Australia & Oceania

The firm’s Chinese and Australian partnerships will operate independently from March next year

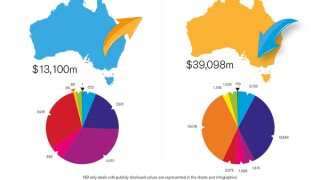

IFLR’s legal accreditation title reveals that 85 firms across the region entered the rankings this year, while 23 dropped out across seven practice areas

The firm announced the launch of a new office in Sydney with four partners 'to open doors' to opportunities for Australian clients

New hires were made across the finance and corporate practices in Hong Kong, Melbourne and the Czech Republic

The finalists for the 26th annual Asia-Pacific Awards 2025 are revealed - winners will be presented in Hong Kong on April 16

From geopolitical and demographic challenges to technological and regulatory change, financial services firms are having to adapt to an ever-changing environment in 2025

Heightened merger control measures and FDI regimes will also require creative, adaptable and resilient strategies in M&A deals, lawyers say

An investment bank and law firm Chapman Tripp discuss the intricacies behind the transaction that won structured finance and securitisation deal of the year at a recent IFLR Awards

Sponsored

Sponsored

-

Sponsored by Kirkland & EllisWashington DC-based Kirkland & Ellis lawyers review regimes in the US, the EU, and further afield

-

Sponsored by Gilbert + TobinPeter Reeves, Georgina Willcock and Candice Fraser of Gilbert + Tobin assess Australia’s ongoing efforts to regulate the digital currency market

-

Jurisdictions