayed in its most devastating but perversely elegant manner – to take control of the narrative.

GameStop and Dogecoin are examples that draw out from traditionalists an eerie sense that the entire rule book is going to be re-drafted. Philosophically, the Doge-Collective is the ultimate validation and perhaps, acknowledgement, that one could tribute to the martyrdom of what was the genius of Satoshi and what he, she or they set out to do over 12 years ago – rewriting the narrative by democratising the financial markets.

Coins, alternative coins and tokens

The good news is that there is no holy grail of infrastructure protocols. The altruistic philosophy that underpins this technological revolution commands that everything is shared, and thusly, democratised. Wrong parallels have been drawn with the 'Kodak moment', the 'Betamax runner-up' and the 'MySpace irrelevancy'. That is not how it works with this generation. You see, this generation observes with a religious fervour the fundamental tenet that all things have to be democratised – their data, their finance, their art, their future. There is a brilliance in the simplicity of this narrative. Freedom and choice is as inspiring as it gets. Rival protocols can co-exist. If a better one comes along, you simply hard or soft fork to the platform you choose. No one is left behind.

In sense, you can have your sushi and eat your pancake – and be free to universally swap around as you please. The community works for each other, and collectively they usher along together, bettering each other with higher standards and greater sophistication. Everything is open sourced, for all to share. Ethereum has been a worthy baton holder of what is going to be a multiple relay run – it's not a race.

Above all, it is not a zero-sum game – all can participate and expand the universe to win their own personalised, democratised race in life. The competition is perhaps only on who achieves the credibility to empower the rest. It is this pure and altruistic tenet that I was drawn to several years ago as I consciously parked aside my intellectual arrogance to become open-minded and free of the morass that was the Old World Order, and its unquestioning acceptance of the status quo. Do yourself a favour and watch Ready Player One (and Two when it comes out). That 2018 movie is nostradamic!

Token fungibility

Much has been said, seen and speculated about a class of cryptocurrencies popularly known as non-fungible tokens (NFTs). An important misconception that needs to be clarified is that these NFTs are not merely pieces of $69 million digital art or skins from the gaming world. What the NFTs really represents are the significant shifts and advancements in the sophistication and quality of smart contracts embedded into tokens. This further evidences the maturity of the developer community (a critical factor in assessing the rate of adoption of cryptocurrencies generally).

|

|

“Digital currencies are going to start occupying the physical and virtual universes as the ecosystem expands beyond the metaverse” |

|

|

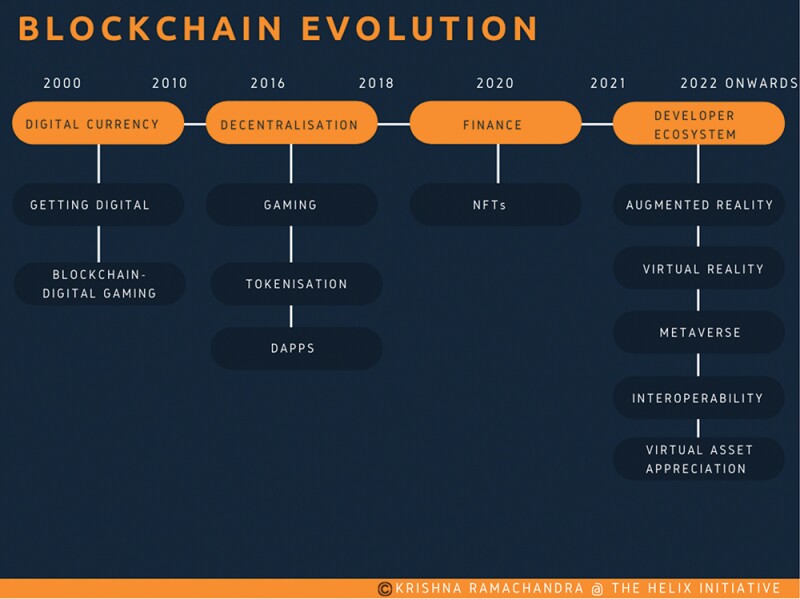

The 'blockchain evolution' diagram describes the eventual composition of various digital currencies that will interoperate and interact seamlessly across space and time. There are no borders. The markets will be more open – as communities of digital participants globally start recognising the value of their assets (whether represented synthetically or otherwise) but more importantly, governments and the FAANGs (Facebook, Amazon, Apple, Netflix, and Google) will start competing against each other for the citizenry's mind share and revenue – and in the instance of governments – to ensure their equivalent M1, M2 and M3 measurements (to be tracked by a digital equivalent) result in the efficient programmability of central bank issued currencies.

The sophistication in which each programmed digital dollar will hit the wallets of its intended citizens will result in greater citizenry engagement and accordingly, deeper electorate recognition. It will no doubt be a powerful tool that governments must start utilising in an increasingly demanding, and savvy electorate.

So here's the thing – when governments finally go all-in – or rather and perhaps more accurately, when governments realise that the proverbial river has burst its banks – pun completely intended – regulations and legislation will then be crafted, conceptualised, guided and ultimately curated to enable both parties to embrace the efficacies and efficiencies that digital currencies will bring to the fore. Ironically, black markets and tax dodging will be less commonplace.

All parties in theory should win – governments become more efficient and suffer less tax revenue leakage as much as they are required to be more transparent and accountable.

What is next for the banks?

Contrary to popular belief, the onslaught by neo-banks and new digital bank licensees are not going to dislodge the traditional banks – at least not the traditional banks that have taken the initiative to adapt, adopt and acquire the necessary skillsets. For example, JP Morgan and Goldman Sachs lead the charge among the bulge brackets but JP Morgan's playbook is the one to applaud – if not for their opportunistic knack, certainly for their courage to redefine their own industry's status quo.

JP Morgan understood their own internal ecosystem and client base and cleverly developed their very own enterprise grade blockchain platform and their permissioned (private) digital ledger enabled JP Morgan coin to operate as a useful currency ledger within their ecosystem of clientele as well as setting up the framework for a future industry grade payment system.

What is particularly uncanny about JP Morgan's strategy in this digital currency space is their acute understanding of the evolving digital currency ecosystem – as evidenced by their move to offload their demanding (and unprofitable) permissioned blockchain infrastructure protocol (Quorum) to an organisation that would do a better job to enhance and market Quorum widely beyond just as an under-utilised internal JP Morgan synthetic currency ledger.

JP Morgan has also gone on to integrate other traditional divisions of the bank with their blockchain expertise – their investment and merchant banking divisions seek out synergies and are now able to provide a holistic and truly digital solution to traditional corporate transactions.

For example, JP Morgan's role as an advisor to the recent still-born multi-billion-dollar breakaway European Super League belied their probable strategy to be in a prime position to consequently snag an early adopter advantage. This is because the European Super League would have given them the opportunity to coordinate numerous other token ecosystems given that several of the football clubs involved had already embraced a promising Chiliz coin that is based on a sports and entertainment blockchain fintech solution for sports franchises.

Merchant and investment banking is certainly not dead. JP Morgan has shown the rest of the pack how it is done, and potentially embracing the riches of the digital currency ecosystem at the same time. Traditional banks cannot simply set up a crypto exchange, serve ultra-high-new-worth clientele and assume they have the antidote to non-bank challengers. To the bankers, a siren call to shed the intellectual arrogance and clock in those 10,000 hours.

Lite speed development

The 'blockchain evolution' diagram sets out the chronological evolution of blockchain applications and cryptocurrencies. The adoption by central banks and governments of varying types of digital currencies is a forgone conclusion when one considers the network effect that early adopters are enjoying over the multitude of infrastructure protocols that are beginning to interoperate among each other in quest to reap market share. These early adopters are likely to monopolise the ultimate prize – what I term as the Exponential Trampoline Network Effect (ETNE).

A meshed reality ahead

Digital currencies are going to start occupying the physical and virtual universes as the ecosystem expands beyond the metaverse, which very simply refers to the interoperable gateway dimension between the physical and virtual worlds.

'Traditional' technology companies such as Microsoft have, like JP Morgan, adapted well and staked their claim to a seat at the high table through the launch of the mesh communications platform, effectively converging the realities of the virtual, augmented and mixed universes.

Back on earth, all rational participants would do well to seek out the ETNE in their respective fields or risk being at the wrong end of the digital divide. Watch 'Back from Mars' the movie. Please (or better yet, read the book).

The author would like to thank Leon Yee and Jonathan Vincent Chan Jr for their valuable contributions to the article.

Click here to read all the chapters from the 6th IFLR Asia Fintech Special Focus 2021

Krishna Ramachandra

Managing director

Duane Morris & Selvam

Chairman

Selvam LLC

T: +65 9822 5011

E: kramachandra@duanemorrisselvam.com

Krishna Ramachandra is the managing director of Duane Morris & Selvam in Singapore. His practice includes mergers & acquisitions (M&A) and capital markets, investments funds, private equity, financial technology, sports, and telecommunications, media and technology. Krishna also has significant experience in Myanmar, Indonesia, Malaysia, Taiwan and Korea.

Krishna has advised on over 200 digital technology projects and is widely regarded as a leader in this space. He advises family offices, senior management and boards of companies, typically as an independent senior adviser.

Krishna serves as chairman of The Helix Initiative, a not-for-profit movement dedicated to promoting and empowering thought leadership among the youth. He is especially focused on developing a digital commons protocol and in addressing the growing concerns related to the digital divide.