The Japan M&A market is currently experiencing an upward trend over the previous year in terms of total deal value. According to data from Dealogic, Japan saw a total deal value of over $100 billion in 2021, an increase of over $25 billion from 2020. This is despite a decrease in the number of deals with a total of only 493 deals (including domestic deals).

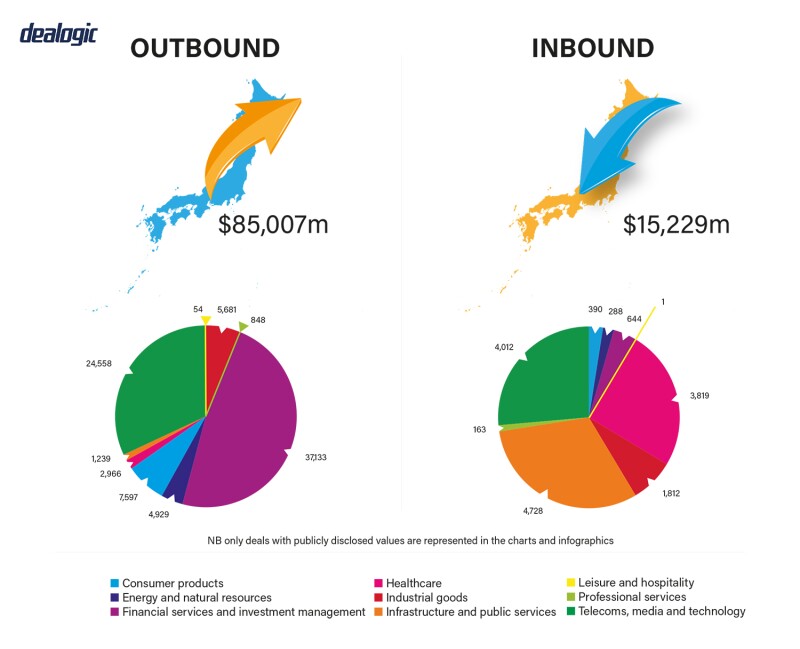

While the financial services sector brought in a total deal value of slightly over $37 billion, the increase in deal value was largely due to a surge in outbound deals by Japanese companies in the technology sector valued at over $23 billion.

Japan also experienced a greater focus on transformative cross-border deals. Eight of the biggest deals were outbound deals aimed at transforming the acquirer’s portfolio. Another trend pushing companies into deals is decarbonisation.

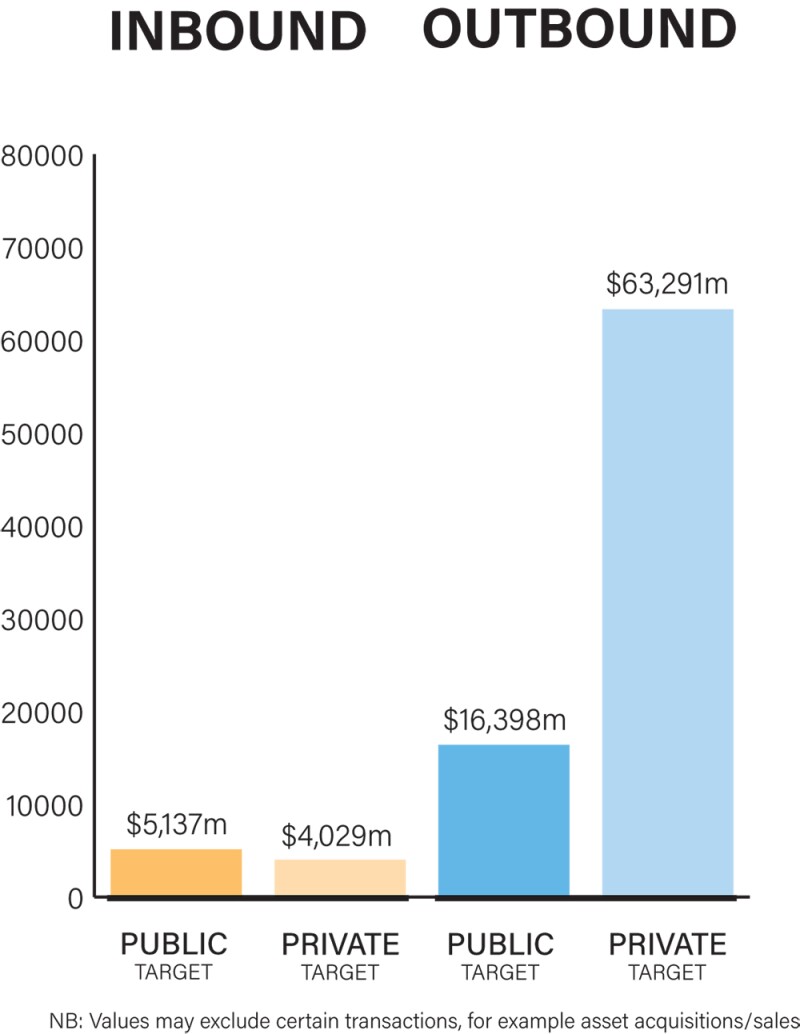

Japan is largely driven by private M&A transactions in terms of both deal value and number of deals. In 2021, 403 private transactions between Japanese companies and foreign companies resulted in over $67 billion in deal value, compared to 37 public transactions between Japanese companies and foreign companies with $21 billion in deal value.

The two largest outbound deals were Hitachi’s $9.6 billion acquisition of GlobalLogic Inc., a US-based digital solutions provider, and Panasonic Corporation’s (Panasonic) $7.1 billion purchase of Blue Yonder, a US-based digital supply chain management solutions provider. Hitachi’s acquisition of GlobalLogic has changed Hitachi’s portfolio, allowing it to strengthen its cloud-based storage system as well as cultivate the Lumada Internet of Things (IoT) business platform.

Similarly, Panasonic’s acquisition of Blue Yonder, an AI-powered supply chain software vendor, demonstrates Panasonic’s change in its business focus from hardware to software and on improving Panasonic’s own existing technologies to increase productivity and efficiency.

Economic recovery plans

In 2021, Japan saw a surge in M&A deal values from the previous year, reaching aggregate deal values that reflected more closely those of 2019 and 2017. In 2021’s Q2 alone, the aggregate deal values were already six times the amount of those recorded in 2020.

One of the lasting impacts from Covid-19 seems to be companies’ efforts to overcome changes in their business environments caused by the pandemic. This includes diversifying their businesses to ensure sustainable growth and selling off subsidiaries and businesses to offset shrinking domestic customer demands.

|

|

“Tax amendments in 2021 may potentially have an impact on M&A structuring by offering broader structuring options for squeeze-out transactions” |

|

|

Japan will continue to see a number of companies reorganising their businesses to move towards decarbonisation, which means either focusing their resources in other high growth areas or selling subsidiaries with large carbon footprints. We have also seen Japanese companies move to sell businesses that are no longer considered their core businesses (e.g. Hitachi’s sale of Hitachi Metals in 2021) to refocus their energy and resources in future growth areas, many of which are new technologies. For example, Eneos Holdings Inc. (Eneos), an oil vendor in Japan, is currently in the process of selling one of their high carbon-yielding subsidiaries, Nippo Corp., and is also looking to acquire one of Japan’s leading companies in renewable energy, Japan Renewable Energy Corp., for an estimated amount of 200 billion yen. Japan Renewable Energy Corp.’s core business is in providing electricity generated from solar power and other kinds of renewable energy.

In 2021, the outbound boom in Japan continued and the trend for outbound deals was centered on transformative M&A. The impact of Covid-19 remains, however, and Japan is not quite back to its pre-pandemic momentum.

As countries begin to slowly move out of the pandemic, it is expected that Japan will be positioned for a M&A boom. Many deals in Japan are on hold as Japanese companies traditionally hesitate to enter into deals without holding face-to-face meetings or conducting on-site due diligence. Another factor is that many companies have spent the pandemic building up cash on hand and restructuring their operations so that they will be ready once restrictions are lifted and travel can be conducted more freely.

Japanese companies are adopting tactics that are more appealing to shareholders, resulting in companies selling off unprofitable sectors of their businesses and purchasing new businesses to diversify into new areas with greater potential for future growth. This trend of selling off or offsetting shrinking businesses appears likely to continue in the foreseeable future.

Legislation and policy changes

The Financial Services Agency (FSA) and Japan Fair Trade Commission (JFTC) are the key regulatory authorities in Japan that govern M&A activities. The FSA is responsible for enforcing the Financial Instrument and Exchange Act (FIEA) and the JFTC is responsible for enforcing the Act on Prohibition of Private Monopolisation and Maintenance of Fair Trade (Anti-Monopoly Act).

The most relevant law to M&A in Japan is the Companies Act. The Foreign Exchange and Foreign Trade Act, FIEA, and the Anti-Monopoly Act are other rules and regulations relevant to M&A in Japan. Publicly listed companies are also subject to the applicable rules and regulations of the relevant stock exchange where their shares are listed.

Tax amendments in 2021 may potentially have an impact on M&A structuring by offering broader structuring options for squeeze-out transactions. If certain conditions are met, spin-off transactions may be completely tax-free. In April 2022, the Tokyo Stock Exchange (TSE) will also be revising its listing standards by restructuring into three new market segments: Prime Market, Standard Market, and Growth Market.

Consideration of Environment, Society and Governance (ESG) has become a factor in identifying target companies and is discussed at the beginning of negotiations with such companies. Japan is witnessing a large number of companies proactively engaging in M&A related to climate change countermeasures, with one such example being the emphasis to decarbonise.

The TSE has further revised its Corporate Governance Code (CGC) for listed companies in 2021. This impacts not only the corporate governance of a company, but also M&A deals, as the CGC contains principles relating to M&A such as anti-takeover measures, capital policies relating to management buyouts or share offerings, and cross-shareholdings. For example, the CGC requires companies to have stronger shareholder protections to be in place and have a diverse board of directors, if the company is to be listed in the Prime Market (one of the new sections of the TSE). This would affect deals in how they value a target company, including considering how shareholder appraisal rights might be impacted in a buyout situation.

Market norms

The misconception that Japanese companies are resistant to making hostile bids still persists. While it is true that there has never been a successful foreign hostile takeover of a major Japanese target, some domestic examples have occurred in the past few years. This is due to efforts to change corporate governance, leading to management and boards that are more accountable to shareholders.

An overlooked area for Japanese companies preparing for outbound deals or foreign companies looking to sell to a Japanese company is that the decision-making process of Japanese companies is quite different from foreign companies. The timing of the decision-making process in most Japanese companies can be slower, with each phase of a negotiation process requiring an official internal meeting and approval by consensus among various stakeholders in the company.

Clearly technology has played a larger role during the Covid-19 pandemic when travel and in person meetings have been restricted. The gap created by restrictions has been filled by technologies that have nevertheless allowed deal making to proceed. Face-to-face meetings have been replaced by video conferences with the increasingly user-friendly interfaces as compared to pre-pandemic. Due diligence exercises have long made use of cloud-based datarooms, the use of which has continued, if not increased.

Public M&A

The main means of obtaining control of a public company in Japan would be through stock purchase, merger, stock-for-stock exchange, issue of new stock, business transfer and company split. Further, in a merger or stock-for-stock exchange situation, the target company must obtain an independent opinion that the contemplated merger or stock-for-stock exchange is not disadvantageous to its minority shareholders.

A public takeover offer needs to be conducted in accordance with the FIEA. In addition, it becomes more important to comply with various recommended procedures discussed in the guideline (the Guideline regarding the process of fair M&A) announced by the Ministry of Economy, Trade and Industry on June 28 2019, which mainly is designed to address MBOs and acquisition by a controlling shareholder, but in reality is taken into account in the other public takeover offers.

In June 2021, the TSE’s amended CGC came into force. This amendment establishes high-level corporate governance standards that are seen to support the TSE’s establishment of new market segments. Some examples include one-third outside directors, management appointment committees and ensuring diversity for key employees.

There is no Covid-19 legislation having an impact on this area. In 2021, there were a number of Japanese court decisions that addressed the validity of takeover defense measures adopted by listed companies confronting hostile takeovers.

While the inclusion of break fees have increased, reverse break-fee arrangements have not yet gained any traction in Japan. Also, courts may not uphold a break fee if it is deemed to be unreasonably high, as it would go against public interest and therefore most likely be held null and void.

Private M&A

Traditionally, representations and warranties insurance has not been widely used in Japanese domestic M&A deals. One of the reasons for this is that non-Japanese insurance companies which have been leaders in this field have been unable to provide such products based on Japanese-language due diligence reports and transaction documents. Recently, however, insurance companies are starting to offer such insurance in Japan based on Japanese-language documents leading to expectations that such insurance will become a more common feature in domestic M&A deals.

Tender offer rules under the FIEA do not apply to the acquisition of shares in private companies, the target securities of which are not subject to the reporting requirement under the FIEA. Cash offers are dominant in private takeover offers. Instead of a takeover offer, a company reorganisation (such as merger, statutory share-for-share exchange, share-for-share transfer or company split) or a squeeze-out by way of reverse share split, is also often utilised.

Usually, the laws of Japan are selected by the parties because certain provisions of the Companies Act cannot be eliminated from agreements, regardless of the choice of law.

A common exit method is a trade sale of shares to a similar business operator as that of the target company. Initial public offerings have also been actively used as an exit method for private equity firms. Auction sale of companies are also quite common, but selling shareholders and the target company are subject to regulations under the FIEA.

Looking ahead

In 2022, Japan will likely have another strong rebound year for M&A deals, with emphasis on technology and, particularly, software related deals as more companies are looking at ways to diversify and streamline to make businesses more efficient.

Click here to read all the chapters from the IFLR M&A Report 2022

J Ryan Dwyer III

Managing partner

K&L Gates

T: +81 3 6205 3601

About the author

J Ryan Dwyer III is the managing partner of K&L Gates’ Tokyo office and is a member of the firm’s global advisory council.

Ryan concentrates his practice on cross-border M&A for Japanese clients investing outside of Japan, foreign direct investment into Japan by US and other non-Japanese companies and international joint ventures involving Japanese parties. He has extensive experience advising non-Japanese companies on the corporate, regulatory, employment and commercial aspects of transactions and investing in Japan and setting up and operating businesses in Japan. He has a particular focus in the technology sector, advising companies in relation to licensing and distribution agreements, and regulatory issues.

Ryan holds a bachelor’s degree from the University of Vermont and a JD from William S Richardson School of Law, the University of Hawaii.

Tsuguhito Omagari

Partner

K&L Gates

T: +81 3 6205 3623

E: tsuguhito.omagari@klgates.com

About the author

Tsuguhito Omagari is a partner at K&L Gates’ Tokyo office.

Tsuguhito is experienced in matters including domestic and cross-border M&A, PE, domestic and international joint ventures, investments into Japan and by Japanese companies overseas, and private investment in public entities (PIPEs). He has acted for domestic and international banks, PE firms, manufacturing companies in various industries, securities firms and real estate asset managers.

Tsuguhito has a bachelor’s degree in law from the University of Tokyo and a LLM from the University of Pennsylvania.

Andrea Ng

Associate

K&L Gates

T: +81 3 6205 3618

About the author

Andrea Ng is an associate at K&L Gates’ Tokyo office. She focuses on M&A and other corporate matters.

Prior to joining the firm, Andrea worked as an in-house counsel for a Tokyo-based entertainment and media company where she worked on licensing, co-promotion, and merchandising for video games, mobile applications, animation and consumer products. She also worked as in-house counsel at other companies operating in the gaming device industry.